US April CPI Preview: Has inflation peaked?

- Annual CPI in the US is forecast to decline to 8.1% in April.

- Underlying factors driving inflation higher remain in place.

- A soft CPI print could cause the dollar to face temporary selling pressure.

Annual inflation in the US, as measured by the Consumer Price Index (CPI), climbed to its highest level in four decades at 8.5% in March. On a yearly basis, CPI is forecast to decline to 8.1% in April. Core CPI, which excludes volatile food and energy prices, is expected to fall to 6% from 6.5% in the same period.

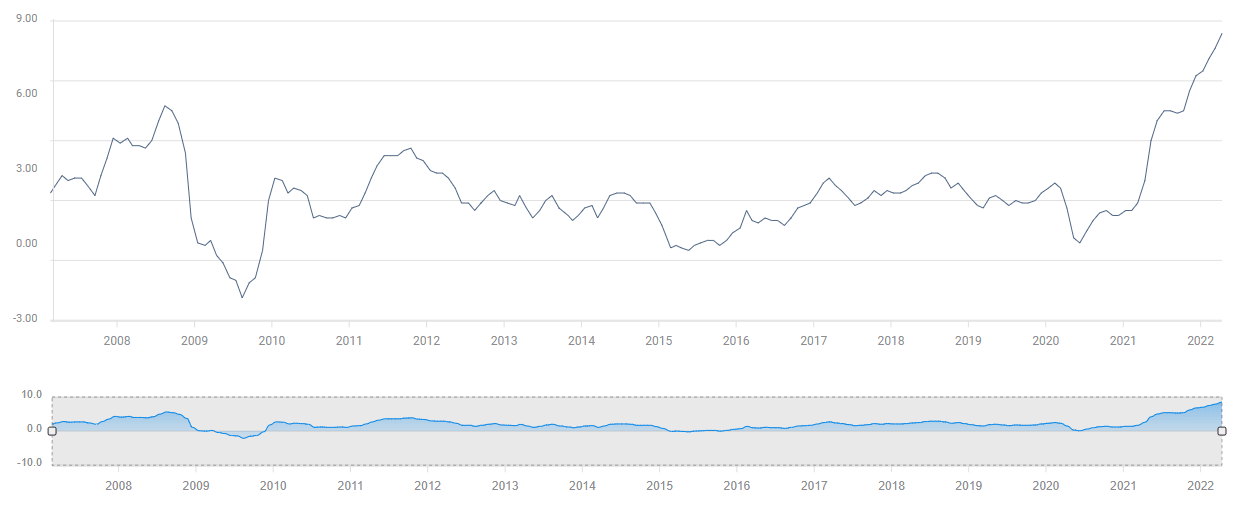

US Consumer Price Index (YoY)

Has inflation peaked in the US?

The Prices Paid component of the ISM Manufacturing PMI declined to 84.6 in April from 87.1, showing that input prices in the manufacturing sector continued to rise at a softer pace than they did in March. On the other hand, the ISM Services PMI report revealed that the Prices Paid sub-index climbed to a new all-time high of 84. from 83.8. Moreover, crude oil prices rose more than 3% in April.

Just by looking at these figures, it’s difficult to conclude that the 8.5% CPI inflation recorded in March was the peak. Additionally, coronavirus-related restriction measures and lockdowns in China remained in place throughout the month, suggesting that supply-chain challenges are likely to continue to drive prices higher. In the meantime, consumer demand remains healthy in the US. The US Bureau of Economic Analysis’ latest publication revealed a 1.1% increase in consumer spending in March, compared to the market expectation of 0.7%.

The strong consumer demand combined with higher input and energy prices in the private sector indicates that inflationary pressures are likely to remain high in the next couple of months.

Assessing the S&P Global’s April PMI survey for the US, “many businesses continue to report a tailwind of pent up demand from the pandemic but companies are also facing mounting challenges from rising inflation and the cost of living squeeze, as well as persistent supply chain delays and labor constraints,” said Chris Williamson, Chief Business Economist at S&P Global.

Market implications

Even if CPI prints were to point to a slowdown in inflation in April, it will not be enough to convince investors that we are at the beginning of a downtrend. The protracted Russia-Ukraine conflict and its impact on crude oil prices, China’s zero-Covid policy and robust consumer activity all point to high inflation lasting for longer.

Nevertheless, the initial reaction to a soft CPI reading should cause the benchmark 10-year US Treasury bond yield to edge lower and force the greenback to weaken against its rivals with market participants reassessing how aggressively the Fed will continue to tighten its policy moving forward. Atlanta Fed President Raphael Bostic said on Monday that he is going to stay open to the possibility that inflation will be approaching policy target at a faster pace than projected. “If so, we would not need to do as much,” Bostic added. Similarly, Minneapolis Fed President Neel Kashkari told CNBC that he was on “team transitory” and noted that he was confident that the Fed could get inflation back down to the 2% target.

As mentioned above, however, factors that have been driving inflation higher remain in place and the Fed is unlikely to overreact to a single data point. Hence, a dollar sell-off on a weaker-than-expected CPI print should remain short-lived and provide an opportunity for investors to long the greenback at a lower cost.

On the flip side, a surprise increase in annual CPI should trigger another leg higher in the US Dollar Index and revive speculations about a 75 basis points rate hike in June. According to the CME Group FedWatch Tool, markets are pricing a 13.5% probability of such a move at the next policy meeting.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.