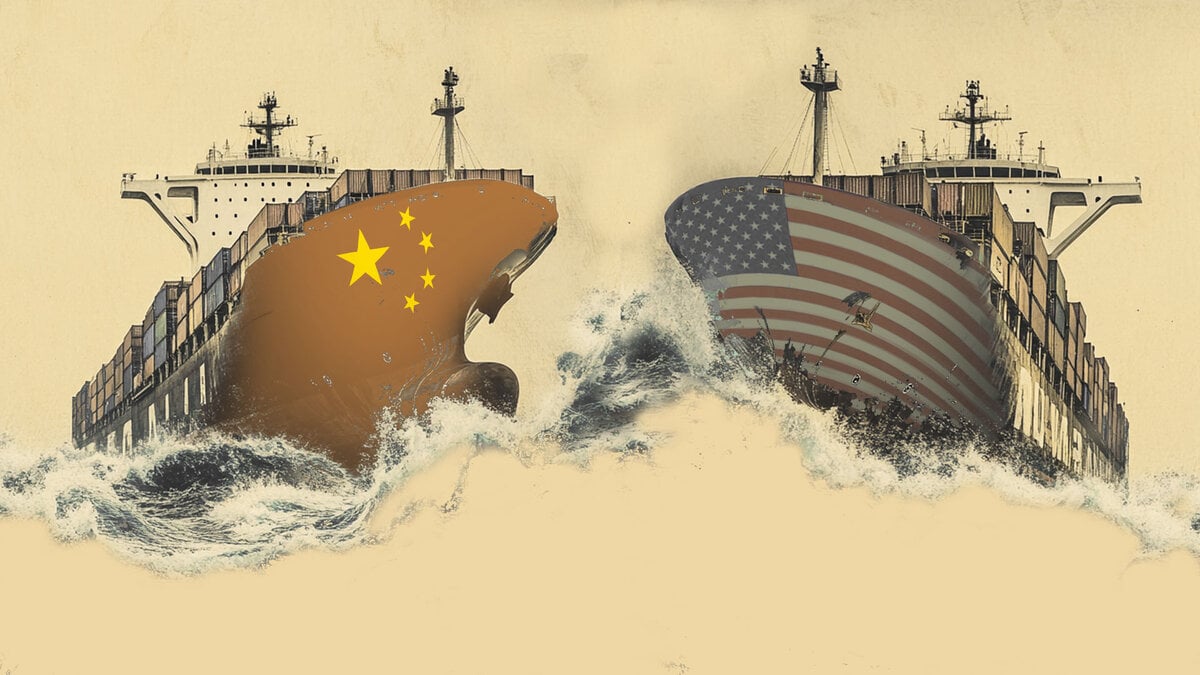

Trade talks between US and China hit a wall

Hopes for progress in US-China trade relations dim as negotiations stall, raising the possibility of a Trump-Xi call to break the deadlock.

US-China trade talks have lost momentum, according to US Treasury Secretary Scott Bessent, who said discussions are currently “a bit stalled”. He suggested that a phone call between Donald Trump and Xi Jinping might be needed to revive the process.

The negotiations had shown promise during earlier meetings in Geneva, where both sides agreed to reduce tariffs for 90 days. However, little follow-up progress has been made. As part of the temporary truce, the US agreed to drop tariffs on Chinese goods to 30%, while China lowered its own to 10%. China also pledged to suspend certain non-tariff barriers, but gave no specifics.

Despite establishing a framework for continued economic dialogue, there have been few updates or public signs of ongoing cooperation. Instead, the US has escalated pressure by restricting the sale of AI chips and semiconductor design software to Chinese firms, including Huawei.

Bessent expressed optimism that once President Trump shares his intentions directly, China might return to the negotiating table, thanks to the reportedly strong relationship between the two leaders. Meanwhile, Chinese officials have avoided commenting on recent US remarks, and analysts in Beijing suggest they are preparing for a prolonged standoff.

Author

Jacob Lazurek

Coinpaprika

In the dynamic world of technology and cryptocurrencies, my career trajectory has been deeply rooted in continuous exploration and effective communication.