Three questions for the market this week

-

Will inflation become a problem?

-

How confident is the US consumer?

-

Bank Earnings on tap.

Will inflation become a problem?

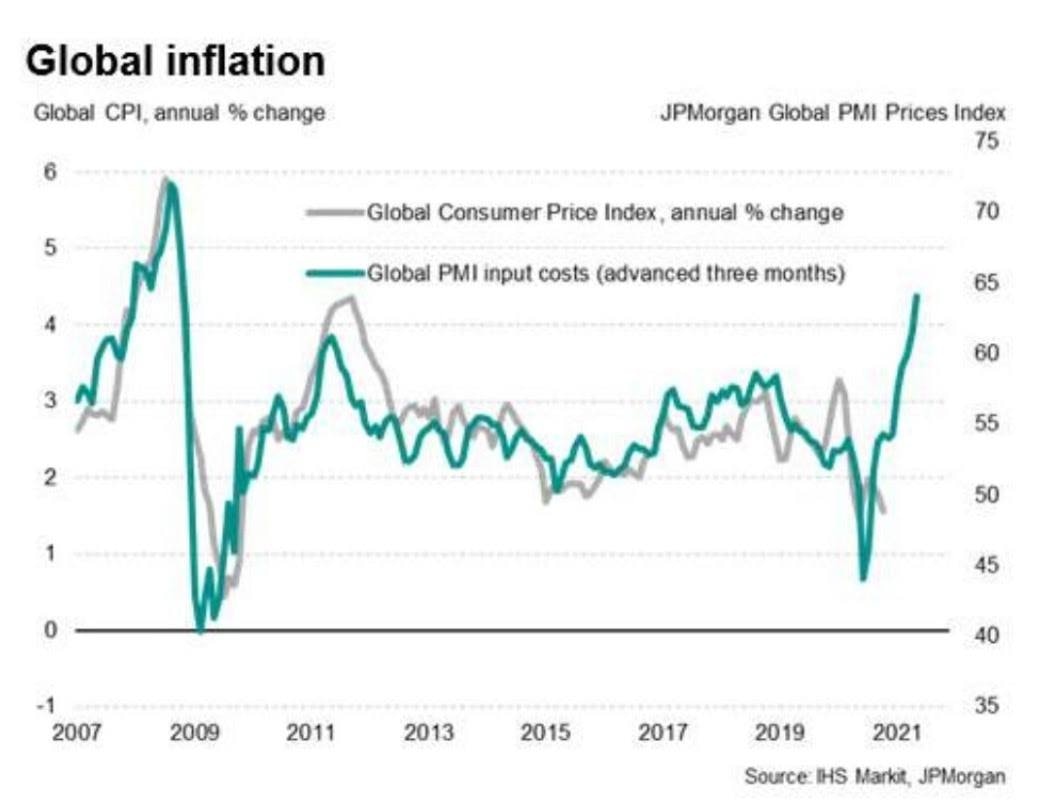

Inflation pressures are beginning to concern investors as the surge in demand in combination with COVID-hobbled supply lines is creating bottlenecks all across the supply chain and spiking costs for producers at rates that we haven’t seen in years. Last week’s PPI data showed a much bigger than expected rise with core jumping 0.7% versus 0.2%. Several analysts have pointed out that this is a global rather than just US problem as the following graph shows.

The key question going forward is whether this rise in prices is transitory and will ease as more supply comes back on line and capacity rises putting downward pressure on prices. For now however the main concern is that the rise in Producer Prices will begin to bleed into the CPI. The market anticipates that core CPI will remain moderate, rising just 0.2%, but if the number prints at 0.4% equities could sell off as yields rise.

How confident is the US consumer?

With the US economy returning to full capacity and many US states lifting COVID restrictions the consumer is likely to return with a vengeance. Flush with stimulus cash and a resurgent labor market the consumer is expected to begin spending in earnest. The market is looking for a massive jump in Retail Sales to 5.3% from -3.0% the period past so expectations are already very high. A sharp rise in demand will help fuel the growth narrative and should help equities climb higher. However if inflation rises and Retail Sales fail to meet their forecasts that would set up the worst possible scenario for stocks as fears of stagflation will spread through the market. With equities trading at record highs, the double whammy of negative news could trigger a sharp selloff as the week proceeds.

Bank profits – Will they beat?

This week kicks off the earnings season and it is dominated by the banking sector with all the major money center banks and investment banks reporting their numbers. Wednesday will be the first big day of earnings news as JP Morgan Chase, Goldman Sachs and Wells Fargo all report their numbers with Bank of America, Citibank and Morgan Stanley all reporting later in the week.

The XLF ETF which is comprised of financial services sector companies has hit multi-year highs with bull looking to break through the 35.00 level with authority. A slew of good earnings would provide key fundamental support for the sector and could put the XLF on a path towards 40.00 as the year proceeds.

Author

Boris Schlossberg

BKTraders and Prop Traders Edge

Boris Schlossberg was key speaker at the FXstreet.com International Traders Conferences 2010. Mr. Boris Schlossberg is a leading foreign exchange expert with more than 20 years of financial market experience.