This is not likely to inspire the Fed to cut rates

The GDP numbers yesterday deliver implied PCE inflation. Consumption rose to 3.7% from 2.8%, so PCE likely fell a mere 0.1% to 2.1% and core to 2.6%. Together with the ADP rise in jobs, this is not likely to inspire the Fed to cut rates.

We also get the Q3 employment cost index, likely up 0.9% (the same as Q2) and the slowest since 2021. So the Fed could have a hard time naming the labor market as the primary focus that justifies rate cuts. But never mind, we need to wait for nonfarm payrolls tomorrow.

We continue to expect the Fed will cut only once of the two meetings before year-end.

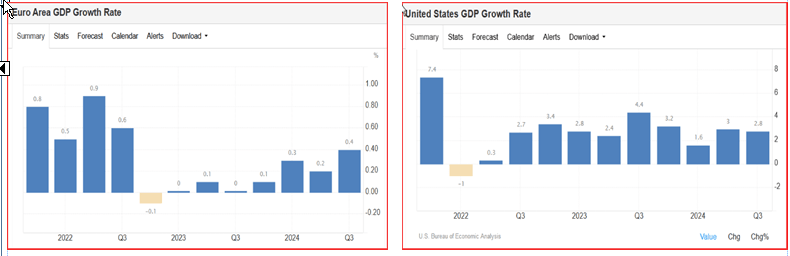

Tidbit: Growth matters, and cumulative growth matters, too. See the comparison of eurozone vs. US GDP quarterly growth. Charts from Trading Economics.

The US has well over 2% annualized from 2022, while the eurozone never made it to 1%.

Forecast

The switcheroo in technical trading signals indicates a correction but it’s incomplete/not confirmed by multiple indicators. The only one that has any real moxie is sterling. It’s highly likely that this is a momentary blip in the grand scheme of things, although it could grow momentum if Trump loses the election, now only 5 days away and the final count perhaps 10 days away. We advise against taking a flyer on a move so un-anchored in anything except position adjustment by big players.

Political Tidbit: Nobody trusts polls any more except the ones that favor pre-existing views, aka confirmation bias. A CNN poll yesterday shows Harris leading Trump in Michigan, 48% to 43%, and in Wisconsin by 51% to 45%. There is the tiniest suggestion that this story inspired the dip in yields…

The cable news channels preaching to the choir are currently focusing on the rising repulsiveness of Trump, including his rally comedian insulting Puerto Rico and Trump saying he doesn’t know the guy--not an apology.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat