The weekender: When the AI party went quiet

This was one of those weeks where the tape stopped lying politely and started telling the truth in fragments. On the surface, it looked like a gift from the Fed: dovish tones, reserve management quietly doing the heavy lifting, the dollar slipping through its technical floorboards. But underneath, the market was re-pricing something far more uncomfortable — the gap between AI promise and AI delivery.

The cleanest read on the chaos wasn’t equities or rates. It was precious metals. When gold and silver both print record weekly closes in a week supposedly defined by “risk-on” rotation, that’s not noise. That’s a hedge against narrative credibility.

Start with risk assets. Crypto told the story perfectly: bitcoin spent the week ricocheting between $90k and $94k like a pinball machine, only to end exactly where it started. Maximum motion, zero conviction. That pattern echoed across broader markets — lots of rotation, very little aggregate progress.

Equities looked healthy only if you stopped at the index level. Dig deeper and the split was surgical. Nasdaq and the S&P sagged while the Dow and small caps quietly carried the load. This wasn’t panic selling — it was capital walking away from the most crowded bar in the market and rediscovering the exits.

The catalyst was simple: reality checks. Oracle slipping back below its 200-day, Broadcom disappointing, and suddenly the AI infrastructure trade — the market’s sacred cow for most of the year — looked less like a straight line and more like a construction site with delayed permits. When reports surfaced that Oracle-linked data centers tied to OpenAI are now being pushed into 2028, it wasn’t about one company. It was about timing, capex duration, and return visibility.

Semis felt it immediately. The Philly chip index dropped hard on the week, even as it remains massively up on the year. That’s not a trend break — it’s profit being taken from a trade that had become reflexive. Mag7 underperformed the other 493 names decisively, and for once, the market didn’t rush to defend them. The spell cracked.

At the same time, cyclicals finally blinked after an almost comical 15-day win streak, defensives caught a bid, and sector leadership shifted toward materials and financials. Utilities, oddly, joined tech at the bottom — another sign that this wasn’t a simple growth scare but a re-ranking of duration risk.

Rates markets delivered their own version of the same message. The front end rallied hard while the long end lagged, steepening the curve aggressively. The 3m–2y inversion evaporated at speed, and 2s–30s pushed out to its steepest level since late 2021. That’s not the bond market pricing imminent recession — it’s pricing policy control at the short end and uncertainty everywhere else.

Rate-cut odds nudged higher, with June still pencilled in as the market’s preferred window — notably after Powell’s successor is expected to take the reins. In the meantime, the Fed’s “we just want to manage money-market plumbing” explanation for balance-sheet activity is being treated the way traders treat most cover stories: acknowledged, then ignored. Call it what it is — liquidity is leaking back into the system, quietly. ( more on that in a follow up piece)

The dollar felt it immediately. Three straight weeks lower, sliced cleanly through major technical levels, now hovering near three-month lows. And that’s where precious metals took over the narrative entirely.

Gold surged through $4,300 before late-week selling trimmed the excess, still locking in a record weekly close. Silver flirted with $65 intraday — another record — before meeting the same fate. This wasn’t speculative froth. This was capital hedging duration, currency debasement, and the idea that policy generosity may outlive growth clarity.

Oil, by contrast, told a different story. WTI had its worst week in two months, sliding back toward the mid-$50s. That’s the market quietly questioning near-term demand acceleration even as equities rotate toward “growth.” It’s a reminder that narratives don’t always synchronize.

Under the hood, the mechanics matter. Options positioning has flipped from November’s hostile setup to something far more supportive. The S&P is now sitting in a positive gamma pocket around 6,850–6,900, pinning price action even as tech struggles. Implied volatility continues to bleed lower, with the VIX crushed and the VVIX — the market’s fear of fear — collapsing as post-FOMC hedges get unwound.

Holiday-shortened calendars and December expiries are encouraging vol selling again. Upside calls and downside protection both look cheaper, CTAs are slowly re-levering, and vol-control funds are being invited back in as realized volatility drifts lower. This isn’t euphoria — it’s mechanical stability.

The bigger takeaway is structural. The rally is no longer standing on a single AI pillar. Participation is broadening, leadership is rotating, and the market is slowly replacing a narrow, story-driven melt-up with something sturdier: an expression of improving real-activity expectations, backed by easier financial conditions.

That doesn’t mean the AI trade is dead. It means it’s being priced like an industrial build-out instead of a miracle cure. And when that shift happens, gold doesn’t wait for permission — it just shows up, takes the floor, and reminds everyone what confidence hedging looks like.

Until the data breaks this re-acceleration narrative, the tape has found a wider base. But the message from this week is clear: liquidity can carry markets forward, rotations can keep indices afloat — yet credibility, once questioned, always finds its way into the price.

Green shoots for 2026: From policy shock to policy payoff

2025 will be remembered as a year where policy noise drowned out the signal. Tariffs came in hot, immigration tightened, federal spending was put on a DOGE-style crash diet, and the OBBBA landed like a late-cycle tax remix. The result was predictable to anyone who’s sat on a trading desk through a policy-induced supply shock: hiring froze, capex hesitated, costs pushed higher, and growth bled lower. Real GDP slowed to roughly 1.6% Q4/Q4—below trend, below potential, and likely a full point shy of where the economy might have been absent this year’s policy cocktail.

Yet markets, as they so often do, refused to play the macro script cleanly. Equities ripped higher from the April lows, cushioning higher-income households and keeping discretionary demand alive. Meanwhile, the AI and data-center buildout didn’t just persist—it accelerated, punching through inflation headwinds and reminding investors that productivity cycles don’t wait for Washington or the Fed to get its act together. That tension—soft macro versus hard asset optimism—sets the stage for 2026.

The most underappreciated shift is that the tariff shock is no longer intensifying. In market terms, the tightening impulse is behind us. Average effective tariff rates look set to plateau, and there’s a non-trivial chance they drift lower. A Supreme Court ruling early next year could invalidate the IEEPA tariffs, temporarily pulling a major thorn out of the supply chain. Even if the White House later tries to reassert pressure through other channels, the interim matters. For corporates, this isn’t ideology—it’s cash flow. Estimates of $125–$150 billion in potential tariff refunds represent a quiet but meaningful balance-sheet windfall. Layer on larger federal tax refunds under the OBBBA—skewed, once again, toward higher-income households—and you have a first-half demand impulse that looks far more constructive than the current mood suggests.

Monetary policy, too, has shifted from brake pedal to steady throttle. The Fed’s third consecutive 25 bp cut matters less for the headline than for the cumulative effect: 175 bps off the peak, with policy now sitting much closer to neutral. In trader terms, the Fed has stopped fighting the cycle and started prepping the runway. This doesn’t guarantee a hiring boom, but it does improve the odds that the labor market stabilizes rather than fractures. A jobless rate hovering around the high-4s, payroll growth grinding along near 80k a month—uninspiring, yes, but consistent with an economy that’s bending, not breaking.

Inflation dynamics follow the same logic. As the tariff impulse fades and labor market slack quietly reasserts itself, pricing pressure should cool. Core PCE drifting toward the mid-2s by end-2026 isn’t a heroic call; it’s what happens when cost shocks roll off and wage growth loses momentum. That gives real growth room to re-accelerate. A 2.1% Q4/Q4 GDP print in 2026 doesn’t scream boom, but it does mark a return to something resembling balance.

The wild card remains the composition of growth. This expansion has been narrow—almost uncomfortably so. Job creation has leaned heavily on healthcare and leisure. Equity gains have been concentrated in the Mag 7 and hyperscalers. It’s a high-beta structure propped up by high-income spending and AI capex. If equities suffer a meaningful drawdown, that support could evaporate quickly, taking confidence, spending, and investment with it. That’s the left tail risk traders can’t ignore.

But markets don’t trade tails alone—they trade probabilities. And the probability-weighted story for 2026 looks better than the one priced into today’s anxiety. Tariffs are no longer tightening, fiscal refunds are flowing, monetary policy is no longer restrictive, and productivity gains from AI are beginning to leak into the real economy rather than just earnings calls.

In market metaphor terms, 2025 planted the seeds under miserable weather. 2026 is when we find out whether the soil was fertile all along. The setup isn’t explosive, but it’s constructive. For the first time in a while, the policy mix looks less like a headwind and more like a mild tailwind—and that’s usually how economic recoveries begin, not with fireworks, but with quiet green shoots pushing through the morning dew.

Chart of the week

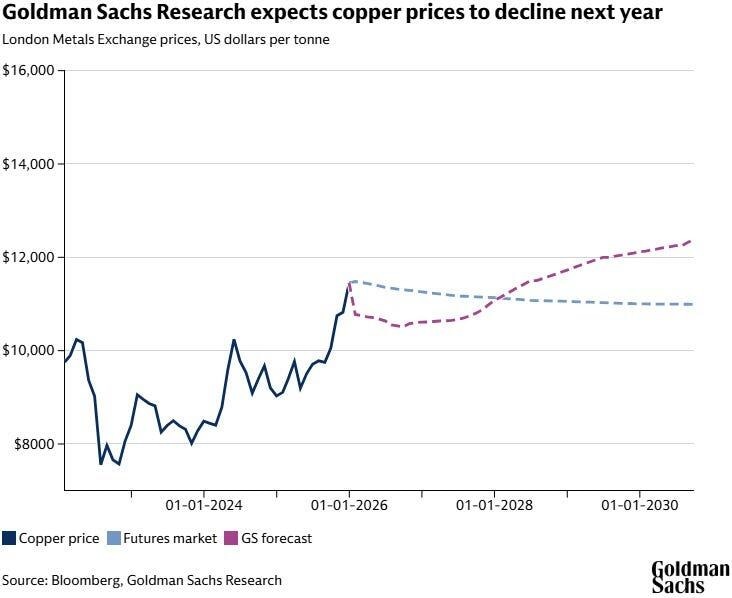

Copper’s record rally forecast to stall

Goldman Sachs Research expects copper prices to decline somewhat in 2026 from their recent highs, even as demand from the grid and power infrastructure, combined with limited growth in supply from mines, gradually drives prices up again in the longer term.

The price of copper on the London Metals Exchange (LME) reached a record $11,771 per tonne on December 8 amid fears of a looming supply shortage outside the US. Inflows to the US are also expected to ramp up in the first half of next year ahead of a potential copper tariff.

Slowing demand for copper from China in recent months has contributed to a growing global surplus of the metal. Analyst Eoin Dinsmore expects the surplus to shrink next year, but “it means that we do not expect the global copper market to enter a shortage any time soon,” he writes in the team’s report.

Goldman Sachs Research forecasts the LME copper price to average $10,710 in the first half of 2026.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.