The Trump trade

The US markets may have had a mild reaction to the assassination attempt on Donald Trump at a rally in Pennsylvania at the weekend, however, there are long term ramifications for financial markets, particularly in Europe.

US Trump’s Europe as polls show clear US Presidential winner

In the aftermath of the events at the weekend, Donald Trump’s chances of winning the election have surged to 67%, according to PredictIT’s survey, with Joe Biden’s chances languishing at 25%. Thus, the prospect of a second Trump Presidency has unleashed the ‘Trump trade’ on the market. For now, the Trump trade is buy American stocks and ditch everything else. For example, US stocks are rising on Monday, yet European stocks are selling off sharply. The S&P 500 has reached a fresh record high at the start of this week, and is easily outpacing its European stock index counterparts, as you can see in the chart below.

Chart one: S&P 500, Dax, FTSE 100, and Eurostoxx 50 indices, normalized to show how they move together over 1 year.

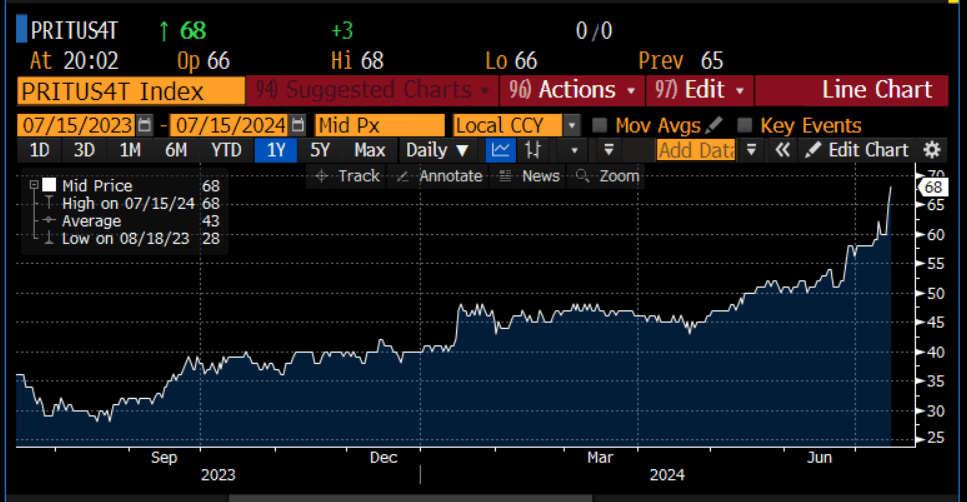

The divergence between US blue chip stocks and their European counterparts started in early June, at the same time as Trump’s chances of winning the November election started to rise, as you can see below.

Chart two: PreditIT’s poll of Donald Trump winning the Presidential Election

The source of the divergence between US and European stocks could be the market’s assessment that a Trump Presidency will be America first, protectionist and isolationist. This mix may hurt European economic prospects and Europe’s trade and export prospects, since the US is the largest and most important trade partner to most of Europe.

Too hard to price in US election risk this early

While it is natural for financial markets to react to the election polls and price in the prospect of a Trump presidency ahead of time, the reality could be more nuanced. Although US/ China relations deteriorated during Trump’s first presidency and trade barriers were erected by both sides, by the end of Trump’s term in office progress on US/ China trade relations had been made. Thus, Trump’s impact on global trade could be more nuanced than some expect. In our view, it is too early to price in the outcome of the US election. We believe that this will be a Q1 2025 trade, once we know who the next President of the US will be and what their policies will entail.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.

-638566730896163038.png&w=1536&q=95)