The time and place to defend Nasdaq is now

We can say in all certainty that the first few days of 2022 for the tech-heavy NASDAQ have been terrible. 2021 ended close to an all-time-highs and 2022 so far is a year of misery and suffering. Sure, maybe those words are too strong but I’m sure that people who are going long would totally agree.

Post pandemic trading on stocks and indices can be pretty much summed up by one phrase: Buy the dip! So, when over those several months we had a correction, traders were eagerly anticipating the local dip to buy with vengeance. That created a lot of V-shaped reversals on the chart and frankly speaking was a bulletproof approach for months. Will that be the case now too?

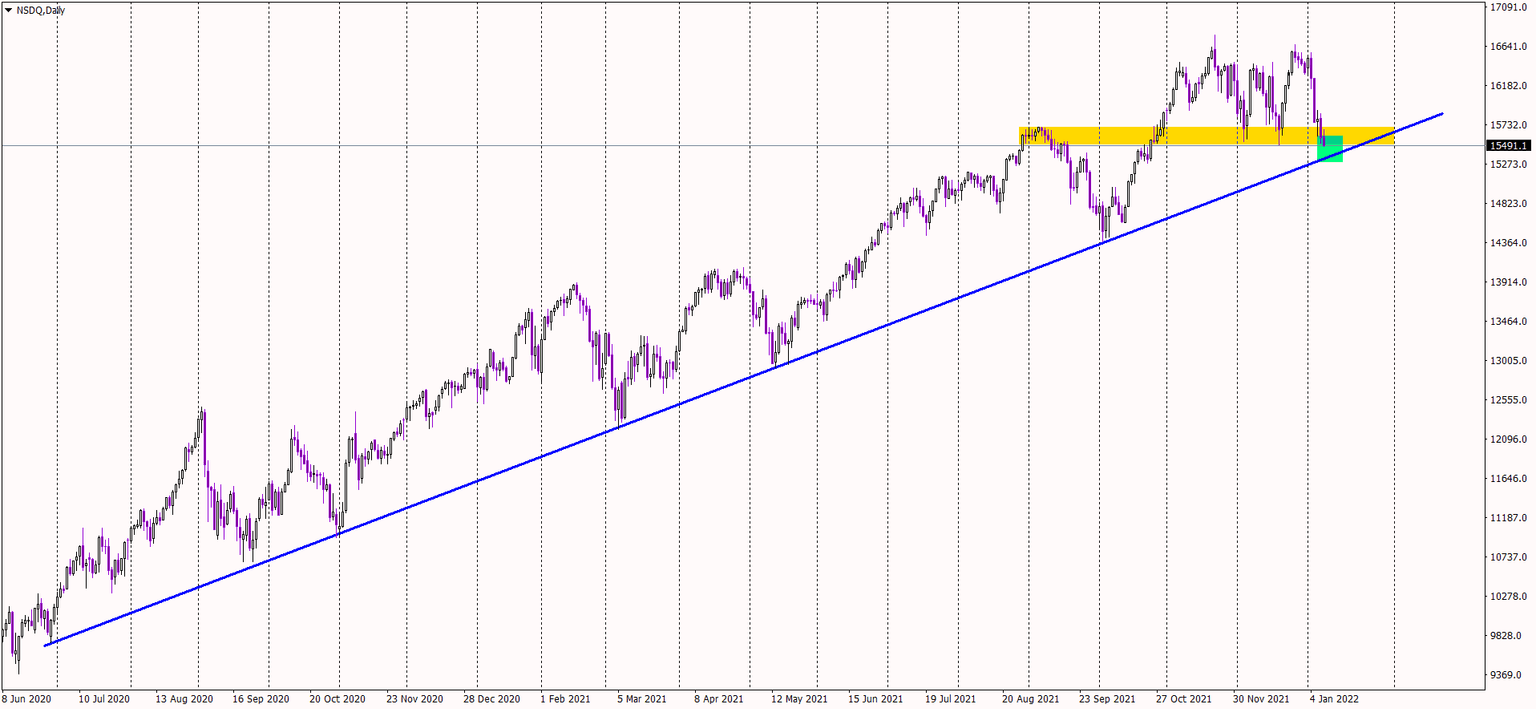

The reason we are wondering is that the NASDAQ is currently flirting with an absolutely crucial long-term support. This support is created by the combination of two important lines: a horizontal and a dynamic one. First the dynamic one – it’s an uptrend line, which connects crucial higher lows since June 2020 (blue). The horizontal one is the area around 15600 points (orange), which has already proven to be a great help throughout December.

It’s absolutely crucial for buyers to buy the dip here and defend this area (green). If we will see a breakout, that would mean a long-term sell signal and potentially huge trouble for the tech index. The next few days should be really interesting.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.