Which is the first cause of sterling’s slide?

Outlook

This is a payrolls week, with ADP on Wednesday. The forecast so far–700,000 new jobs vs. 559,000 last month. Early evidence is that the prospect of wage subsidies ending early is not bringing out the unemployed to all those new jobs. The WSJ reports 22 “states are canceling enhanced and extended unemployment benefits this month, ahead of a federal expiration date in September.” Separately, Goldman predicts “We think these worker shortages will diminish in coming months, primarily because we expect the expiration of federal unemployment benefits to substantially increase labor supply.”

As for that transitory nature of the US inflation, Goldman estimates “supply-constrained industries have added 105 basis points to year-over-year PCE inflation, but that should fall back to 35 points by year end and be a negative 55 points by the end of 2022,” according to Bloomberg.

It’s a very big week for fresh data, including European inflation on Wednesday and the Case-Shiller home prices tomorrow, probably another big number despite its laggardliness. This is going to put attention on the view of important Feds that reducing mortgage QE purchases should be the first of the taperings in a “two-speed taper.” Dallas Fed Kaplan, Boston Fed Rosengren, and St. Louis Fed Bullard are all on record as wanting to pare purchases of mortgages-backed as no longer needed in a booming market and containing unintended consequences and side effects, something the Bank of Canada names “moral hazard.”

We see some disconnects in the Big Picture. In the UK, Delta variant cases are rising at a fast enough pace to threaten the already-postponed end-of-lockdown date–and at the same time, the BoE declined to whisper it might be tapering. Which is the first cause of sterling’s slide, or is it both? In Brazil, the central bank already raised rates and seems on track for more, in the face of rising Covid cases that surely will hinder growth, but not, apparently, inflation. Here’s another one–green energy ETF’s are one of the few sectors to see prices falling, and some by rather a lot (like 15-20%)–and yet investors are still pouring their savings into them. We call this the Ford 150 effect.

Lest we forget that growth leads asset prices, the always reliable Authers at Bloomberg has a doozie of an essay accompanied by this chart. We may think the US stock market is a bit bubbly. “The S&P 500 has risen 91.3% from its Covid panic low last March. With the year not quite half gone, it is up 14%. These are very impressive results, particularly with the latest consumer price index data showing the worst inflation in main street prices in almost three decades.

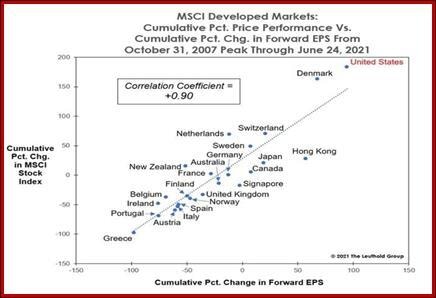

“The U.S. is also running a long way ahead of the rest of the world. The MSCI World Excluding the U.S. index is somewhat below the high it set earlier in June. In the long run, the difference between the two is extraordinary. It was only a couple of weeks ago that the world excluding the U.S. topped its previous all-time high, set on the ominous date of Oct. 31, 2007. As of Friday’s close, the index is 0.18% higher than it was on Halloween 14 years ago.”

…“There are some obvious explanations for this. All the biggest winners from the growth of the internet and online commerce have been American; the euro zone inflicted the sovereign debt crisis on itself for much of the last decade; the Federal Reserve was far faster and more enthusiastic to prime the pump with quantitative easing asset purchases. But still, the U.S. economy continues to cause great discontent amid the population at large, and it’s not as though the rest of the world has suffered anything like the Great Depression, outside small pockets such as Greece.

“If there is a long-term driver, it is corporate earnings. The following remarkable chart comes from Doug Ramsey of the Leuthold Group in Minneapolis.” Refinements of the argument include using forward expected earnings, but the result is not all that different. And “… the short-term implication is that even if price-earnings ratios look extremely high (which they do, particularly in the U.S.), it is plenty possible for share prices to rise even as multiples fall, if profits keep expanding.” Authers has other refinements, but we find this argument reassuring. We might get a burst bubble in housing, at least in some places, but we can put off ideas of a major downturn in US equities. Can’t we?

We continue to see the dollar’s recent gains as having some muscle (lasting power). One caveat–position adjustment ahead of month-end, quarter-end and the US July 4th holiday next Monday (with the accompanying thin Friday).

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat