The Monetary Sentinel: Banxico is widely expected to lower its policy rate

Despite a light calendar of central bank meetings this week—with only Banxico set to decide on interest rates—officials are expected to maintain a cautious stance amid continued uncertainty over US trade policy.

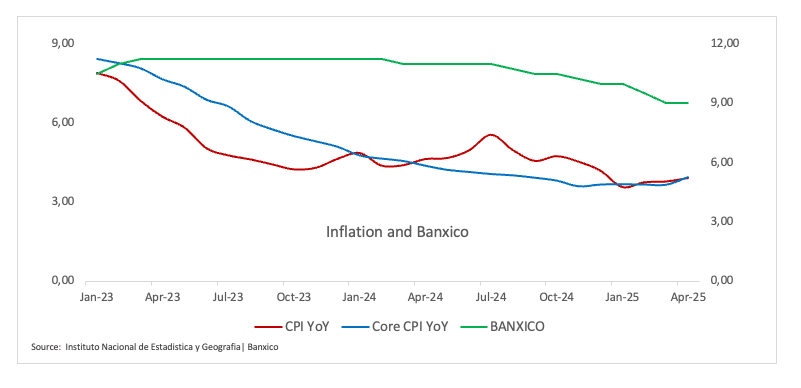

Banxico – 9.00%

At its March 27 policy meeting, Banco de México cut interest rates by 50 basis points to 9.00%, opening the door to further easing of a “similar magnitude.”

In recent comments, Governor Victoria Rodríguez highlighted Mexico’s “solid macro-financial fundamentals” and comparatively low sovereign debt levels, suggesting these factors equip the country to weather potential external shocks—including the prospect of new US tariffs.

Separately, Deputy Governor Jonathan Heath said there is still room for additional rate reductions. He characterised further cuts as “highly likely,” though stressed the need for caution given persistent uncertainties in the economic outlook.

Upcoming Decision: May 15

Consensus: 50 basis point rate cut

FX Outlook: On the monthly chart, the Mexican peso (MXN) has appreciated steadily since the start of the year, pulling USD/MXN down to levels last seen in October 2024, near the 19.4000 mark. While further losses remain likely as long as the pair trades below its 200-day SMA—currently around the 20.0000 barrier—the MXN is expected to stay sensitive to the ongoing back-and-forth over the US tariff narrative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.