The front-burner issue for the FX market is Brexit

Outlook:

We may get some progress on China trade talks and there is a glimmer of a chance the US could team up with the EU to devise new rules for dealing with Chinese subsidies, but we guess the thing to worry about is the absence of a robust response in China to the slowdown. Analysts had been expected a loosening of financial controls on shadow banking, rate cuts, etc. but today Bloomberg reports PBOC chief Yi Gang "emphasized that the country's policy focus remains on keeping its debt load under control, hinting that there may not be much more stimulus in the pipeline... Two major policy meetings are scheduled for the coming weeks, with little sign yet that there will be a push to ensure growth remains at around 6%. China's issues are far from unique, as the trade war continues to erode the global economy. The latest data on exports from South Korea and Japan showed further declines, with finance ministers and central bankers gathered at the IMF pledging to use all their tools to help support growth." What tools?

We get no US releases of interest today, with housing data, durable, and capital goods orders later in the week. The Canadian election is today. Also coming up is the ECB policy meeting, Mr. Draghi's final one before departing Oct 31 and handing over the reins to Lagarde. With the Fed meeting only ten days away, comments from Feds will come to a halt soon.

Aside from these developments, the front-burner issue for the FX market is Brexit. Still. Maybe forever. Gittler at ACLS puts its well: "Brexit is the gift that keeps on giving for people like me who have to write a daily comment. After 3 1/2 years we've had two extensions, three UK Prime Ministers, 21 party deselections, seven party defections, countless amendments, two prorogations of Parliament (a new word for most of us!), one UK Supreme Court judgement, and we're still at square one, trying to work out the date for leaving – never mind the arrangement that will follow withdrawal."

We are no better than any other analyst at guessing what comes next on Brexit. That's one of the main points—everyone is guessing. The uncertainty is extreme, just like the uncertainty over what stupid and outrageous thing Trump will do next. When the two leaders of the Anglo world are such incompetent fools, the financial world feels precarious. It's not wrong, either.

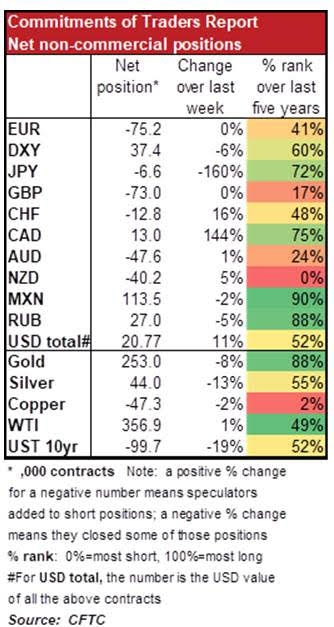

And while we can't count on the Commitment of Traders report to tell us much of anything about the fate of sterling, it might be telling us that the reign of the dollar may be ending. See the Gittler chart of the COT report. For once a format not so hard to grasp. See the drop in long gold and long dollar index. This is somewhat confusing. You'd think they would move with a negative correlation. But the point is that while the euro positioning is flat and sterling is bonkers, the yen and others are switching sides. Can it be the beginning of a reversal? We are practically alone in finding the COT not useful—it reflects sentiment from last Tuesday, after all—but we now think we see a shift in perception away from the dollar (run for the hills) to accepting the euro is not as hideously awful as it used to be. It does look like the Bund yield has bottomed.

Again we show the long-term euro chart. It's not tradeable, of course, but it reminds you that an upside euro breakout can go quite far without changing the overall trajectory. On this monthly basis, the euro is sitting on the linear regression line—i.e., it's "normal." It can go to 1.2130 or so before it becomes exceptional. Not a forecast, of course, but a possibility no one has been contemplating so far. For this to happen, the Fed has to cut rates to the bone and the Bund yield has to keep getting less-bad. That is not a silly idea. Curb your enthusiasm.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat