The Fed is pretending growth is not an issue

Outlook: Today has little to offer but tomorrow we get US CPI, with retail sales on Friday. We also get the University of Michigan consumer confidence, plus the Empire State and Philly Feds. Over the course of the week, we get labor market reports from the UK and Australia, sometimes market-movers.

One thing we can expect this week is a rise in stories about rising inflation and falling growth. Tomorrow we get both in the form of Aug CPI and the NFIB business optimism index. We also get the Redbook weekly retail store sales, but that includes the big shopping days around Labor Day sales, so perhaps not the most representative of consumer sentiment.

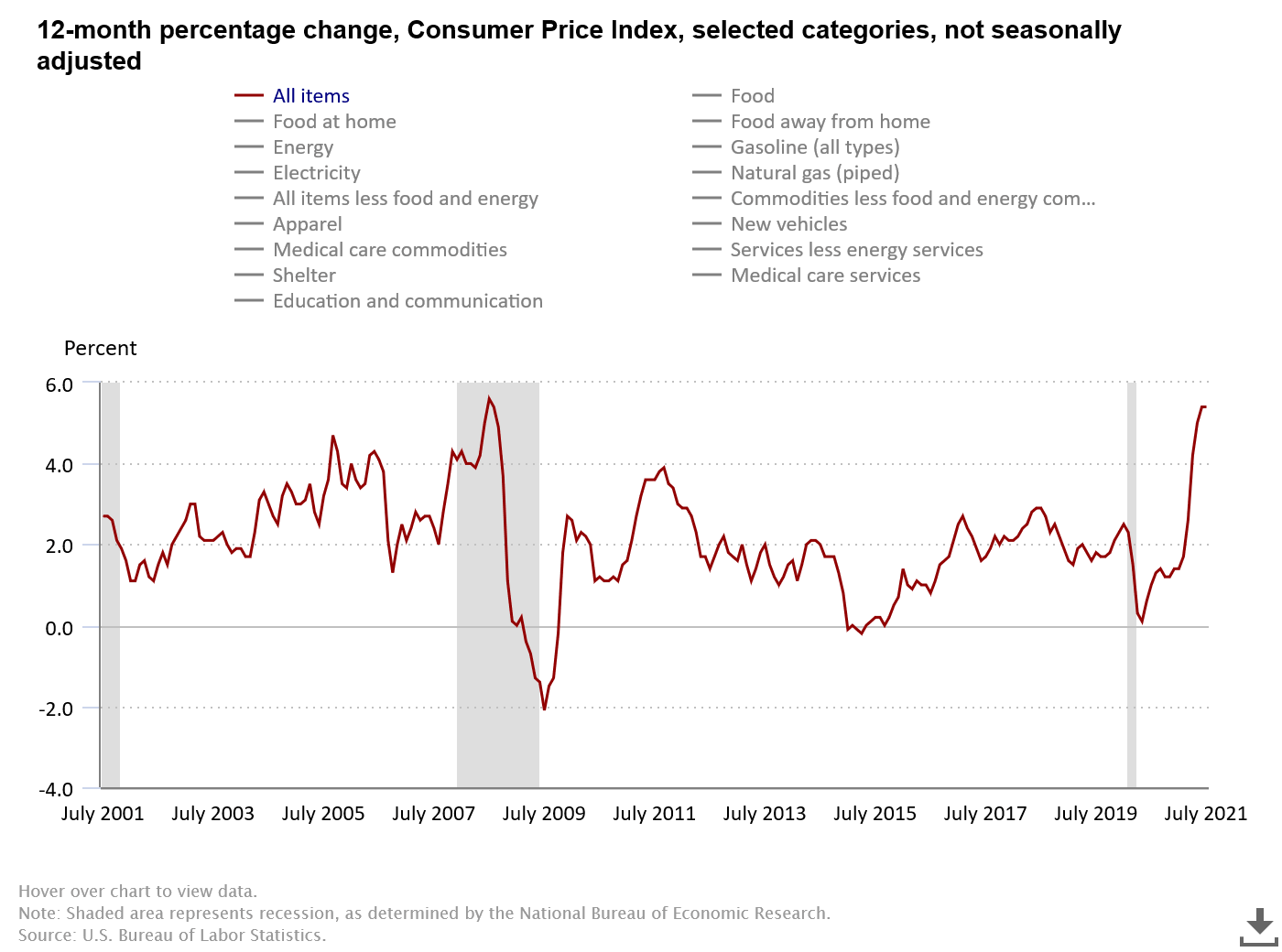

See the CPI chart from the source, the BLS, and notice the correlation of the total to new car prices…. It’s fun (well, sort of) to fiddle with the components.

To be fair, the cost of electricity is also highly correlated, while the costs of medical commodities and services are falling.

Here’s the problem: the supply chain issues are not going away. The Fed claims they are transitory but that’s a wish and a hope, not a certainty. As the WSJ points out, durables that had been falling an average of 1.9% a year between early 1995 and early 2020 has flipped to rising by 7% as of July, with fresh data coming tomorrow. The rise in durables prices is double the rise in services. We can blame commodity prices, shipping problems, and Covid. To imagine this trend is going away in a blink of the eye, or when US job growth improves, is not realistic.

As for growth, no Armageddon yet—the Atlanta Fed’s GDPNow on Friday was the same 3.7% for Q3 as it had been the week before. Consumption up, capex down. Last week the NY Fed announced it was suspending its Nowcast because the pandemic is making data volatile. Its last estimate for Q3 GDP was nearly the same as the Atlanta Fed’s—3.8%. We need to wonder if when we finally get the first “advance” GDP from the BEA on Oct 28, the interim estimates will have dipped some more.

The Fed is pretending growth is not an issue. The Bloomberg survey shows the majority sees the taper announcement in November and action beginning already in December. No sign of a tantrum yet. Most recently, Philly Fed chief Harker said the Fed’s bond-buying is not relevant anymore, and last Friday, Cleveland Fed Pres Mester said the economy has improved enough to taper.

The so-called reflation trade is alive and well, with equity market analysts busily measuring growth vs. value and other silly stuff. But while inflation can dominate the week, the real story is growth. The mood may be somewhat risk-on (and an out-of-favor dollar) but can reverse on a dime to risk-off if the US economy looks like stumbling.

Tidbit: Property speculation has been a problem in China for several years. Remember those ghost towns full of empty apartment buildings? Housing is still some 75% of household wealth, and the funding comes not only from savings but also debt, which The Economist says exceeded 70% of GDP last year. The government has been trying to get speculation under control, in part by limiting banks’ ability to lend to developers. Now sales are falling, down 23% y/y in Aug. In addition, housing accounts for a large amount of income in inequality, running against the grain of the new “common prosperity” goal.

Now the speculation problem could become a stability problem for more than just Chinese companies and banks—as we await the default or rescue of Evergrande, other weak Chinese developers are facing falling demand for their bonds and rising yields, snuffing demand for new bonds. The WSJ reported yesterday “… the extra returns investors demand to hold Chinese high-yield dollar bonds instead of U.S. equivalents, have soared, with that spread widening to about 9.4 percentage points as of Thursday, up from about 4.8 percentage points three months earlier, according to ICE BofA indexes.”

We dismiss Mr. Soros at our peril; he said a few weeks ago China is headed for a hard landing. The question may be how much it could contaminate the rest of the EM financial world, as in the 1997-98 crisis.

Tidbit 2: Everyone had an overload of 9/11 memorials all day Friday and over the weekend. If you worked in finance in New York in those days, you knew someone at the World Trade Center.

Now we await the removal of the redactions of the Saudi government participation, if any, from the 9/11 Commission report. The bright spot—a ceremony honoring the 800+ boat captains that rescued more than 500,000 people from the southern tip of Manhattan twenty years ago. It’s the biggest boatlift evacuation in the world, bigger even than Dunkirk but with the same heroic spirit and coming together of citizens.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat