The Fed is in a pickle and seems to have known it was coming

Reuters has a terrific headline today: "Fed can soothe Trump or Treasuries, not both." As already noted, the rise in US yields is extreme and credited to the rise in the risk premium demanded by fixed income investors specifically because of Trump Risk.

Reuters' Dolan writes that "The so-called term premium has largely been absent from the market for over a decade. But the New York Fed's estimate of the 10-year term premium has climbed sharply this year, topping half a percentage point for the first time since 2014.

A 50-basis-point risk premium may not be excessive by historical standards, but it's 50 bps above the average of the past 10 years."

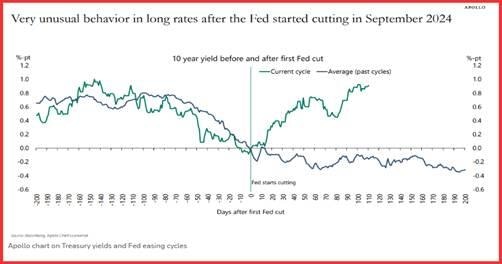

The Fed has cut 1% and the 10-year yield has risen 1%, which is backwards and a screaming message to the Fed that far too much danger lies ahead. Reuters has a dandy chart showing the divergence. Evidence is also in the 2/30 yields curve, the widest in about three years—when the Fed started tightening.

The Fed is in a pickle and seems to have known it was coming, with the minutes showing hesitation by some members over whether inflation really was whipped. Now that the bond vigilantes are shouting as loud as possible, the Fed is going to have real trouble pretending it has no responsibility here. But if the Fed speaks out that the yield rise is overdone and not justified (which Trump would like), it knows it would not be believed, and to the Fed credibility is a top prerequisite.

A battle is looming. Can we really think that a guy who wants to make Canada the 51st state is going to leave the Fed alone?

Fed Waller said yesterday he doesn’t know what's coming next. Ther is a tiny possibility the Fed can continue cutting rates, or promising to, to assuage the raging Trump. Another idea is that Trump figures out the high yields demonstrating uncertainty are about his fiscal deficits plans, and pare back. Neither of these ideas is in keeping with Trump's behavior. He is the bull in the china shop.

We say Trump's 59 things to do on the first day may not include firing the Fed, but it's surely there in the first week. Considering he had evaded legal consequences his whole life for his whole life, he thinks he will win any legal battle Mr. Powell can bring. One Fed has already said he's not up for the legal battle and resigned his supervisory job while remaining a member (Barr).

Wat happens if and when Trump dismantles the Fed? The real question is where do the yields go? How about another 2.5% on the 10-year to 7.5%? That might trigger another one of Trump's goofy ideas—repudiating the deficit, bitcoin for reserves, etc. This may seem on the extreme edge of the possible scenarios, but the probability is not zero.

Forecast

Despite the stock market closed today and the bond market closing early, the FX market has plenty of fodder. The rising US yield differential turned out to be the main event, as usual. Downside targets might be the linear regression at 1.0277 and/or the B band bottom at 1.0247. Going the other way, in the event of a small recovery, the 20-day lies at 1.0382.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat