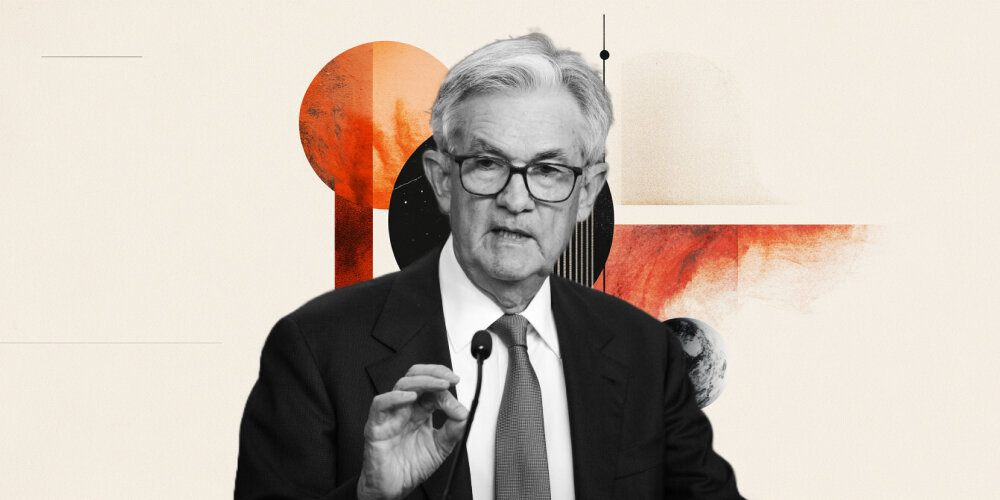

The Fed chief is worried about the wildly uncertain inflation outlook

Consumer sentiment is near an all time low. Leading indicators today are expected to be grim. The Fed chief is worried about the wildly uncertain inflation outlook. That was affirmed by the Walmart CEO who said tariffs are too high and his stores will be raising prices because of them. Several companies, including Walmart, won’t give advance earnings reports because of tariffs. JP Morgan chief Dimon still thinks recession is on the table.

So why was the stock market posting gains?

The reality-denying stock market may get a comeuppance today and deliver an opening gap to the downside. The Moody’s downgrade is sort of silly, as TreasSec Bessent says, because so late after the other agencies downgraded the US and so late after the deficit became so unwieldy. He has a point about the Moody’s downgrade not being all that important, since the agencies collectively lost respect by totally screwing up the ratings on mortgage packages that led to the 2008 financial crisis.

Still, he must know that some managers (like insurance companies) are required to place some percentage of holdings only in Triple A paper. Buyers and holders will be lost.

Off on the side and of unknown consequence is the ECB prodding banks to reduce their dollar funding needs, in case the US pulls back on swap funding if there is a another global funding crisis. In the 2008-09 crisis, the Fed lent almost a trillion to various European central banks. This is a Fed capability, not the Treasury, so the risk of the US letting down the European banks is low—so far. We never did understand why European banks would offer dollar-denominated mortgages and consumer loans in places like Hungary.

But it may be too late for the Moody’s decision to have much effect, considering the other two big agencies already did it. When S&P downgraded the US on August 5, 2011, the next trading day saw the S&P crash almost 7%. Weirdly, the dollar rose that time on the safe-haven idea. The next time, when Fitch downgraded the US on August 1, 2023 , there was hardly any response in any market. Some analysts say all it took was one downgrade for the investment managers to change their requirement of “only Triple A”—because there were so few—and that was 14 years ago. We are not sure we buy it.

Still up in the air and not a little confusing are conditions in the UK and Japan. We get a slew of UK data this week (CPI, retail sales) but the focus remains on what the government is doing to alleviate pressure on the public and the grim mood. A rate cut is expected but not until the late summer. In Japan, we get the trade balance at mid-week, recently back in the black for the first time in years but under severe threat of tariffs. Washington says we are close to a deal but Washington lies, so who knows?

Forecast

The trade war is not over. The biggest effect will be in China, so far holding up and with a few months to go before a deal must get done or the country falls into a deep recession. There is a limit to how much China can transfer exports to other countries, specifically the eurozone.

The Moody’s downgrade is a shock and it remains to be seen how long-lasting it will be. It could easily be a small and short-lived effect, like the Fitch downgrade. All the same, the dollar has a bad smell these days and aside from the usual bounceback on profit-taking, any forecast of a true recovery is wishful thinking.

Tidbit: The TICs report for March fails to show foreigners fleeing the US and the dollar. China, Japan and Ireland (huh?) reduced purchases, but overall, foreigners bought $233 billion in the month for a year-over-year gain of $942 billion. The total us new record high of $9.05 trillion. Long-term was $133 billion of $233 or 57%. WolfStreet notes that Canada was a gigantic buyer in March.

The US debt, currently capped at $36.2 trillion, has grown faster than foreigners can buy, reducing their total share of the debt, with domestic buyers stepping in.

Wolf reports “The most recent Treasury Auction Allotment Report on May 7, which covers all auctions through April 30, shows that foreign investors purchased $36 billion in notes and bonds (‘coupons’), for a share of 9.7% of the $370 billion in notes and bonds sold to the entire market (Fed purchases excluded).

“Both the dollar amount and the 9.7% share were higher than in March. And the rumors raging in April, spread by the anti-tariff clickbait crowd, that foreigners were boycotting the Treasury auctions to punish the US government for the tariffs, were shot down by reality.”

See the list for March:

-

United Kingdom: +$29 billion, to $779 billion

-

Luxembourg: unchanged, at $412 billion

-

Cayman Islands: +$37 billion to $455 billion

-

Ireland: -10 billion to $329 billion

-

Belgium: +$7 billion to $402 billion

-

Switzerland: +$21 billion to $312 billion.

And Canada is a doozy: a spike by $20 billion in March after a $55 billion spike in February, to $426 billion. “Since March 2021, holdings have quadrupled! Since 2012, holdings have octupled!”

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat