The Fed can cut 50 bp because it can

Yesterday new guru Sahm wrote that there is a decent argument for 50 bp.” Progress on inflation alone justifies the start of the Fed’s easing cycle and gets us the first 25 basis points…. The disappointing labor market data since the July FOMC meeting should add another 25 basis points to the cut. My argument is one of recalibration and does not rest on the risk of a recession, though that could be an alternate path to 50.” See her charts.

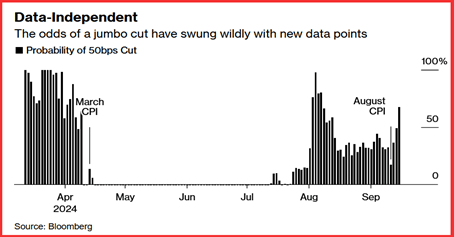

So there we have it. What looked like wishful thinking at first has now become the consensus view. And it has started to make sense, too. The Fed can cut 50 bp because it CAN. The data-dependency box is checked—see Sahm’s charts. And the absence of a crisis is actually a positive factor. Nobody is going to get upset and nobody can claim the Fed is behind the curve. It also signals the Fed hears the Gloomster recession talk and gives it a wave.

Now that the yield curve is disinverting, meaning the 10-year yield higher than the 2-year where it belongs, some folks believe a recession is inevitable. Well, not every time. And in past cases, there were other economic trends or events to help the recession develop. This time it might be the labor market, but it isn’t in crisis by any means, and remember the Atlanta Fed and its pretty good nowcasts. Also, remember the one-time-only demographic and post-Covid conditions.

Bloomberg’s Authers inject a note of skepticism. He points out that it’s almost unheard of for this 25 vs. 50 dispute to have arisen and turned the Fed decision into a casino game. “In FOMC roulette, the market has put 70% of its chips on a 50-basis-point cut. Whatever the Fed chooses, it will be the biggest surprise since the GFC (Global Financial Crisis 2008-09). A chart from Deutsche Bank shows the gap between market betting two days before a Fed decision and then the resulting rate. This time it’s the biggest ever, and clearly due to the Fed working to avoid surprises.

And “At least traders seem to trust the WSJ, the FT and Bloomberg Opinion, which is good. One reason the Fed might be cautious — the BIS suggests the yen carry trade has further to unwind.” We say the yen is not in the Fed’s wheelhouse. It’s barely in the Treasury’s, where currency matters reside. We rather like the chart showing the history of 50 bp.

Big-shot former Fed chief Dudley says the Fed should “go big”—the logic supporting a 50-basis-point cut is compelling. He runs though the familiar arguments, the bottom line being “Monetary policy is tight, when it should be neutral or even easy. And a bigger move now makes it easier for the Fed to align its projections with market expectations… “

Forecast

The Fed can do 50 bp precisely because we don’t have a crisis and policy is too tight given the data, with a dollop of fear that the labor market could deteriorate. At this point we would be surprised if the Fed does not do 50. As usual, we need to worry about a sell-off of anti-dollar positions once the actual news arrives. This is a rare set of circumstances and traders might do well to get out and stay out. If the Fed disappoints tomorrow with only 25 bp, there fur will fly.

Tidbit: Note that among the charts, the one loser is the Canadian dollar. Analysts say this is because the BoC is already pretty dovish and expected to follow suit or at least say it’s going to cut dramatically, without admitting it is following the Fed.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat