The dollar continues to remain stronger globally after the hawkish comment by Fed Powell

Key highlights

Japan's factory activity growth slowed in June as China's strict COVID-19 curbs took a toll on manufacturing demand, even as service sector sentiment hit a nearly nine-year high on the fading pandemic drag. The au Jibun Bank flash Japan Manufacturing PMI slipped to a seasonally adjusted 52.7 in June from a final 53.3 in May, marking the slowest expansion since February when it also was 52.7.

Euro zone business growth has slowed significantly this month as consumers concerned about soaring bills opted to stay at home and defer purchases to save money, a survey showed. S&P Global's flash Composite PMI, seen as a good gauge of overall economic health, slumped to 51.9 in June from 54.8 in May, far below the 54.0 predicted in a Reuters poll and its lowest level since February 2021.

Britain's economy is showing signs of stalling as high inflation hits new orders and businesses report levels of concern that normally herald a recession, a closely watched industry survey showed. S&P Global's PMI, covering services and manufacturing firms, also showed companies raising pay and passing higher costs on to clients, a worry for the Bank of England. The PMI's preliminary composite index held at 53.1 in June, above the median forecast of 52.6 in a Reuters poll of economists and unchanged from May.

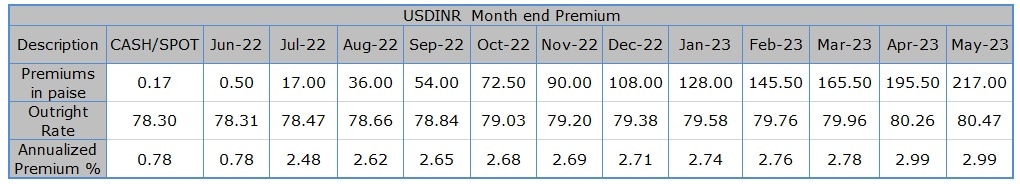

USDINR movement

The USDINR pair made a gap-down opening at 78.25 and traded within the range of 78.23-78.375. The pair closed the day at 78.30 levels. The pair continued to trade near the 78 levels, not too far from its all-time high amid broad strength of the US dollar and persistent foreign fund outflows. The crude oil prices continued to trade above 110 levels, giving discomfort to the domestic currency and denting investors' sentiment. The dollar continued to remain stronger globally after the hawkish comment by Federal Reserve Chair yesterday in the Fed Chair Testimony. The exporters are not selling the forwards as the forward premium have crashed, this will limit the major losses in the pair.

Global currency updates

The EURUSD pair has declined sharply and tested the 1.0500 level. The shared currency is having a difficult time finding demand following the disappointing data releases and the pair could extend its slide in case safe-haven flows dominate the markets in the second half of the day. The monthly data published by S&P Global revealed that the business activity in the private sector grew at a softer pace than expected in early June. The GBPUSD pair has declined sharply but managed to recover modestly after having briefly dipped below 1.2200. The PMI data published by the S&P Global revealed that the business activity in the UK's manufacturing and service sectors continued to expand at a relatively healthy pace in early June. Although the British pound erased a portion of its daily losses after these data, it could find it difficult to gather further bullish momentum. The intraday slide extended and dragged spot prices of the USDJPY to a fresh daily low today below 136 levels. Market players turned caution amid speculations that any further sharp depreciation of the Japanese yen might force some form of practical intervention.

Bond market

The yield on the benchmark U.S. 10-year Treasury note fell to its lowest level in almost two weeks as investors continued to assess the likelihood of a recession. The yield on the 10-year Treasury note was seen at 3.12%. The moves come after Federal Reserve Chairman Jerome Powell told Congress that the U.S. central bank is “strongly committed” to cooling the soaring inflation rate. However, India’s 10-year sovereign bond yields rose as the investors turn sellers and took a flight toward safe-havens.

Equity market

Indian equity benchmarks Sensex and Nifty 50 managed to finish a volatile session in the green, amid mixed moves across global markets after Federal Reserve Chair's speech. Gains in financial, IT, and auto shares pushed the headline indices higher. Broader markets also mirrored the gains in the main indices, with the Nifty midcap 100 and the Nifty small cap 100 rising more than one percent each.

Evening sunshine

"Focus to be on the US Fed Chair Powell’s testimony."

European stocks were lower, as global markets see renewed volatility after a brief recovery following last week’s tumultuous trading. U.S. stock futures crept higher ahead of weekly employment data and Federal Reserve Chair Jerome Powell’s second day of testimony on Capitol Hill.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.