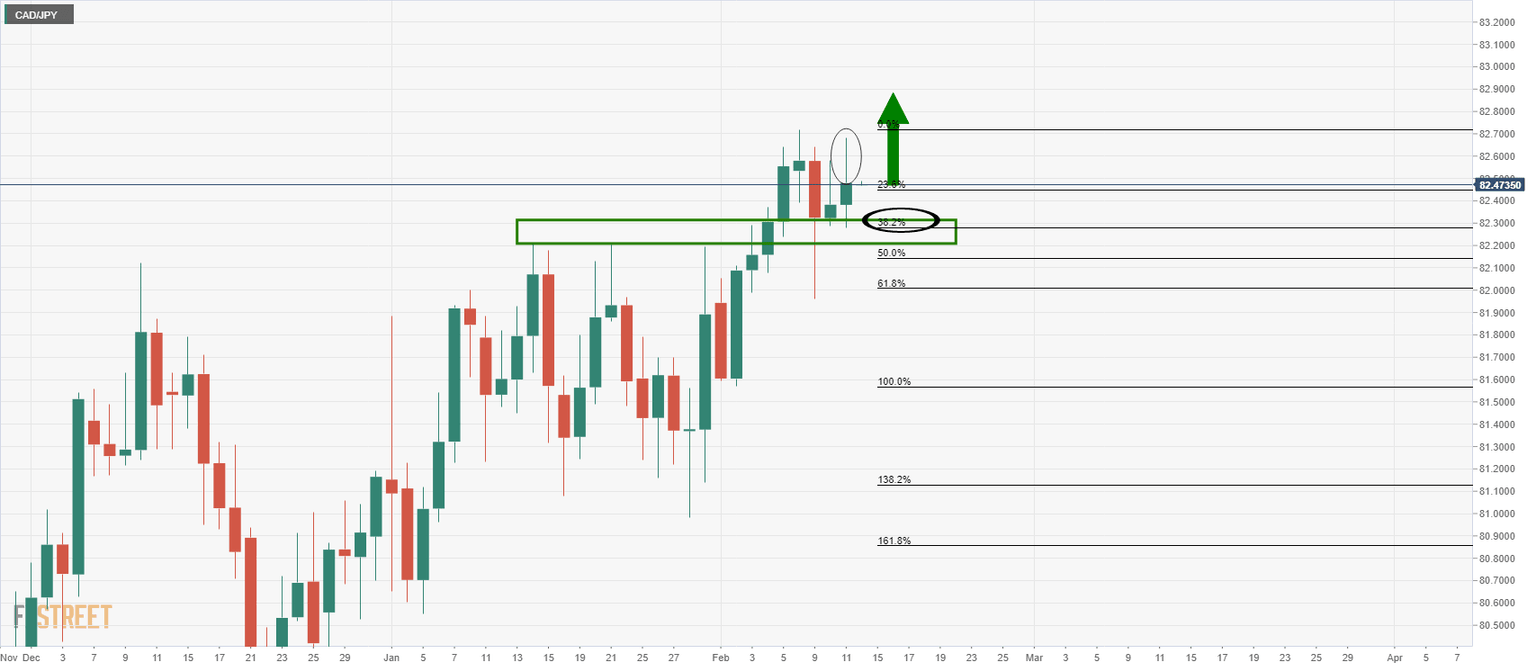

The Chart of the Week: CAD/JPY bulls seeking upside continuation

- CAD/JPY bulls in play from support and target a daily extension.

- There are bullish prospects from an hourly perspective on a 38.2% Fibo retracement for the open.

Following on from last week's analysis, CAD/JPY Price Analysis: Bulls stepping in at a discount within long-term bullish trajectory, the cross is indeed headed in a northerly trajectory, albeit correcting.

However, it is expected to continue towards a measured target of 82.9150.

The cross spiked from within 4-hour demand on Thursday to print a higher high in resistance which has now seen the cross buckle to support in the 82.61 territories.

The following is a top-down analysis that illustrates a bullish bias still from a longer-term perspective.

Prior analysis

The daily chart was showing prospects of a bullish fill of the wick left by the strong bid in the cross that crystalised at a 38.2% Fibonacci of the bullish impulse.

From a 4-hour perspective, the set-up was based on the correction's prospective floor at the support structure. While prices ran in drawdown momentarily, bulls were firmer ahead of the previous low and proposed stop-loss zone.

Subsequently, the price has expanded to the upside to print a higher high and closed in bullish territory.

Live market

A breakeven scenario has evolved from a swing trading perspective, but for the open, there is a day trading set-up for the takings.

From an hourly perspective, the price has made a 38.2% Fibonacci retracement and is holding at support structure.

A continuation can be expected to the upside. A -272% Fibo of the correction's range opens prospects to 82.8110 for a1:2 risk to reward ratio.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637489258858572380.png&w=1536&q=95)

-637489261600482169.png&w=1536&q=95)