EUR/JPY: Technicals meet macro for trading insights

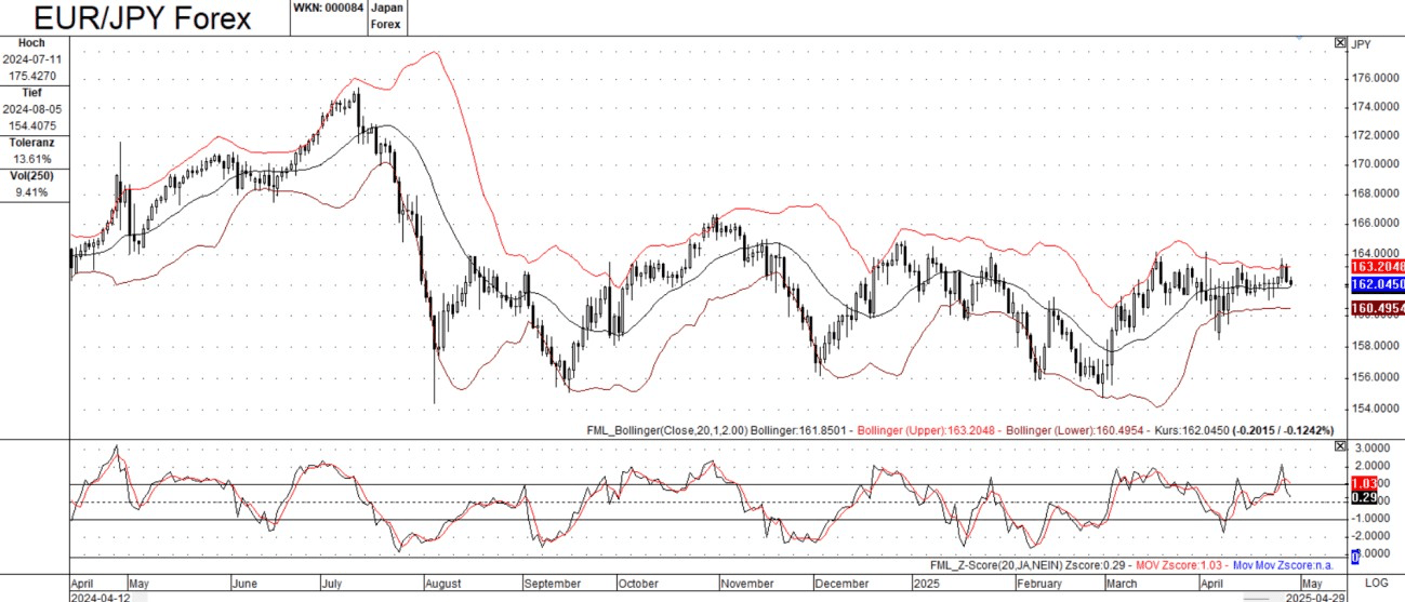

The analyst will provide an analysis of the EUR/JPY forex pair, incorporating macroeconomic factors but before diving into macroeconomics, let's summarize the technical picture presented in the charts below:

Inflation rates in the Eurozone, driven by energy prices, supply chain disruptions, and wage growth, significantly impact the ECB's monetary policy decisions and, consequently, the Euro's value. While Japan has historically struggled with deflation, recent global inflationary pressures have also affected Japan. The BOJ's response to inflation is critical for the Yen's direction.

Global events, such as geopolitical tensions, trade wars, or financial crises, can significantly impact risk sentiment and drive flows into safe-haven currencies like the Japanese Yen. During periods of uncertainty, the Yen tends to strengthen.

Overall investor confidence in the global economy and specific regions (Eurozone, Asia) influences currency valuations. The Eurozone's trade balance (exports minus imports) reflects

its competitiveness and can affect the Euro's strength. Japan's trade balance, heavily reliant on exports, is sensitive to global demand and currency fluctuations.

Connecting macro to technicals

To effectively analyze EUR/JPY, it's crucial to connect the technical picture with the macroeconomic backdrop:

Uptrend (early-mid 2023): This uptrend might have been fueled by factors such as: A stronger Eurozone economy relative to Japan. Expectations or actual increases in ECB interest rates while the BOJ maintained its dovish stance. Increased risk appetite in the market.

Consolidation/range-bound (late 2023-present): The consolidation could reflect: Uncertainty about the future direction of monetary policy in both the Eurozone and Japan. Conflicting economic data from both regions. Increased volatility due to global economic or geopolitical events. The market waiting for a clearer signal on the sustainability of inflation or the strength of economic growth.

Key levels (support/resistance): These levels often align with significant macroeconomic thresholds. For example, a break above resistance might occur if the ECB adopts a more hawkish stance than anticipated, or if the Eurozone economy outperforms expectations. Conversely, a break below support could be triggered by weaker Eurozone data, a more dovish ECB, or increased safe-haven demand for the Yen.

Indicators: Technical indicators can provide clues about how macroeconomic factors are being reflected in market sentiment and price action. For instance, increasing bearish sentiment (red bars in the sentiment indicator) might coincide with concerns about Eurozone economic growth. Bollinger Bands can highlight periods of heightened volatility when major economic data releases or policy announcements occur.

To make informed predictions about EUR/JPY, it's essential to monitor: ECB and BOJ policy meetings, key economic data releases, global economic outlook, geopolitical events. Analyzing the EUR/JPY forex pair requires a comprehensive approach that combines technical analysis with a deep understanding of macroeconomic factors. By monitoring interest rate differentials, economic growth, inflation, risk sentiment, and trade balances, traders and investors can gain valuable insights into the drivers of this currency pair and make more informed decisions. The technical charts provide a visual representation of market action, while the macroeconomic analysis provides the fundamental context for understanding why those movements occur.

Author

FxPro Traders Research Team

FxPro Traders

The FxPro Traders Research Team delivers advanced analysis and strategies designed to empower your success in today's dynamic forex markets.