Gold technical analysis: XAU/USD tackles consolidation’s top frontier; drive frail

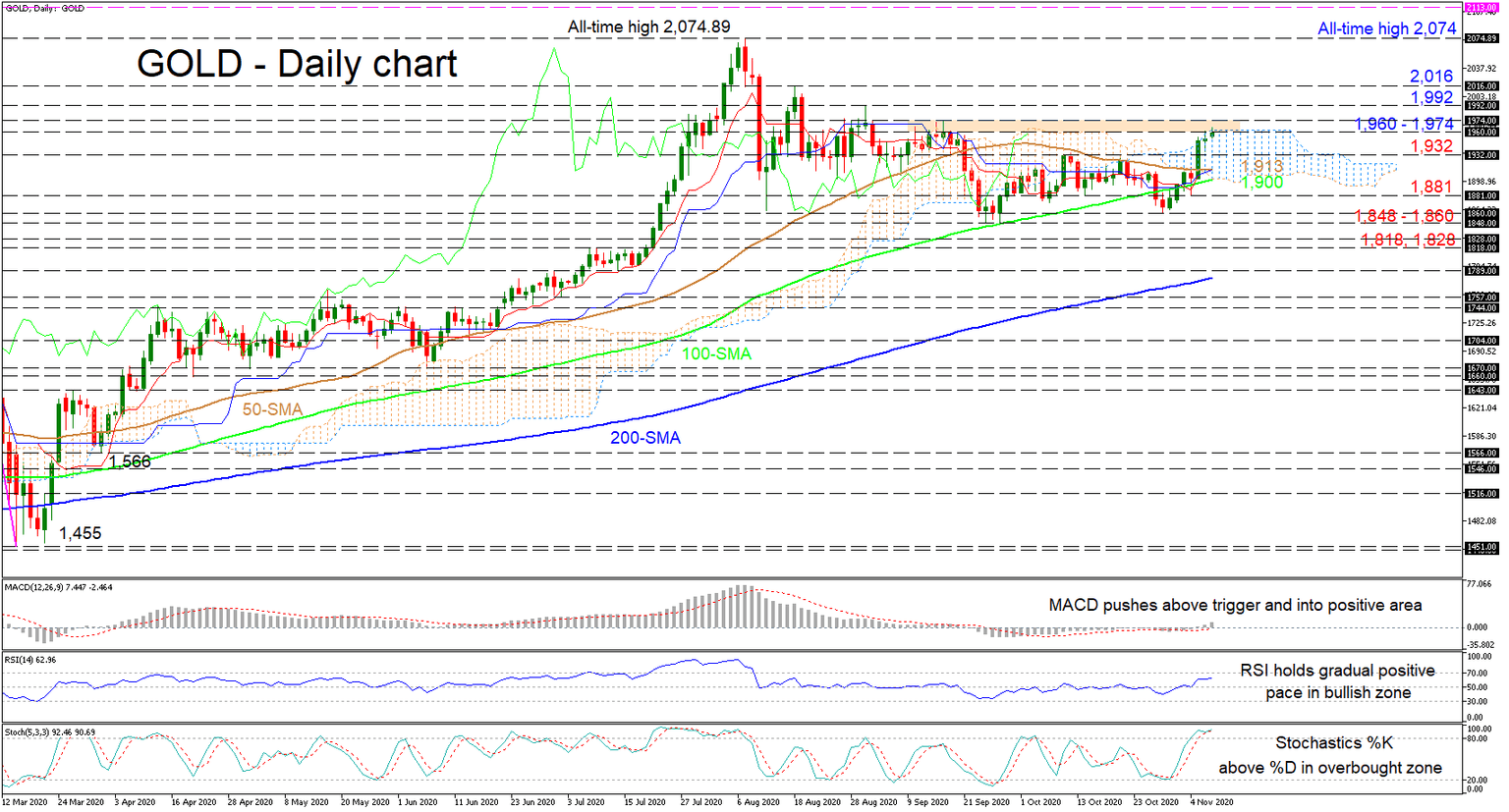

Gold appears shackled as it is struggling to break above the cloud’s ceiling, which coincides with the roof of the two-and-a-half-month ranging market. In spite of the dwindling 50-day simple moving average (SMA), the SMAs defend the broader dictating bullish tone. The near-term gradual fading of the 50-day SMA and the directionless Ichimoku lines promote the commodity’s neutral demeanour.

The short-term oscillators maintain a positive attitude despite flimsy sentiment. The MACD is above its red trigger line and the zero mark, while the RSI is creeping higher in the bullish region. The %K line is increasing above its %D line in overbought territory and has yet to show signs of waning in price. Nonetheless, a pullback cannot be ruled out as the price is currently encountering a heavy obstacle.

To the upside, the bulls face immediate fortified constraints from the upper surface of the cloud, encapsulated in a resistance band from 1,960 to 1,974. If buyers manage to overcome this reinforced border the hike may meet the 1,992 high and the 2,000 round number, before attempting to hit the 2,016 peak from August 18.

If the resistance zone bounds the ascent, early limitations may arise from the 1,932 inside swing high. Following is a tough support region, which also contains the Ichimoku lines, from the 50-day SMA at 1,913 until the 100-day SMA at 1,900, currently in-line with the cloud’s lower band. Dipping underneath the cloud, the 1,881 low may come next before the foundation of 1,848-1,860 of the horizontal move attempts to terminate the descent. If it fails to do so, the commodity may next struggle at the 1,828 and 1,818 barriers.

In brief, the commodity appears chained between 1,848 and 1,974 in the short-term picture. Decisive breaks above or below these boundaries may signal the next clear price course.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.