Stocks turn lower as risk appetite churns

Is Boris a busted flush? Of course! But can he cling on? Less savaged by a dead sheep, the big dog, trying to cajole his flock, was headbutted by a gnarly old ram. If Sue Gray’s report lets the PM off, he could yet have enough political capital to hold on, but only for a limited period while the plotters scheme...polling data will not improve much and that’s all that ultimately counts. MPs in marginals are already looking for a new leader but even so-called safe seats are no longer safe (Chesham & Amersham, North Shropshire). Things are just about to get interesting in British politics. Markets won’t be too concerned – the leading candidates like Sunak and Truss seem pretty free-market, fiscally conservative, on the whole. And remember, Brexit is done. So too, the pandemic. The new leader will hopefully have a brighter outlook.

After a decent start for stocks in Europe, the main bourses turned broadly lower, after more selling in the US, whilst Asian markets snapped a week’s run of losses as China cut benchmark mortgage rates. As the UK and US tighten policy, they are leaving many peers behind...The Bank of Canada might hike next week, the RBA likely later this year. The ECB is way behind and looks deaf to cries of inflation – German PPI inflation rose to a record-breaking 24.2% in December, data this morning shows.

Bonds are not moving in a straight line up by any means...US 10s back to 1.85% after touching 1.90%. Maybe a hint of geopolitical risk premium weighing on stocks and helping cool the rout in bonds...does Russia invade Ukraine? Joe Biden thinks it’s likely. Oil prices are a little lighter after touching multi-year highs. US nat gas is also weaker with yesterday’s sharp reversal signalling the end of the uptrend since the end of December.

The FTSE 100 marked a fresh post-pandemic high at almost 7,620 in early trade but turned lower to trade down about 0.3% after the first hour of trade. ABF shares were a little lower as sales at Primark remained depressed by the pandemic. Declining footfall due to the rapid rise of the omicron variant left like-for-like sales at its UK stores down 10% from before the pandemic. Total sales were 5% down and LFLs were 11% below two years before, but up 36% on last year. Margins are looking good though, up ahead of forecast to above 10%.

Unilever shares rose a touch as the company said it would not increase its £50bn offer for GSK’s consumer unit. Investors kicked up a fuss and the board stepped back. Now the question is whether GSK finds another suitor, there are candidates though it can just spin it off; and what Unilever does to boost its share price. After Kraft-Heinz tried to buy the company, it reacted by increasing debt. It can’t pull that trick again. Selling off some of its brands is a likely choice. There are plenty of innovative businesses in consumer foods - Unilever can probably find smaller prey that are easier to digest.

Deliveroo shares rose over 2% as it recorded a 70% rise in sales (gross transaction value) last year, which was at the top end of guidance. The company posted market share gains in the UK and good sequential growth in international markets (+10% in Q4 over Q3). Gross margins seen in line at 7.5%-7.75%. Shares traded at 173p, barely above the all-time low struck this month...lots of work to do. No more lockdown tailwinds to look forward to.

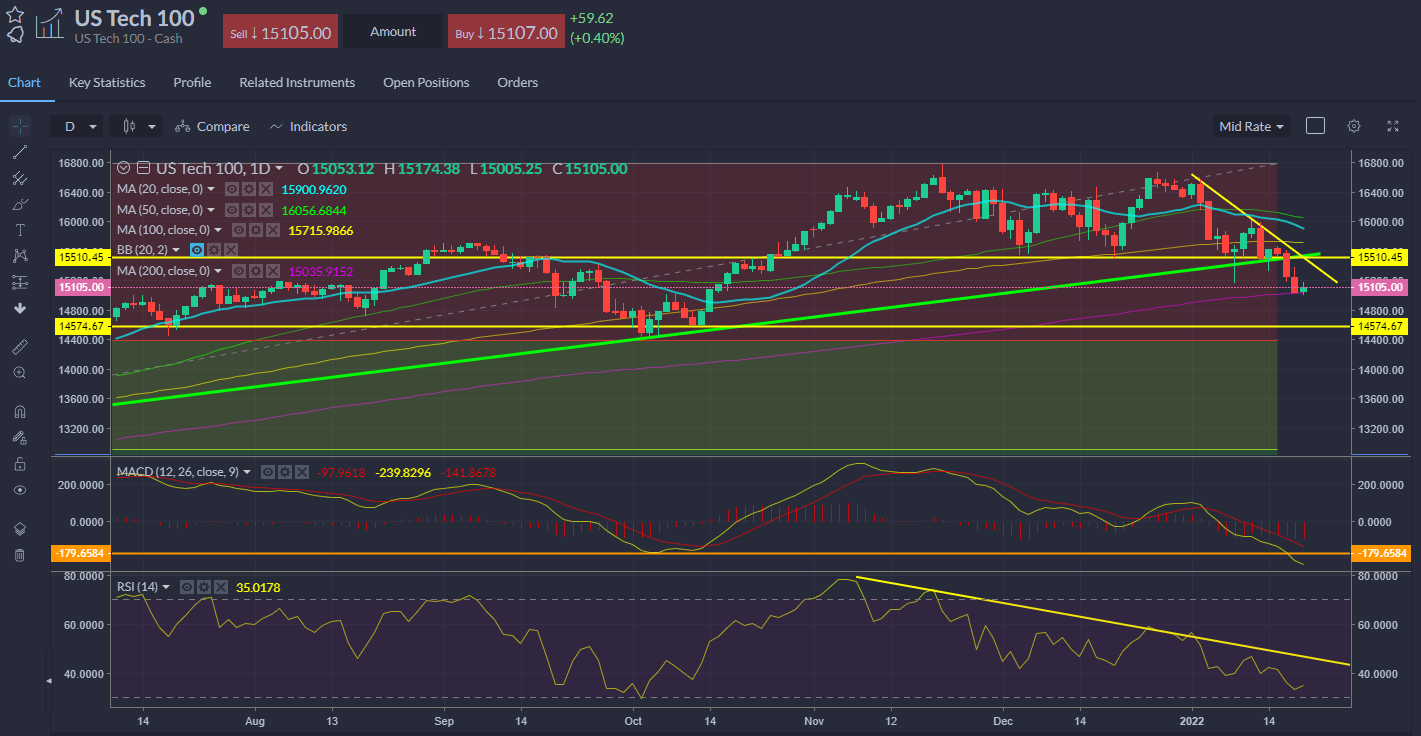

US stock markets fell, led by a 1% decline for the Nasdaq which is now in correction territory – 10% off its all-time high. The S&P 500 and Dow Jones fell by similar margins as they marked fresh lows, with SPX now trading back in the pre-Santa rally range around 4,500-4,700. Consumer defensives and Utilities outperformed, large cap tech soft again. Futures point to a higher open.

NDX testing the 200-day moving average.

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.