Sterling slides after disappointing Q4 GDP data

The British pound fell against most currencies today as traders reacted to mixed economic numbers from the UK. Earlier today, a report by the Royal Institute of Chartered Surveyors (RICS) showed that house prices in the UK rose to a record high in October. The house price index rose to 68% from 62% in September. Later on, the Office of National Statistics (ONS) disappointed. The numbers showed that the overall GDP bounced back by 15.5% in the third quarter. That was lower than the median estimate of 15.8%. On an annualised basis, the GDP contracted by 9.6%, worse than the expected decline of 9.4%. Further data showed that manufacturing and industrial production declined by an annualised rate of 7.9% and 6.3%, respectively.

The euro rose by 0.30% against the US dollar as traders watched the ongoing virtual ECB forum. In his speech, Luis de Guindos, the Vice President of the ECB, warned that the Eurozone economy would require additional fiscal support in the next few months. He also said that the recovery will depend on the rollout of a Covid vaccine. Earlier on, data from Germany showed that inflation was non-existent in October. The headline CPI was unchanged at -0.2% while the harmonised index of consumer prices remained at -0.5%. Further data by Eurostat showed that industrial production declined at an annualised pace of 6.8% in September.

The US dollar declined against most currencies as traders continued following the developments on a vaccine. At the same time, economic data showed that the headline CPI rose by an annualised rate of 1.2%. That was lower than the previous month’s increase of 1.4%. In the same month, the core CPI rose by 1.6%, higher than the previous 1.7%. Meanwhile, according to the Bureau of Labour Statistics (BLS), initial jobless claims fell from last week’s 751k to 709k. This was the lowest figure since March, when the number of claims rose by more than 22 million. The continuing jobless claims declined to 6.7 million.

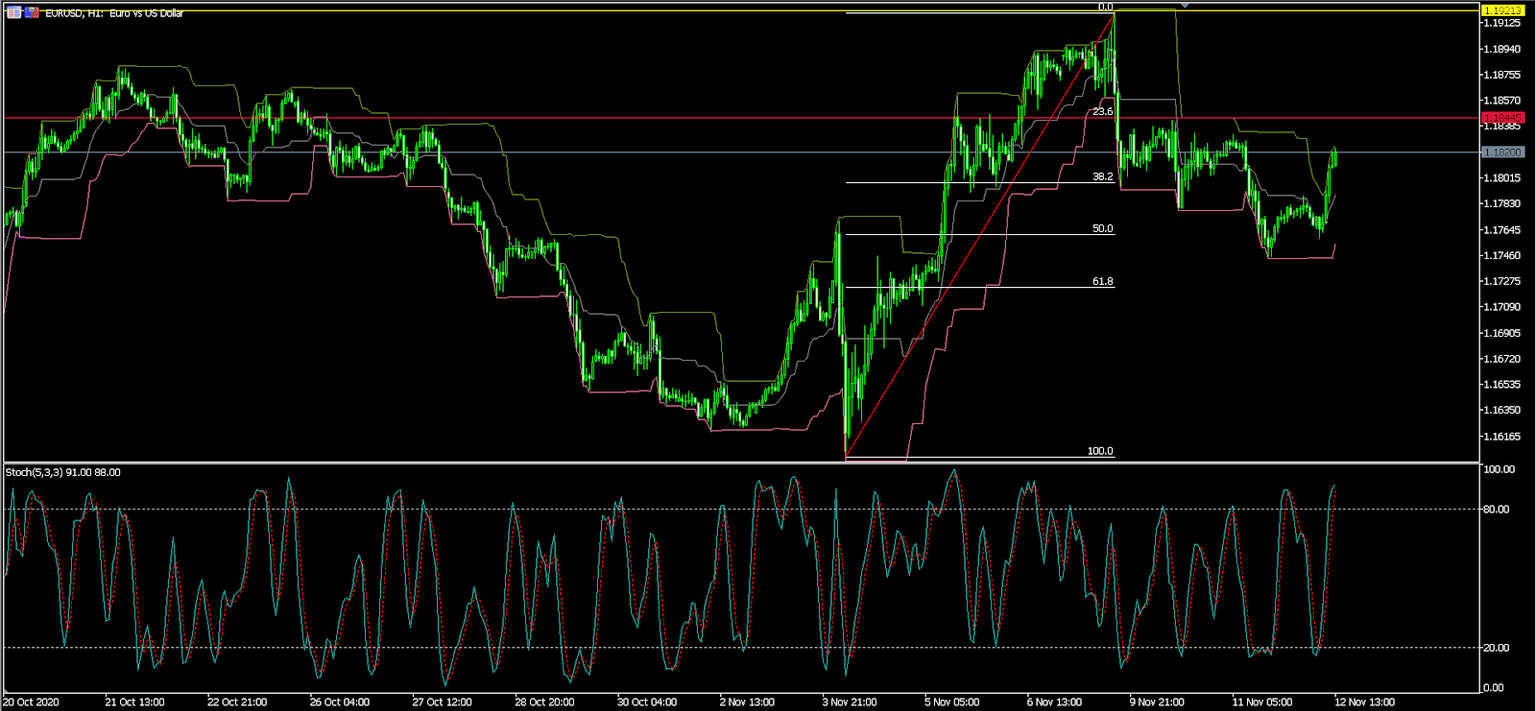

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1816, which is higher than this week’s low of 1.1745. On the hourly chart, the price has moved from below the 50% and 38.2% Fibonacci retracement levels. It is also along the upper line of the Donchian channel. Similarly, the two lines of the Stochastic oscillator have moved to the overbought level. Therefore, the pair may continue rising during the American session as bulls aim for the 23.6% retracement level at 1.1844.

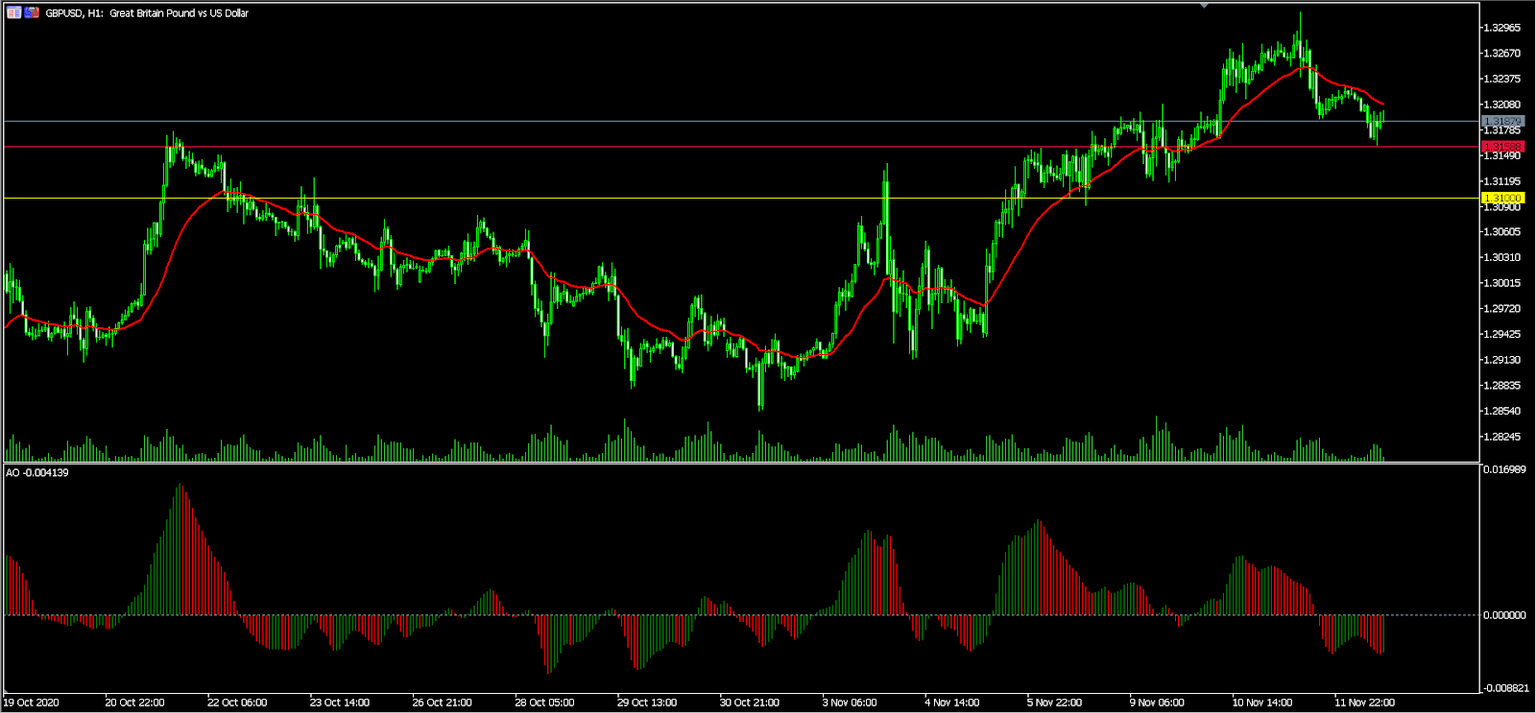

GBP/USD

The GBP/USD pair dropped to an intraday low of 1.3158, which was the lowest level since Tuesday this week. The price is below the 25-day exponential moving average. It is also substantially lower than this month’s high of 1.3315. At the same time, the awesome oscillator is below the neutral level. Notably, the pair has formed a bearish consolidation pattern. Therefore, the pair is likely to continue falling as bears aim for the next support at 1.3100.

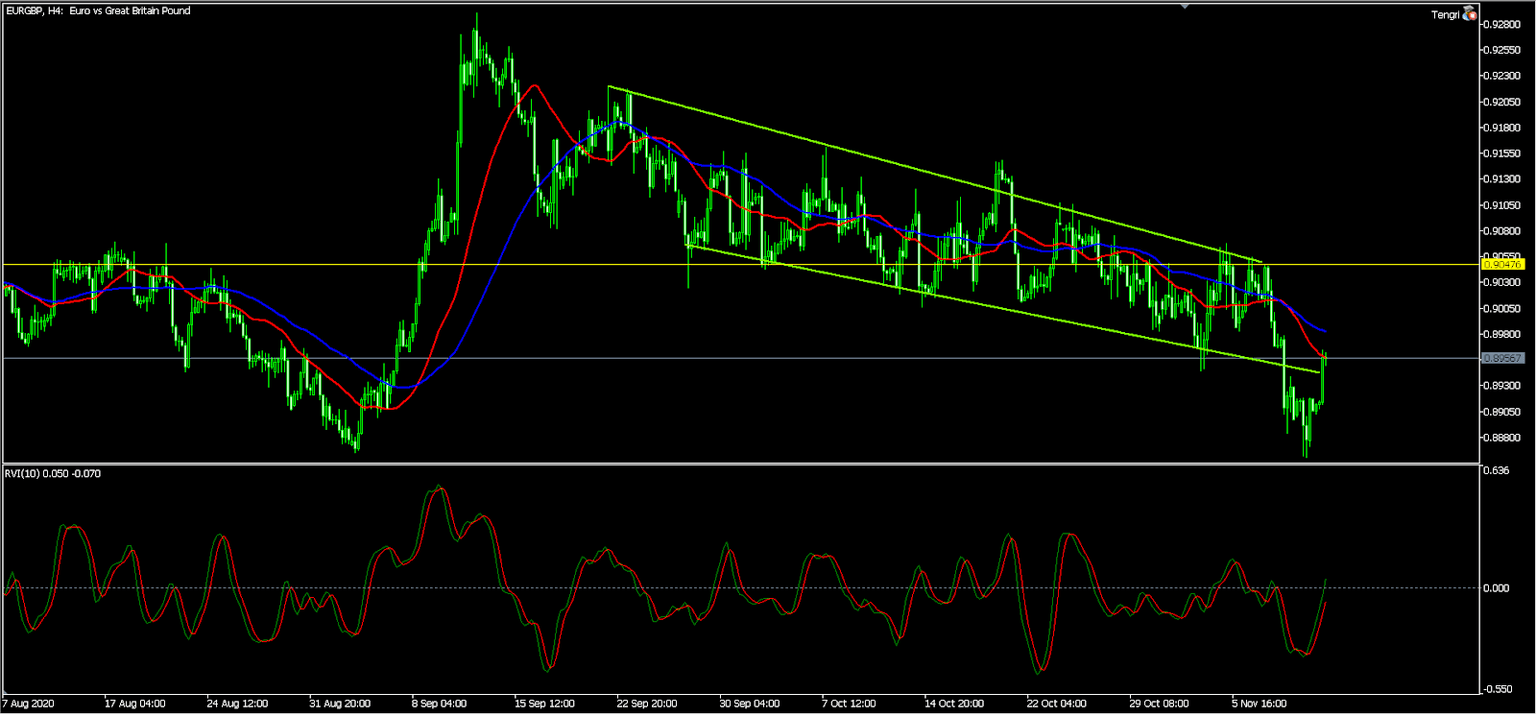

EUR/GBP

The EUR/GBP pair rallied today after the disappointing numbers from the UK. The pair rose to an intraday high of 0.8960, which is the highest it has been since yesterday. On the four-hour chart, the price moved back to the descending trendline that is shown in green. It also moved above the 15-day moving averages. Therefore, if the price manages to move above the 28-day EMA at 0.8923, it will mean that buyers are prevailing, which could push the price to 0.9047.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.