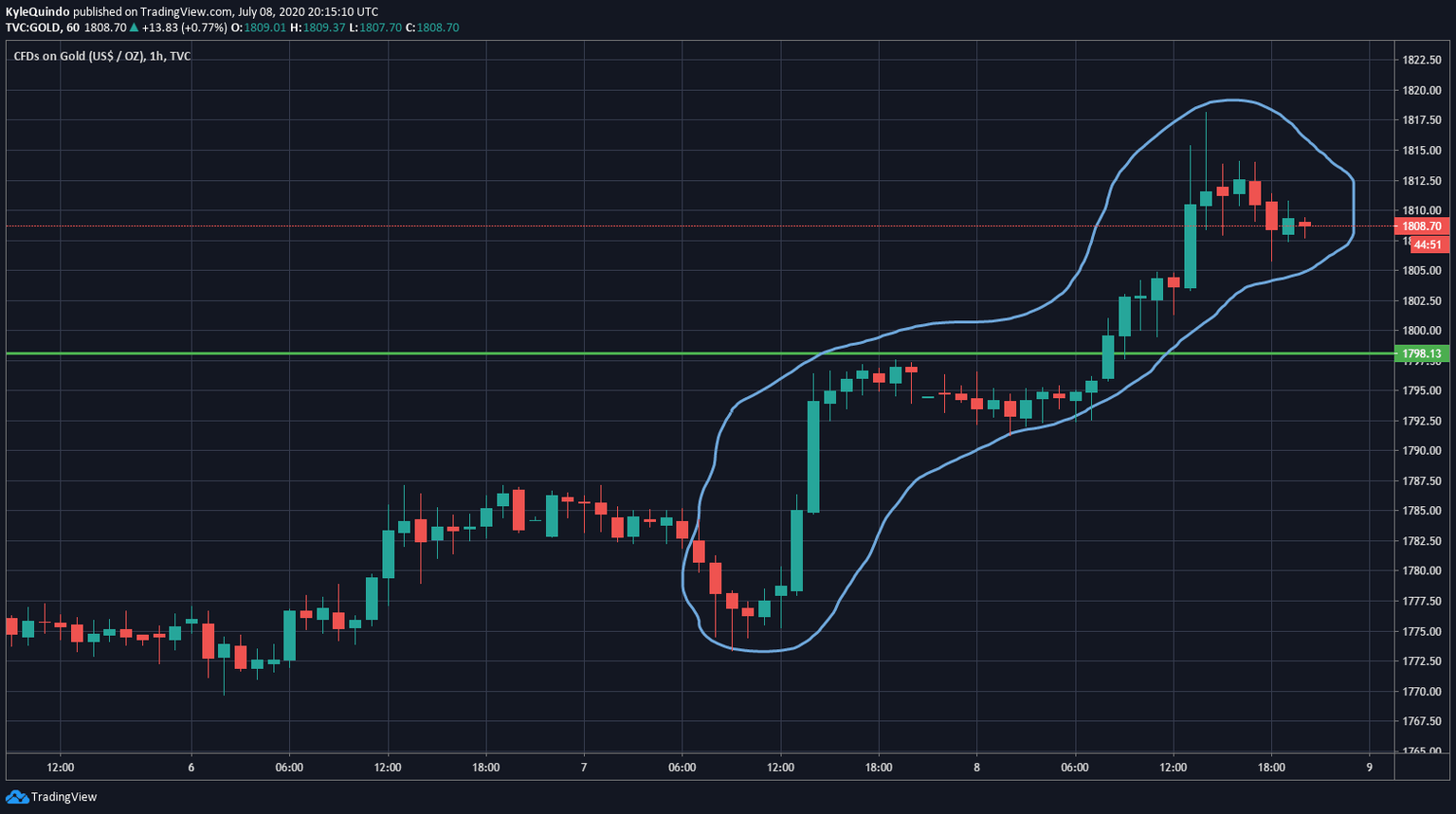

Spot Gold finally pushes past $1,800

Gold finally pushes past $1,800 as retail investors plow $40 Billion into gold-backed funds.

Gold finally pushes past that psychological $1,800 mark

As Coronavirus cases around this world approach 12 Million, Gold has seen a 19% rise year to date as investors continue to crave safe havens. HSBC’s James Steel stated that prices” were already rallying well before the emergence of Covid-19″, which has given Gold more momentum. Furthermore, the increase in Gold’s investment has helped offset a collapse in Jewelry demand, with HSBC estimates being down 20% this year.

There have been other factors other than the Coronavirus increasing the demand for Gold. A low-interest-rate environment and quantitative easing tend to boost demand for metals as investors start looking for alternative safe investments that may provide capital gains.

Banks are Bullish on Gold

James Steel predicts a push to $1,845 by the end of this year, before dropping to $1,705 the next year. However, some banks are more bullish on the bullion. They predict Gold prices to reach $2,000 in 2021, citing low-interest rates and devaluing the USD due to Quantitative Easing. “Gold investment demand tends to grow into the early stage of the economic recovery, driven by continued debasement concerns and lower rates. “Alongside this, JPMorgan recommended investors to stick with Gold in the midterm, citing similar reasons.

It is interesting to note that clearly demand for Gold has been steady, pushing the price higher. However, at the same time, the demand for risk on the asset are still high, evident in the new records being set by the NASDAQ and many risks on stock such as Tesla and Amazon. It shows that this massive divide with investors is cautious of the recovery, and investors who think quantitative easing and fiscal stimulus will continue to prop up asset prices. If the economy continues to recovery, we are likely to see Gold move to the downside.

Will Gold breach $1,900?

Author

Kyle Quindo

Blackbull Markets Limited

Kyle is a Research Analyst with BlackBull Markets in New Zealand. He writes articles on topical events and financial news, with a particular interest in commodities and long term investing.