S&P eyes breakout on AI capex, Dollar firm keeps EUR/USD on the back foot

Macro setup and regime

Risk appetite at the start of November rests on a simple but powerful configuration: earnings visibility in AI and data‑center infrastructure remains intact, the policy path is easing only cautiously, and the latest US–China détente has trimmed immediate supply‑chain tail risks without pretending to resolve the deeper rivalry. That mix allows equities and the dollar to be strong at the same time. It is not a contradiction; it is the definition of a “selective” risk‑on regime—one where cash flows are predictable in the leaders, financial conditions remain tight enough to keep speculative excess in check, and macro data holds the casting vote on any breakouts or reversals.

US activity and Dollar tone

The US manufacturing readings are a case in point. ISM at 49.4 still signals mild contraction but the direction has improved, while the prices component near the low 60s confirms that input costs have been sticky rather than collapsing. The S&P Global manufacturing gauge, by contrast, has hovered above 50, implying a more resilient private‑sector pulse. Together they argue for a firm but capped dollar: enough underlying demand to prevent a dovish capitulation from the Federal Reserve, yet not so hot that yields must lurch materially higher. Equities can live with that as long as the services side of the economy does not deliver a fresh inflation scare.

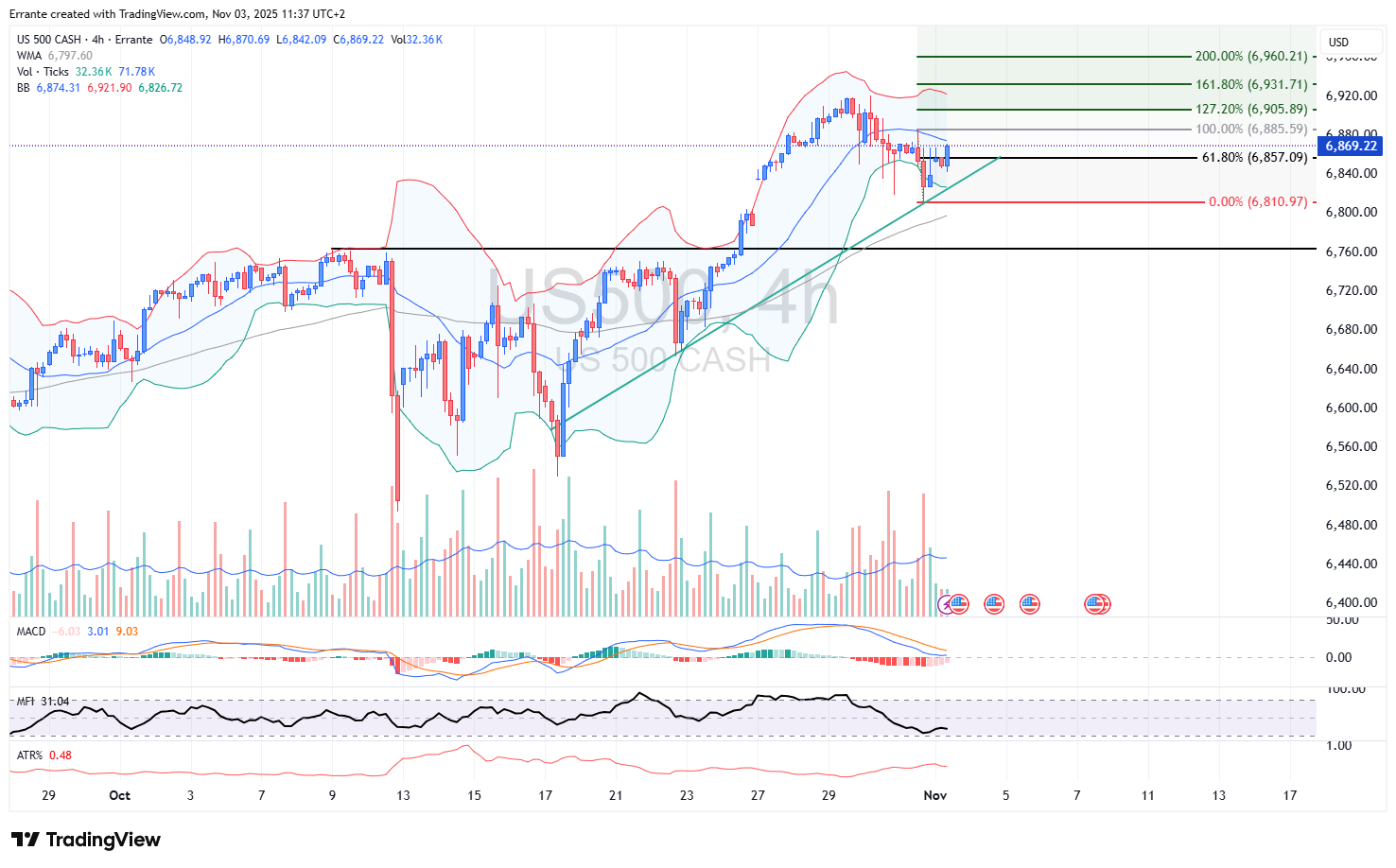

S&P 500 — Technical context

The equity benchmark reflects this tension cleanly on the four‑hour chart. Price has been filling the last week gap after coiling into a compact ascending triangle, with a rising trendline pressing price action into the 6,885–6,905 supply band. In compression phases like this, the Bollinger mid‑band often acts as dynamic support; here it has, absorbing shallow dips while the upper band caps tentative thrusts. Momentum has normalized, not deteriorated: MACD has rotated toward the zero line and Money Flow sits in the low 30s—evidence of selective, not euphoric, dip‑buying. In such a volatility regime, a body close and follow‑through above 6,885 matters far more than an intraday wick.

Should that confirmation arrive, the path to 6,905 and then the 6,932/6,960 Fibonacci extensions is open. Lose 6,857 on a closing basis instead and the market will likely check back to 6,811 and potentially the 6,755 shelf. With leadership still narrow, trade location is more important than bravado: buy the break‑and‑retest, hedge the data windows, and let confirmation lead conviction.

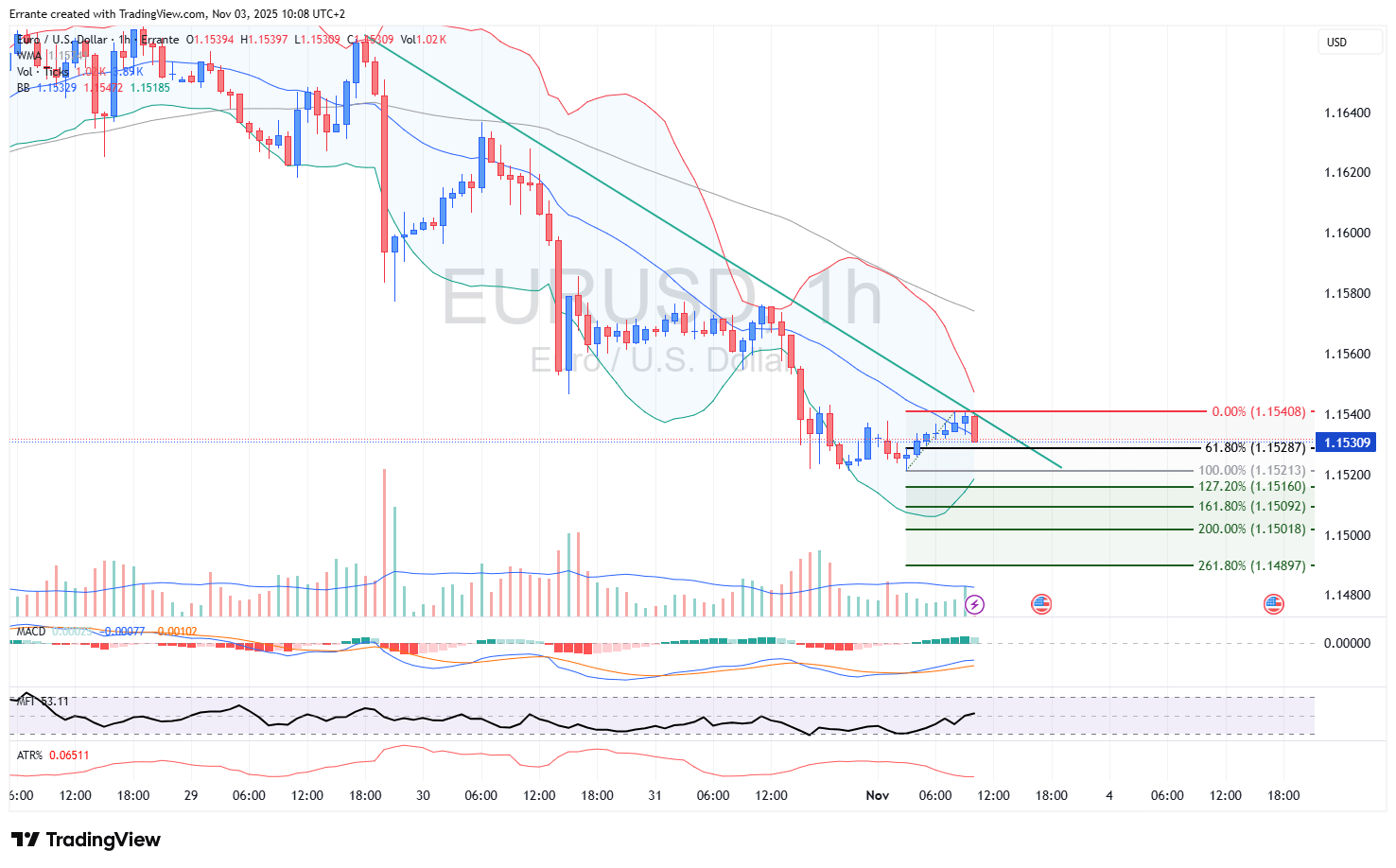

EUR/USD — Technical context

The dollar’s tug‑of‑war is visible most clearly in EUR/USD. Spot remains pinned beneath a descending trendline, with repeated failures around 1.1540 where the Bollinger mid‑band and a falling 50‑hour average converge into a compact ceiling. Momentum is subdued rather than impulsive—MACD oscillates around zero and MFI hovers near neutral—so the pair has rewarded patience. Until that 1.1540/60 zone is convincingly reclaimed, the market invites selling strength rather than chasing weakness.

A close through 1.1521 re‑opens the ladder at 1.1510, 1.1500 and 1.1490, a decisive hourly close above 1.1560 would neutralize the short bias and cue a reassessment toward 1.1600/1.1615. In other words, treat bounces as opportunities into overhead supply—unless and until the ceiling breaks, in which case the burden of proof flips.

Near‑term data catalysts

The calendar now takes center stage. Trade balance and factory orders will refine the growth optics. A narrower deficit alongside firmer orders—especially if skewed toward equipment and structures—reinforces the narrative of a capex‑led expansion driven by digital infrastructure. That tends to support the dollar via rates while underwriting the equity leadership in AI, networking, and power. The real test, however, is services. If ISM services holds near the low 50s with the employment sub‑index languishing below 50 and the prices‑paid measure settling closer to the high 50s than the 60s, the market’s preferred outcome appears: activity is resilient, cost pressure is no worse, and the Fed can ease only cautiously. Equities broaden at the margin, the dollar softens a touch, and EUR/USD is allowed to probe higher into resistance.

If, instead, services prices and unit costs re‑accelerate, the dollar hardens, real yields drift up, and multiples compress at the edges—enough to cap EUR/USD rallies and remind equity investors that breadth is a privilege, not a right.

Margins: Productivity vs unit labor costs

Thursday’s productivity and unit labor cost prints are the fulcrum for margins. A productivity reading at or above three percent, paired with unit labor costs near one percent, is the closest thing to a Goldilocks signal: firms can defend or even expand margins without demanding a risk premium in the discount rate. In that case, equities typically climb a wall of worry and the dollar’s upside looks limited; EUR/USD can squeeze into the 1.1560–1.1600 pocket where the next judgment will be made. If productivity underwhelms or unit labor costs rebound toward two percent or more, the calculus changes. Margins compress at the margin, the Fed’s cautious stance feels warranted, and the dollar retains the upper hand. EUR/USD then tends to fade toward 1.1510 and potentially 1.1490, with gold struggling to sustain rallies in the face of firmer real yields.

Commodities and policy backdrop

Commodities add useful texture to this backdrop. OPEC+ has effectively moved to build a floor under crude by pausing further output increases after a modest December step‑up. That does not guarantee a bull market in oil; it does reduce left‑tail risk as long as demand does not crack. For equities, it means input‑cost volatility is less likely to add an exogenous shock just as earnings visibility improves. Gold sits on the other side of the dollar and real‑yield coin. China’s removal of a long‑standing tax incentive is a sentiment headwind among the world’s largest cohort of retail buyers. With the dollar firm and real yields not yet rolling over, gold trades like a choppy correction: strength into the 4,080–4,120 zone remains a place to de‑risk unless the US cost data cools decisively.

Cross‑asset cohesion

The inner logic across assets is therefore coherent. A cautious‑easing Fed paired with resilient services and better productivity allows the S&P 500 to break higher so long as price confirms above 6,885 and respects risk on any retest. The same mix keeps EUR/USD rallies contained beneath 1.1540/60 unless services disinflate and unit costs fall in tandem. A hotter services‑cost profile or weaker productivity does the opposite: the dollar tightens its grip, equity multiples stall or compress, and EUR/USD bleeds back toward the low 1.15s.

Positioning and risk discipline

From a portfolio perspective, the discipline is straightforward. Treat equities as a buy on confirmation rather than on hope, with position sizes calibrated to ATR and hedges carried into the key releases. In FX, fade EUR/USD strength into the established ceiling until proven otherwise, and be prepared to stand aside if 1.1560 gives way. In commodities, respect the OPEC+ floor in crude without over‑committing to upside until demand signals improve, and trade gold with the real‑yield lens, not headlines.

Conclusion

The conclusion is not dramatic because the market itself is not: it is conditional. If services resilience arrives with benign cost dynamics, a gentle dollar, broader participation in equities, and a test of 1.1560–1.1600 in EUR/USD follow naturally. If costs prove sticky and productivity disappoints, the dollar stays firm, equity strength remains narrow and tactical, and the euro’s rallies are sellable toward 1.1510–1.1490. Between those outcomes lies the strategist’s edge—letting the data grant permission, and letting price confirm the story before you size up.

Author

Ali Mortazavi

Errante

BEc, CMSA, Member of IFTA - International Federation of Technical Analysis, Associate Member of STA - Society of Technical Analysis (UK).