Silver’s plunge shows how market structure can overwhelm fundamentals

Silver prices have fallen sharply in recent sessions, leaving many traders searching for a fundamental explanation. Industrial demand has not suddenly collapsed, global mine supply has not surged, and the long term electrification narrative remains firmly in place. Yet the speed and intensity of the decline felt less like a gradual reassessment of value and more like a forced reset.

The move highlights a key reality about silver. In the short term, price is often driven less by changes in the physical market and more by how the financial market around it is structured.

Silver trades as a financial asset before it trades as a metal

Silver’s price discovery is heavily influenced by activity on futures exchanges, particularly COMEX. Most of the volume in these markets is not tied to the movement of physical bars, but to leveraged financial contracts.

Traders can control a large notional amount of silver by posting only a fraction of that value as collateral. This structure allows for efficient exposure when volatility is low and trends are stable. However, it also makes the market more fragile when conditions change quickly.

When volatility rises, the same leverage that amplified gains on the way up can accelerate losses on the way down.

Rising margin pressure can trigger mechanical selling

During periods of heightened price swings, exchanges and clearing houses adjust margin requirements to manage risk. Higher margins mean traders must commit more capital to maintain the same position size.

For heavily leveraged participants, this can quickly become a problem. If additional funds cannot be posted in time, positions are reduced or closed. This process is automatic and mechanical. It is not a judgment on silver’s long term fundamentals. It is simply a risk control mechanism at work.

As prices fall, volatility often increases further. That can justify additional margin adjustments, creating a feedback loop where declining prices lead to more forced selling, which leads to further declines. What looks like a collapse in confidence can in fact be a cascade driven by leverage being unwound.

A crowded trade becomes vulnerable to a sharp reset

Silver had become a popular trade across multiple segments of the market. Retail investors, tactical funds and momentum driven strategies were all attracted by the metal’s dual identity as both a monetary hedge and a key input in solar panels and electronics.

Crowded positioning can support strong rallies, but it also increases vulnerability. When momentum breaks, the same positioning that helped push prices higher can amplify the decline as traders rush to reduce exposure at the same time.

Fast moves are often a sign that positioning, not just fundamentals, is being reset.

Liquidity stress can spill into silver

Silver’s role as a highly liquid futures market also makes it a common source of cash when volatility rises elsewhere. During broader episodes of financial stress, investors sometimes sell what they can rather than what they would prefer to sell.

Because silver trades nearly around the clock and offers deep liquidity, it can become part of cross market deleveraging. Even if the initial shock comes from outside the precious metals space, silver can feel the impact as capital is pulled back across asset classes.

This reinforces an important point. In the short run, silver behaves as a financial instrument first and a physical commodity second.

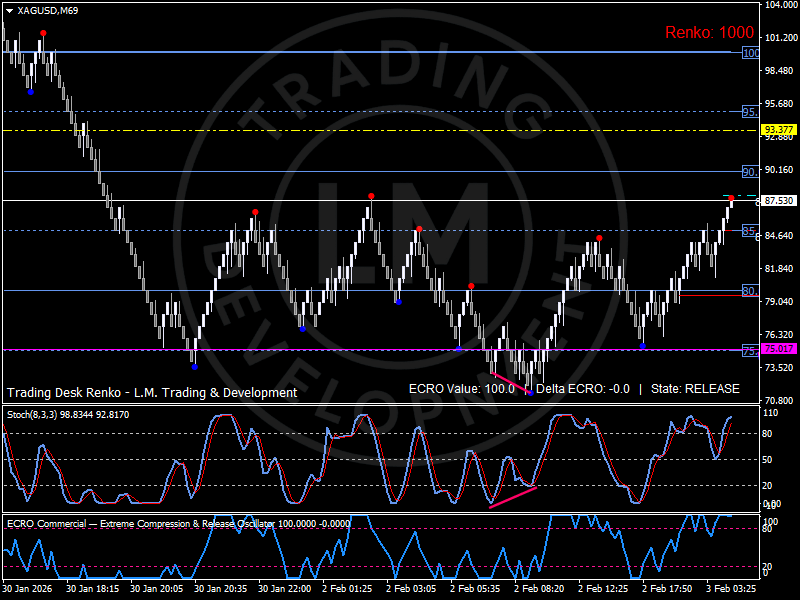

The Renko 100 structure shows a violent release, not a trend collapse

The Renko 100 chart illustrates how the recent move unfolded from a structural perspective.

After a period of choppy consolidation, price broke lower with a sequence of strong downside bricks, reflecting a release phase rather than a slow distribution. The ECRO reading at extreme levels confirms that the market moved rapidly from compression into directional expansion. This is typical of positioning driven moves, where the trigger is mechanical rather than fundamental.

At the same time, the current state reading suggests that the most intense part of the release may be maturing. Momentum has been strong, but it is no longer accelerating. This aligns with the idea that the market has already gone through a significant deleveraging phase.

Importantly, the broader Renko structure does not yet show a long term bearish regime. Instead, it reflects a sharp corrective leg within a market that had previously advanced on strong momentum. In this context, the drop looks more like a forced adjustment than the start of a structurally new downtrend.

Fundamentals remain in the background

None of this means silver’s underlying story has vanished. Demand from electrification, solar installations and electronics manufacturing continues to provide structural support. Supply growth remains constrained in several key producing regions, and above ground inventories are not unlimited.

However, futures markets can overshoot in both directions. On the way up, leverage and momentum can carry prices beyond what fundamentals alone would justify. On the way down, margin calls and forced liquidations can push prices below levels where longer term buyers see value.

The recent plunge fits this pattern. It looks less like a sudden deterioration in the real world supply demand balance and more like a mechanical deleveraging event.

Outlook

Silver’s latest selloff is a reminder that market structure can dominate price action, especially in leveraged futures markets. Fundamentals still matter, but in the short run, the rules of the trading system and the amount of leverage in positions can matter even more.

As volatility stabilizes and positioning becomes less crowded, price behavior may gradually reconnect with the physical market narrative. Until then, silver is likely to remain sensitive to shifts in liquidity, margin conditions and cross market risk sentiment.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.