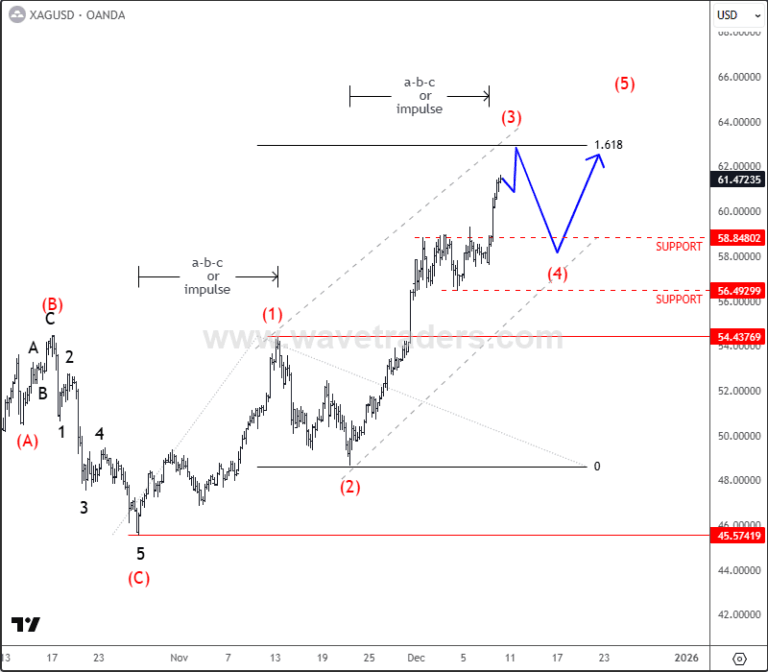

Silver extends gains as wave structure points toward higher levels

Silver broke higher last week pretty sharply and strongly, but gold is not following to the upside that much. However, because of the falling gold–silver ratio, silver is the best performer at this stage, so we are updating the wave counts, which could be a diagonal pattern because the first three legs up from the October lows could represent wave 1 of this five-wave move that can unfold into a wedge formation. However, due to the current strong extension to 61 area within wave 3, it could also be unfolding a five-wave impulse. So, in both cases, it could still grind higher, and it looks like there could be room up to 161,8% Fibo. extension and 62-63 area or higher. On dips, support can be found at the 58-56 area, while the invalidation level is at 54, because if we think we are in an impulse, then wave 4 should not come below wave 1 swing high.

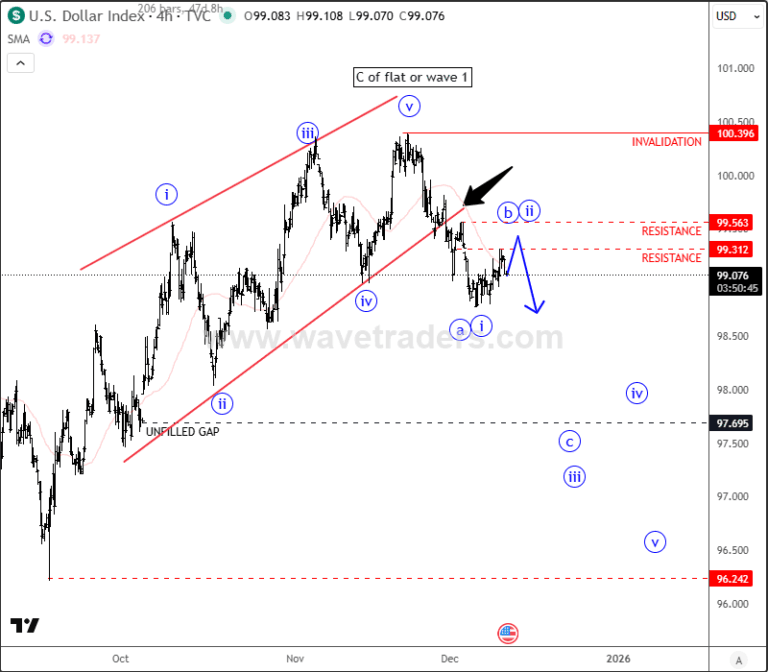

The reason why silver could stay in the uptrend is weakening of the US Dollar Index – DXY. DXY made higher highs and higher swing lows from September when the Fed cut rates, with stock markets being under pressure since expectations for further cuts have decreased. That’s why silver was in consolidation. But this has changed recently, and what’s really important now is that despite this recovery on DXY from September lows, we still see an overlapping wave structure, so it can easily be a five-wave movement that can even represent a diagonal in wave C, meaning a reversal pattern that could send prices lower soon after a completion of the higher-degree wave four. Or it, it can be a leading diagonal, but even in that case we would expect a three-leg pullback that seems underway right now, which can push the price of silver higher.

Thank you for reading and see you on the next one!

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.