Seven Fundamentals for the week: Trump's opening salvo in a trade war casts shadow over Nonfarm Payrolls

- Trump's tariffs and potential changes are set to continue dominating headlines.

- The Bank of England is on course to cut interest rates this week.

- Nonfarm Payrolls promise an explosive end to the week after a full buildup.

The wrecking ball is here. As United States (US) President Donald Trump celebrates two weeks at the White House, the only asset praying in markets is the US Dollar (USD) in response to tariffs. This story is set to dominate the week, with occasional attention given to the Bank of England (BoE) and the buildup to Nonfarm Payrolls (NFP).

1) Trump tariffs have more damage in store

Harsh hangover for markets. Investors basked on Trump's initial avoidance of tariffs, but that is over. Over the weekend, he slapped 25% tariffs on Mexico, 25% on Canada – except for Oil, only 10% – and 10% on China, which comes on top of existing levies.

Markets tumbled, and the US Dollar surged, but after the initial panic, there is some reversal. This hope comes from several factors. First, tariffs go into effect only on Tuesday, and there is room for top-level negotiations on Monday. Trump will talk with Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum. Perhaps leaders will make deals – that seems to be the current thinking.

Another source of optimism is more technical. Trump is using an obscure law to bypass Congress and slap emergency tariffs. Such use of the law is new, and may be struck down by courts – even by the Supreme Court, where Trump nominated a third of justices.

However, my forecast is more pessimistic due to one specific statement the president made. On the door of Air Force One, Trump admitted that Americans will suffer some short-term pain. He is aware and willing to see higher inflation for the greater goal. For me, that means the tariffs will first come into effect, hitting markets further.

These tariffs will only be removed later if Trump gets what he wants. But, what does he want? Limiting imports of fentanyl, halting immigration, or that other countries buy more American goods? At the moment, there is no clear goal for the trade war, and without objectives, tariffs seem to be the endgame rather than a means to an end.

I think that Trump will eventually define goals and strike deals – but only if financial markets force him to. The president cares deeply about the Dow Jones and other indices, and once they extend their decline, he may be ready for a rethink. That may take long days.

2) ISM Manufacturing PMI may provide short-term contrarian opportunity

Monday, 15:00 GMT. Trump's tariffs will hit US manufacturing more than the more significant services sector – especially due to trade disruptions with Canada. Both countries' automotive industries are closely linked.

Moreover, other US factories depend on imports of components, some from the affected countries and others from those that could come next, such as the European Union (EU). The latest move will, therefore, hit the ISM Manufacturing Purchasing Managers Index (PMI) badly – but not in this report.

The survey was held before the tariff announcement on Saturday, meaning the data could be better than expected. An upbeat outcome may boost sentiment in the very short term due to algorithm trading activity, but then investors will realize the lack of freshness, reversing the trend.

All in all, this forward-looking indicator is, for a change, outdated. This discrepancy means jitters that could turn into opportunities.

3) JOLTs set to remind of US labor market strength

Tuesday, 15:00 GMT. This backward-looking gauge of hirings is for December, but it is important because the Federal Reserve (Fed) looks closely at it.

Back in November, JOLTs exceeded estimates and bounced to nearly 8.10 million, showing that America's employment situation is solid. The economic calendar points to a small decline in December, which would still leave hiring strong.

A better-than-expected result would boost the US Dollar, hurting Stocks and Gold on rate hike fears, and a softer outcome would weigh on the Greenback while supporting other assets.

4) ADP employment change has a low bar to cross

Wednesday, 13:15 GMT. America's No. 1 payroll provider controls one of every six payslips, which means it has insights on hiring. However, its leading employment change report is not always well-correlated with the official Nonfarm Payrolls (NFP).

I expect a short-term boost for the US Dollar. Why? Back in December, ADP reported only 122K private-sector jobs gained, below the trend. This time, expectations are somewhat higher but still leave room for an upside surprise that would support the Greenback while weighing on others.

Why only a short-term boost? The quick answer is that that is what usually happens. The longer one is the weak correlation mentioned above, which means moves tend to reverse.

Nevertheless, ADP's data shapes expectations for Nonfarm Payrolls, at least on the margins, but there's another figure to consider.

5) ISM Services PMI to finalize NFP expectations

Wednesday, 15:00 GMT. Services is America's largest sector, and it has been upbeat recently. The forward-looking ISM Services PMI hit 54.1 points in December, holding well above the 50-point threshold separating expansion from contraction.

A similar outcome is on the cards for January. Once again, the fresh tariffs announcement did not count in the survey, but the sector is less affected by tariffs, at least not in the immediate term.

Stocks still fear higher rates, which means "good news is bad news" for them. Gold needs weak data to shine, while upbeat data favors the US Dollar.

Apart from the headline figure, the employment component is of importance toward the Nonfarm Payrolls report on Friday. There is a noteworthy correlation between this component and hiring.

6) BoE to cut rates, voting pattern to shake the Pound

Thursday, decision at 12:00 GMT, press conference at 12:30 GMT. It is “Super Thursday” at the Bank of England – which means the BoE releases its quarterly Monetary Policy Report (MPR) and holds a press conference in addition to the rate decision and voting pattern. Here are the things to watch for.

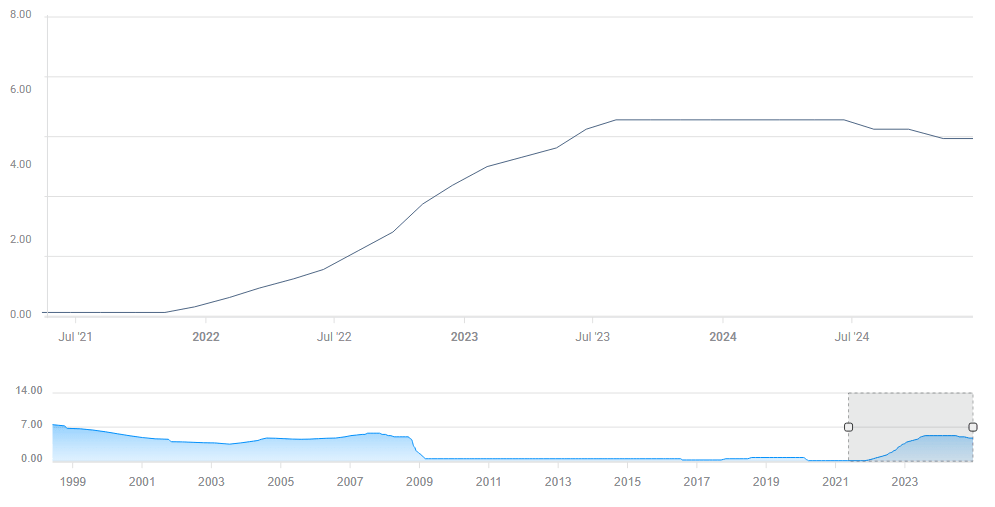

a) Rate cut: The BoE is set to cut rates by 25 basis points (bps) to 4.50% due to falling inflation. That is fully in the price, but it would still leave borrowing costs above price rises – or, in central bank jargon, "restrictive rates."

BoE interest rates. Source: FXStreet

b) Voting pattern: The economic calendar points to seven members supporting an interest rate cut and two opting to leave them unchanged. Any surprise would trigger significant but short-term moves. If a larger majority backs a cut, Sterling would suffer, while narrow support for the central bank’s move would push the Pound higher.

c) MPR: The report consists of forecasts for inflation, which imply monetary policy. Expectations of faster price rises may support Sterling, while lower projections would pound the Pound. Investors will keep an eye open for any comment on Trump's tariffs, but they will likely be more prominent in the final act.

d) Press conference: BoE Governor Andrew Bailey tends to be gloomy, and this tone could be amplified in a week when the world's largest economy kicks off a trade war. While the UK seems spared from Trump's wrath, issues with global growth will likely hit Britain's shores. I expect him to be more pessimistic than optimistic, eventually sending Sterling down.

7) Nonfarm Payrolls may smash estimates once again

Friday, 13:30 GMT. If tariffs outshine other releases, they will likely have to pause at the all-important Nonfarm Payrolls data for January. Full employment is one of the Fed's mandates, and the report is critical.

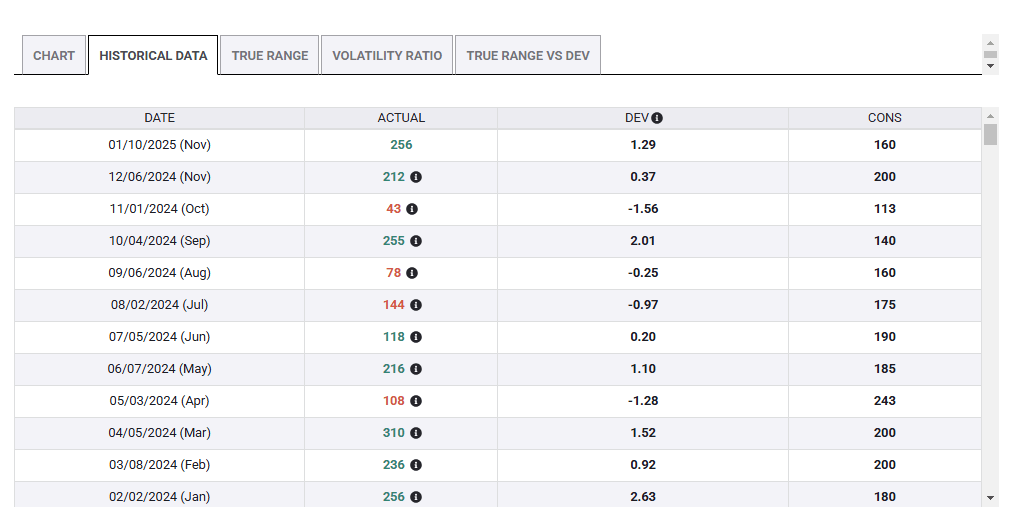

In the past few years, the NFP has, more often than not, beaten expectations. The NFP release for December smashed estimates with a leap of 256K, well above the 160K expected.

Nonfarm Payrolls. Source: FXStreet

For the first report for 2025, economists expect an increase of 170K. This number may move during the week in response to leading indicators, but assuming there is no upgrade, I expect NFP to beat estimates once again, sending the US Dollar up and Gold and Stocks down.

Will the effect be long-lived or last only a few minutes? It depends on the magnitude of the surprise and whether the data comes out outside the range of economists' expectations. During FXStreet's live coverage of the event, we will provide the latest updates to get you up to speed.

Final thoughts

It is hard to overstate the importance of President Trump's trade war, which may push Canada and Mexico into an imminent recession and may tip the Eurozone to a similar fate. The mere uncertainty is a source of trouble, and also volatility. Expect the unexpected as the mood swings from rapid declines to relief.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.