Sea of red in global equities as growth risks remain

Global stocks turned lower today and erased some of the gains made yesterday. In Europe, the DAX index fell by more than 1.3% while the FTSE 100 and CAC 40 fell by 0.35% and 1.30%, respectively. The pan-European Stoxx 50 index declined by 1.30%. In the United States, futures linked to the Dow Jones and S&P 500 fell by 0.40%. These declines are happening because of the rising risks that a second wave of coronavirus will continue to spread in Europe. Also, the market is worried about the United States now that congress has failed to pass a stimulus package. Yesterday, congressional Democrats unveiled a $2.4 trillion package that is unlikely to pass in the Senate.

The British pound declined as the market reacted to disappointing government funding data. According to the Office of National Statistics (ONS), the UK government borrowed more than £30.9 billion to help tackle the current pandemic. This figure represents the highest borrowing since 1993. Therefore, the debt has soared to more than £2.024 trillion, up by £249 billion from the same time last year. This increase is mostly because of the government’s policies to tackle the pandemic such as the furlough program.

The euro declined slightly against the US dollar as investors worried about the health of the European economy. This is because some key countries in the bloc have continued to report high number of coronavirus cases. Also, the recent weakness is partly due to data that showed the growth of the EU economy was stalling. The pair also reacted mildly to the money supply data by the European Central Bank (ECB). The M3 money supply declined from 10.1% in July to 9.5% in August.

EUR/USD

The EUR/USD pair dropped to an intraday low of 1.1646. On the four-hour chart, the price is between the lower and middle lines of the Bollinger bands and below the 25-day exponential moving averages. The price is also below the important resistance of 1.1750, which was the previous support of the horizontal channel. Therefore, it seems like euro bears have prevailed, which is likely to continue pushing it lower.

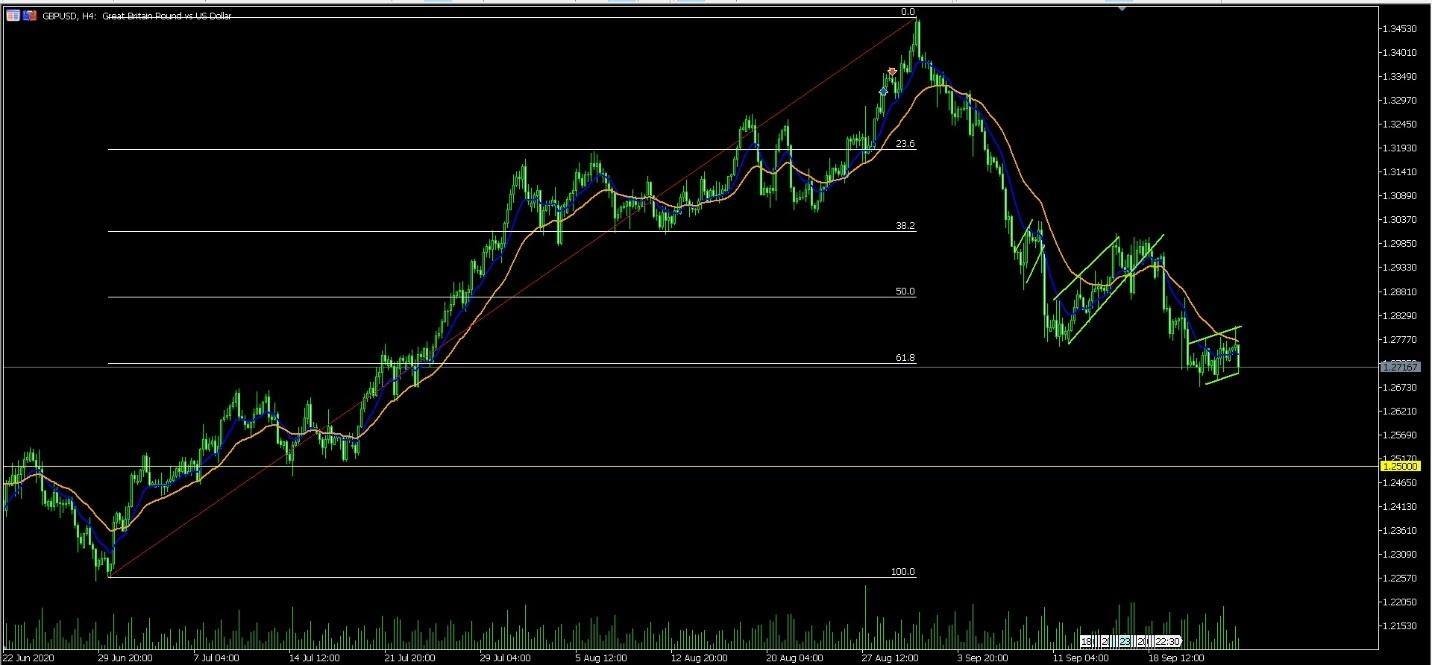

GBP/USD

The GBP/USD pair declined to an intraday low of 1.2715, which is significantly below this year’s high of 1.3480. The four-hour chart shows that the pair is in its fourth bearish flags pattern. Importantly, it is in the lower side of the current flag. Also, the price is along the 61.8% Fibonacci retracement level. It is also below the dynamic resistance of the 25-day EMA. Therefore, the pair is likely to continue falling as bears aim for moves below 1.2700.

GER30

The DAX index declined to an intraday low of €12,375, which is the lowest it has been since July 31. On the daily chart, the price is below the neckline of the previous head and shoulders pattern. It has also moved slightly below the 50-day and 100-day moving averages. Also, it has moved below the ascending trendline that is shown in white. Therefore, with the sentiment being this weak, the price is likely to continue falling as bears aim for the next support at €12,190.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.