Risk rebounds on the Fed’s offer of trillions of dollars of liquidity [Video]

![Risk rebounds on the Fed’s offer of trillions of dollars of liquidity [Video]](https://editorial.fxstreet.com/images/Macroeconomics/CentralBanks/FED/federal-reserve-bank-60556630_XtraLarge.jpg)

Market Overview

Today is Friday the 13th, not a great day for the superstitious. But can the horror show be any worse than Thursday the 12th after some of the worst selling in history and a car crash of a press conference from ECB President Christine Lagarde? Hot on the heels of a broadly terrible address from Donald Trump the night before, Lagarde’s inexperience did little to calm market fears. Her predecessor, Mario Draghi, seemed to be so adept at setting the nerves, but Lagarde compounded a damp squib of a monetary policy announcement by spooking traders. Her comments that the ECB’s role is not to close sovereign debt spreads caused yields on Italian BTPs to spike higher and the euro to dump. The fears of Coronavirus creating economic crisis turned into a liquidity scare yesterday as overnight funding swaps prices soared, with the dollar jumping. The US Federal Reserve has looked to calm markets and it will offer trillions of dollars in liquidity operations through its repos. This is an attempt to stem what it sees as “temporary disruptions” which caused a huge jump in overnight swaps pricing. At least, coming into the European session this morning, there is an element of relative calm and recovery. Risk assets are rebounding. Is this like putting a sticking plaster on a burst dam? Let’s hope that this can begin to provide stability that the markets so badly need right now.

Across the board, yesterday’s moves on equity indices were some of the worst falls since 1987, with the S&P 500 -9.5% to 2480. However, US futures are on the rebound today with a gain of 4.0%. Asian indices played catch up with the Nikkei -6.1%, whilst the relative outperformance of the Shanghai Composite continues (-1.2% last night). European markets look set for a rebound with DAX futures +1% currently. In forex, there is a pick up in risk appetite, with JPY being the big underperformer, whilst AUD and NZD along with CAD are on the comeback. In commodities, gold is trading over +1% higher with oil almost +4% higher.

Although volatility remains immense, the economic calendar shows the Prelim Michigan Sentiment at 1400GMT is data that could be telling. The impact of Coronavirus is expected to begin to hit the US consumer, with the headline Michigan Sentiment expected to drop back to 95.0 in February (from 101.0 in March). The deterioration is expected to be driven by the Current Conditions component falling to 112.0 (from 114.8) whilst Michigan Expectations are expected to reduce to 88.2 (from 92.1).

Once more, there are no central bankers due slated to speak today, and FOMC members remain in their blackout period until next Wednesday’s FOMC announcement.

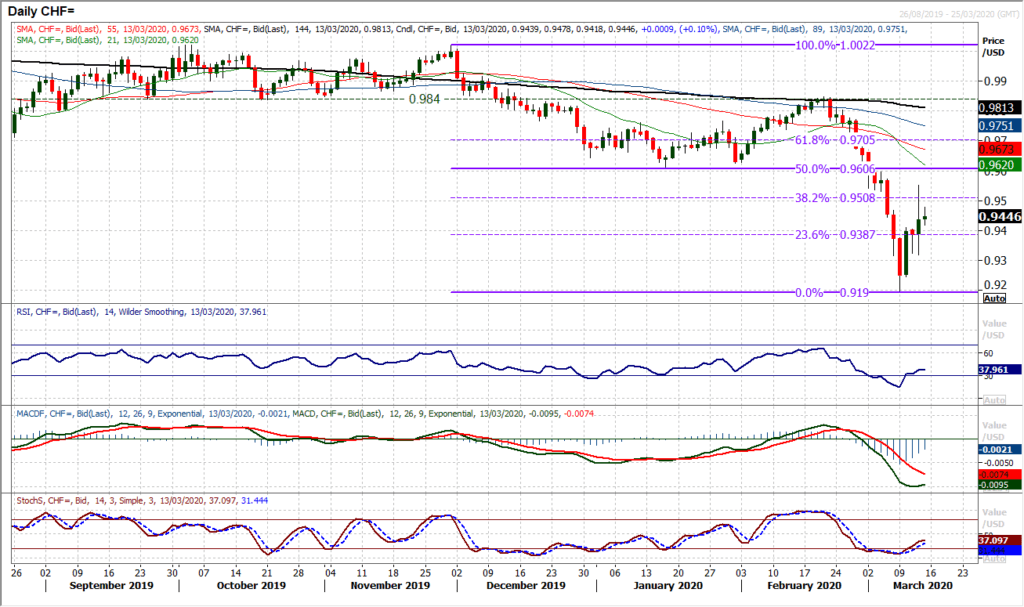

Chart of the Day – USD/CHF

When the Swiss franc sells off as the bottom is fallout out of risk markets, there is a real signal that something is going badly wrong. As such the dollar is strengthening across major forex and unless the Fed’s funding operations calm markets down, the momentum of the dollar move could be like a steam train. Technically, a recovery of the big sell-off on USD/CHF is gathering pace. Yesterday’s positive close came with a lot of volatility throughout the session. In calmer markets, trading decisively through 23.6% Fibonacci retracement (of 1.0022/0.9190 decline) at 0.9387 implies a continued recovery to test 38.2% Fib around 0.9510. Momentum buy signals are coming through fast with crossover buy signals on Stochastics, and the RSI back above 40. Posting another positive candlestick today would suggest the dollar bulls remain on track and recovery back towards the 50% Fib at 0.9605 which is also an old floor of the January low and a basis of overhead supply could be seen. The hourly chart shows good near term support now 0.9325/0.9410.

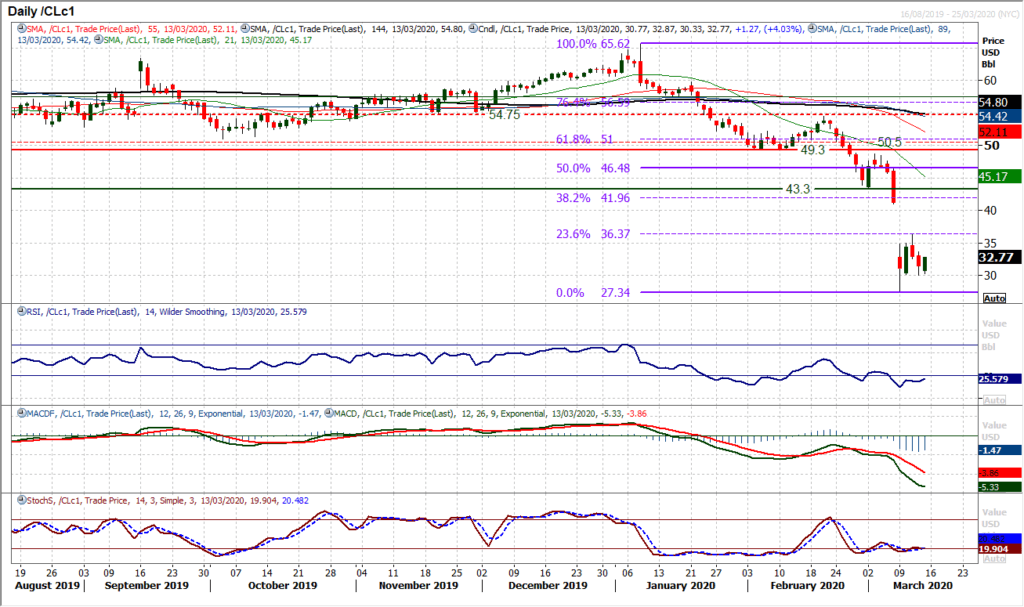

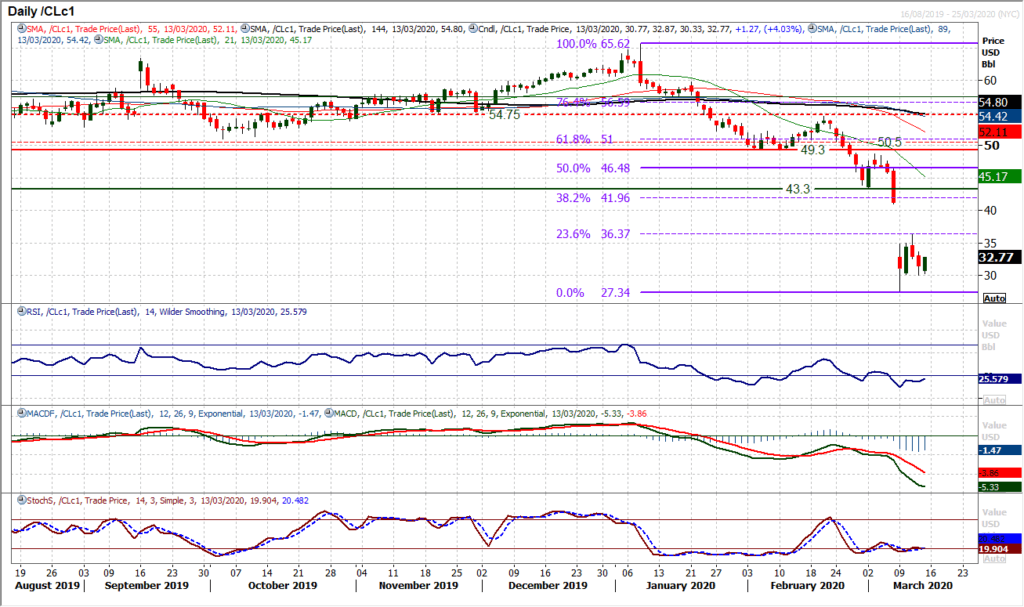

WTI Oil

Given the context of Monday’s oil plunge and the fires that were raging elsewhere across major markets yesterday, a -4.5% decline on WTI was a relatively restrained session. How traders respond today will be key though. It was interesting to see WTI rebounding off $30.00 and a move higher early today suggests that there is an element of settling down of the selling pressure now. However, it is not a good time to be long risk right now, and as such we see rallies on oil fading. A move above initial resistance at $33.75 would begin to shift this sentiment. We still need daily Stochastics and RSI both above 35 (at least) to suggest recovery is building. Until then, we remain broadly negative on oil. Below $30.00 si the key low at $27.35.

Dow Jones Industrial Average

With eye-watering levels of volatility, the bears are absolutely mauling any buyers on the Dow. With a -10% decline on the day, the Dow closed -28% down from its all-time high from exactly one month ago. Technicals do very little in this market, only to say that there is an extremely negative momentum position and that any hint of rally just gets pounced upon by the sellers once more. Yesterday’s intraday rebound after the Fed announced its funding operations, reversed to leave resistance now at 22,838. US futures are higher again this morning, and we can expect another hugely volatilie session. Another massive gap is left gapingly open at 23,328 but once more, gap analysis is struggling in these market conditions. The latest massive support to be broken has left resistance at 21,712 initially. The next key low to come into focus is 20,380.

Author

Richard Perry

Independent Analyst