GBP/USD: The selling pressure could continue to pull further losses [Video]

![GBP/USD: The selling pressure could continue to pull further losses [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-472155766_XtraLarge.jpg)

GBP/USD

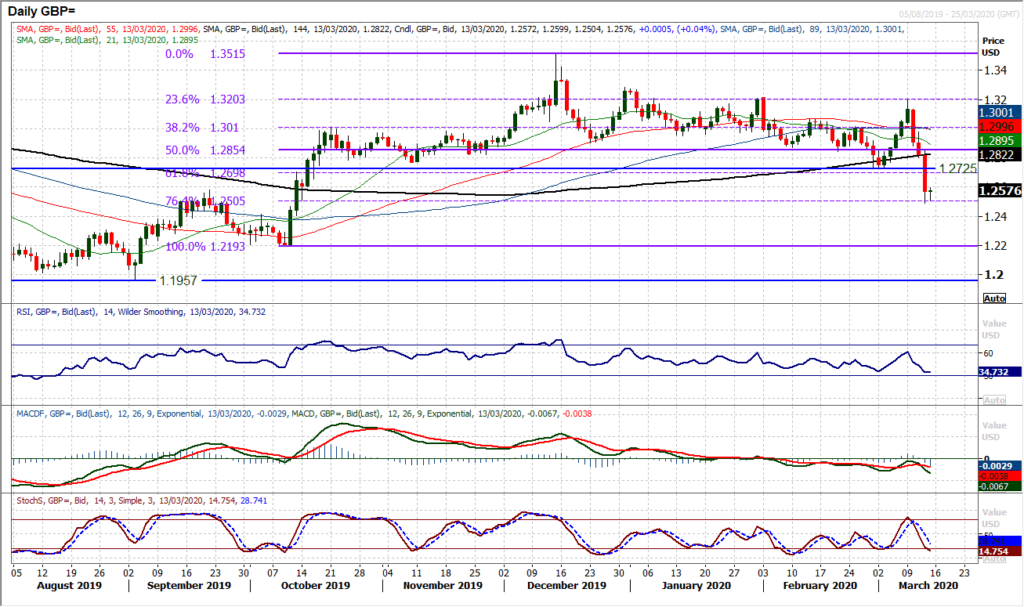

The momentum behind weakness on Cable in the past couple of days can be attributed to the renewed dollar strength. If current market conditions continue, the downside momentum of selling pressure could continue to pull further losses. The medium term range support has been broken and Cable looks pretty negative right now. Although we see this as breakdown of our medium term position, it is still likely to be a longer term buying opportunity for sterling. However that is for another day. For now, watch the Fibonacci levels, as Cable has been extremely conformist despite the significant volatility. The Fibonacci retracements of $1.2193/$1.3515 have been incredible in calling support and resistances in recent weeks. Once more, yesterday’s huge sell off turned to find a low at $1.2490, just a shade below the 76.4% Fib at $1.2505. This Fib has been today’s low also. So, 61.8% Fib around $1.2700 is a barrier overhead now. Considering the old low at $1.2725, there is a resistance band building. A decisive close below the 76.4% Fib implies a full retracement to $1.2193.

Author

Richard Perry

Independent Analyst