EUR/USD: Selling into strength – Little reason to change this view [Video]

![EUR/USD: Selling into strength – Little reason to change this view [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/money-13797882_XtraLarge.jpg)

EUR/USD

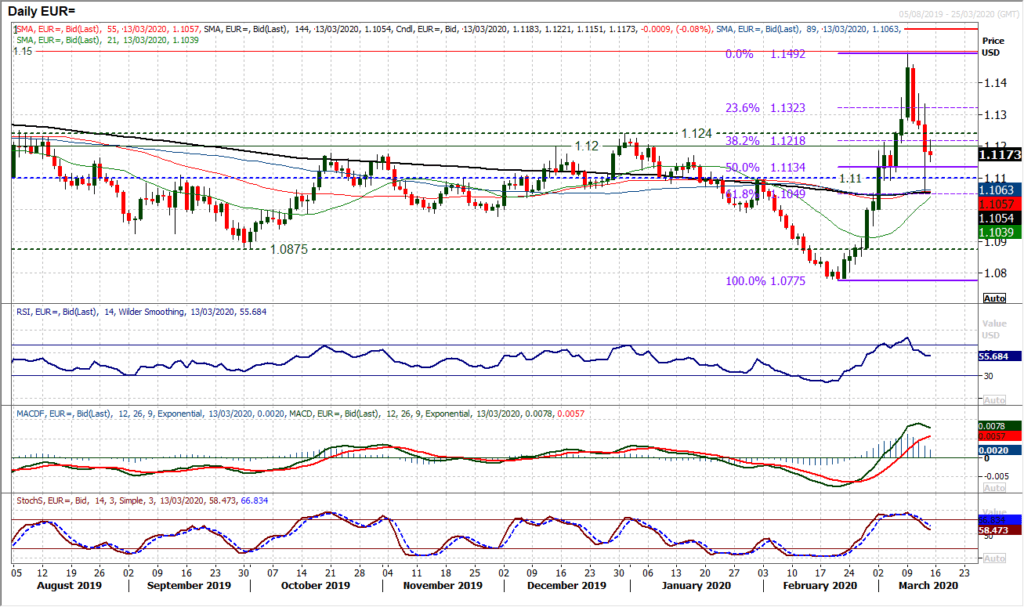

A double whammy of an incredulous ECB press conference, dollar strength on funding concerns and a Fed move to mitigate, generated a wild session on EUR/USD. A high to low range of 280 pips does not even tell the whole story either. Taking a step back though to survey the technical damage to the chart, there is a breach of the support band $1.1200/$1.1240 which we see as being a move that opens the next target area of $1.1100, an old pivot. Selling into strength has already been a developing theme and for now we see little reason to change this view. Technicals are reflective of this, with the RSI below 60 having been above 80 means the corrective momentum is developing still. A Stochastics sell signal add to this. Resistance is now between $1.1200/$1.1240 with the 38.2% Fibonacci retracement (of $1.0775/$1.1492) at $1.1220. Whilst the market trades under $1.1300/$1.1330 resistance the move remains corrective now.

Author

Richard Perry

Independent Analyst