Rising Unemployment Weighs on the Kiwi | NZD/USD, NZD/JPY, AUD/NZD

Weak employment data took its toll on the Kiwi, seeing expectations for RBNZ to cut rise further.

- Q3 Unemployment rose to 4.2% (3.9% prior, 4.1% expected)

- Job growth softened to 0.2% QoQ (0.8% prior, 0.3% expected)

- Labour costs continued to rise, now 2.3% YoY (although 0.6% QoQ as expected)

Given that employment data is now a key mandate for RBNZ’s monetary policy decisions, expectations for RBNZ to ease further have risen. According to OIS (overnight index swaps) markets now suggests a 59.4% chance of a cut this month, up from 52% yesterday, or an 83% chance by May. NZD finds itself under pressure once more despite improved sentiment over US-China trade, and its ability not to crack key resistance levels has not gone unnoticed.

On Monday, NZD/USD printed a key reversal after failing to hold above 0.6450 resistance. It was also the 2nd bearish hammer at the highs which further suggest the top is in. The inverted H&S stopped short of its projected target around 0.6520 but did hit the original 0.6450 target. And given the strength of the DXY rebound, then a bearish case (at least of over the near-term) is taking shape.

Of course, if RBNZ don’t cut or provide a dovish bias, NZD/USD could trade much higher on trade optimism (and assuming no more spanners in the works on that front). Yet given the wide zone of resistance levels nearby, the reward to risk undesirable for bulls on the daily timeframe whilst it trades below 0.6500.

- Bias remains bearish beneath the hammer highs, so bears could look to fade into minor rallies beneath this week’s high (within the resistance cluster) or wait for a break lower

- Whilst bulls could consider bullish setups on the intraday timeframe up towards the resistance level, reward/risk potential is undesirable on the daily chart – so would only consider longs above 0.6500.

NZD/JPY remains of interest for a potential short, although we’d likely need global sentiment to sour for this to see a sizeable downside move. That said, it has one of the weakest performers against the yen since its August low, so if sentiment is to turn for the worst, NZD/JPY looks like a sitting duck.

Prices are clearly paying attention to the resistance cluster ~69.70-70.27, which comprises of a 50% retracement level, structural turns and the bearish channel. Two bearish pinbars have also firmed to show a hesitancy to break higher.

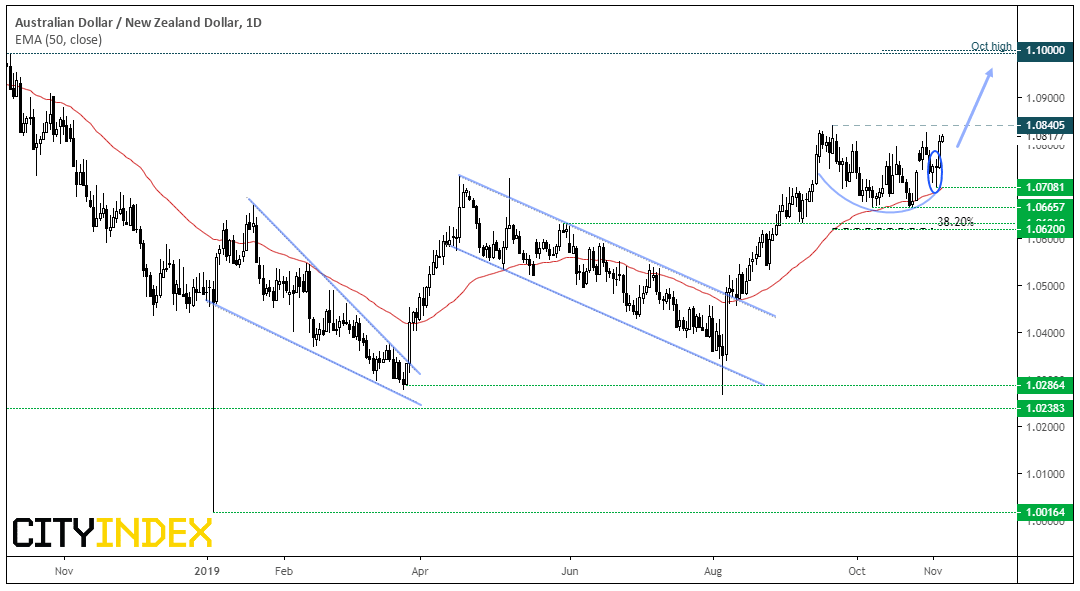

AUD/NZD: With expectations for RBA to cut below 10%, versus RBNZ’s at 60%, a diverging theme is there which could help AUD/NZD break to new highs. A rounding bottom is taking shape which is supported by the 50-day eMA and a bullish hammer and pinbar mark a likely swing low at 1.0708.

You may have noticed the trendline resistance has been removed from the prior analysis, as the shift in central bank expectations this week could allow for AUD/NZD to break higher.

Bulls could trade a break above 1.0840 to target the 1.10 highs. Whilst the trend remains bullish above 1.0665, we’d likely step aside with a break beneath 1.0708.

Related analysis:

RBA Holds, Yet Aussie Upside Remains Clouded By Resistance | AUD/USD, AUD/JPY, EUR/AUD

Author

Matt Simpson, CFTe, MSTA

CityIndex

Matt Simpson is a certified technical analyst who combines charts and fundamentals to generate trading themes.