Reserve Bank of Australia Preview: Lowe and co have a tough decision to make

- The Reserve Bank of Australia will likely hike the cash rate by 25 bps.

- Mortgage rates in Australia are becoming a problem for households.

- AUD/USD is at risk of resuming its bearish trend and testing the 0.6300 area.

The Reserve Bank of Australia (RBA) will announce its monetary policy decision on November 1, with board members stuck between a rock and a hard place. The Australian central bank hiked the cash rate in every single meeting since May but was the first to slow the pace of quantitative tightening, going for a modest 25 bps hike in October. The latter followed five-consecutive 50 bps hikes.

Australian policymakers joined the global tightening train amid spiraling inflation in May, when the benchmark rate stood at 0.1%. The decision to downsize in October resulted from soaring mortgage costs. With rates going from 0.1% to 2.6%, roughly 30% of homeowners started struggling to pay their home loans, according to Finder’s consumer sentiment tracker. But if the RBA wants inflation to return to target, it would need a more restrictive rate.

Australian inflation out of control

According to the Australian Bureau of Statistics, the Consumer Price Index (CPI) rose by 1.8% in the third quarter of the year, while the annualized pace of inflation hit 7.3%. The Trimmed Mean CPI, which tends to soften the average prices´ increase, rose by 6.1% YoY, the highest reading since the series commenced two decades ago.

Finally, like most major central banks, the RBA Board has the mandate to control inflation. Policymakers may keep an eye on a potential recession, but controlling prices is their priority.

For the time being, financial markets anticipate another 25 bps rate hike and one more of the same size in December, although a 50 bps move is still on the table, given the most recent inflation estimates.

Either way, the RBA will likely disappoint markets. A surprise higher-than-anticipated hike will lift the risks of a recession, while a conservative one will hardly affect inflation.

It is worth adding that the US Federal Reserve (Fed) will meet this week itself to decide on monetary policy. The United States central bank has aggressively tightened its monetary policy, and another 75 bps rate hike is already priced in for this meeting. US policymakers are also expected to pave the way for smaller hikes starting in December. The current interest rate in the US is 3.0%-3.25% and is expected to reach 4.5% by the end of the year.

The RBA began later with hikes and kick-started easing the first. The conservative stance is dovish itself, and markets are not expecting a hawkish surprise from Governor Philip Lowe.

AUD/USD possible scenarios

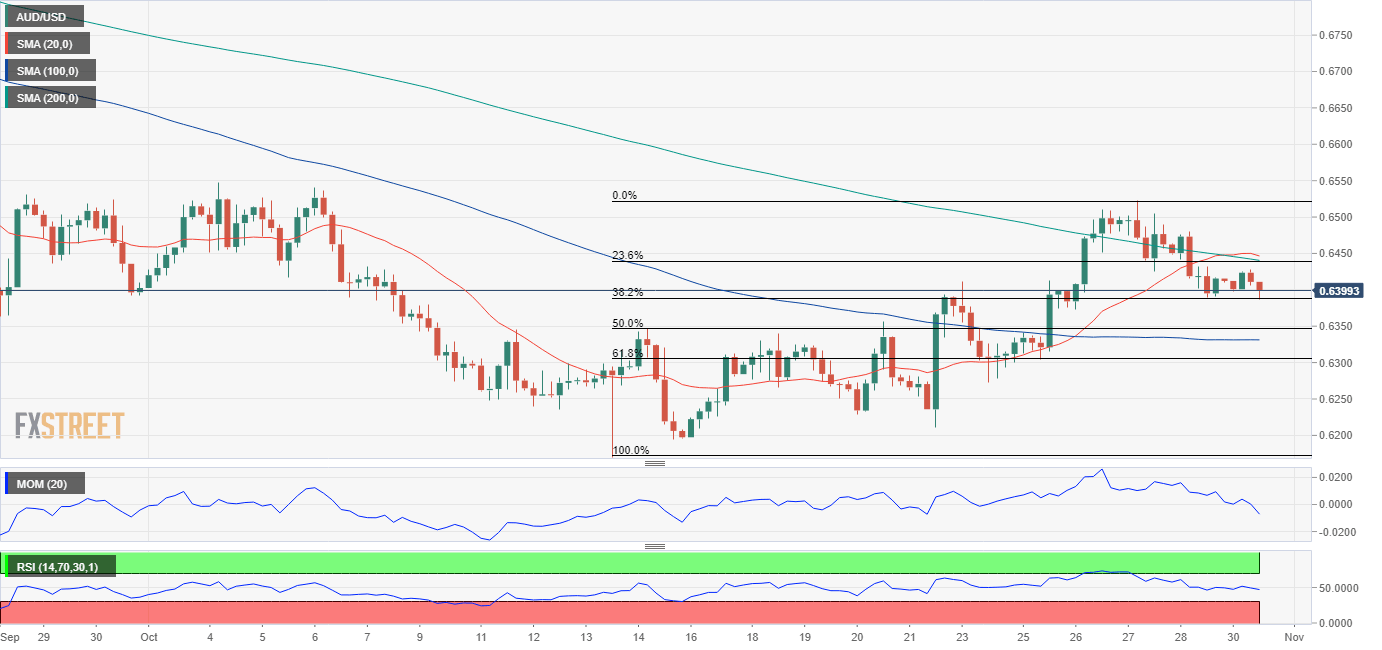

The AUD/USD pair hovers around 0.6400 ahead of the event. The pair recovered from a 2022 low of 0.6169, reaching 0.6521 before easing. It is currently meeting buyers at around the 38.2% retracement of the aforementioned rally at 0.6385. A break below the latter should favor a slide towards the 0.6300 price zone, where buyers may stand ready to defend the 61.8% retracement. The pair will resume its bearish trend on a daily close below 0.6300.

An unexpected bullish surprise could help AUD to resume its bullish run. The first resistance level comes in at 0.6440, followed by the 0.6500 figure. Yet it seems unlikely AUD/USD will strengthen beyond the monthly high ahead of US first-tier events scheduled for later in the week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.