RBNZ Preview: Improving economic performance but same policy

- The Reserve Bank of New Zealand to leave monetary policy settings unadjusted in May.

- The RBNZ is expected to upgrade its economic forecasts, showing a strengthening recovery.

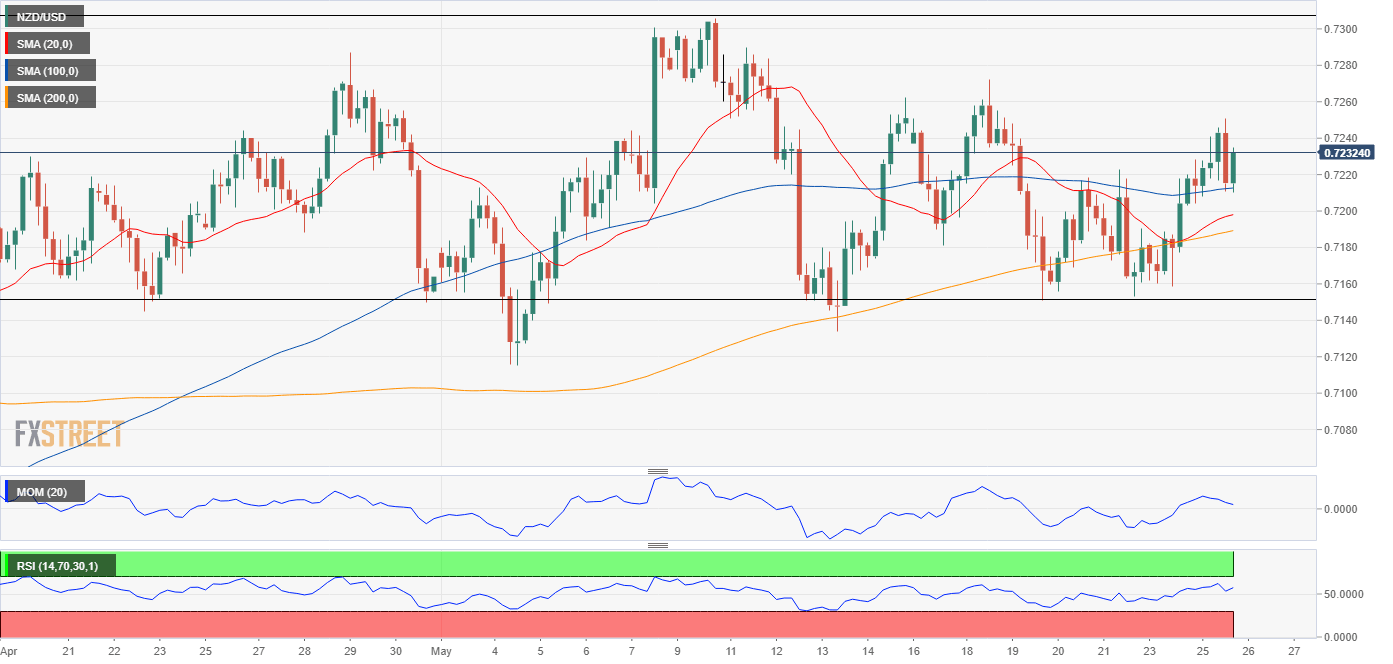

- NZD/USD has room to rise, although subject to US dollar’s dynamics and risk tone.

The Reserve Bank of New Zealand (RBNZ) is likely to maintain its monetary policy settings at its meeting on Wednesday, taking into account improving economic performance, the country’s nascent vaccination campaign and concerns over the new Indian covid variant.

RBNZ to stand pat, dismiss spike in inflation

The RBNZ is expected to keep the Official Cash Rate (OCR) at a record low of 0.25% for the seventh straight meeting in May. The central bank is also likely to maintain the LSAP program at NZ$100B while keeping the Funding-For-Lending program (FLP) in place.

The rate decision will be announced this Wednesday at 0200 GMT. Governor Adrian Orr’s Orr will hold a press conference at 0300 GMT.

The recent positive fundamentals are likely to be well received by the RBNZ, as the central bank is widely expected to upgrade its economic assessments. However, the dovish tone on the monetary policy stance will remain intact, as the unemployment rate is far from the central bank’s target of 4% while the spike in inflation is likely to be seen as ‘transitory’.

The unemployment rate fell further to 4.7% in the first quarter of 2021. The labor cost index rose +1.6% YoY during the period. Two-year inflation expectations, seen as the time frame when RBNZ policy action will filter through to prices, rose to 2.05% from 1.89% last.

Meanwhile, the leading indicators in the NZ Retail Sales saw a growth of rose a seasonally adjusted 2.5% in Q1. Confidence amongst the domestic firms jumped while the country’s manufacturing sector also remains on a recovery path.

Additionally, key commodity exports such as dairy have beaten price expectations and improvement in the housing market has boosted the construction sector.

Against this brighter economic outlook, the RBNZ is seen weighing the potential downside risks to growth, as the world still combats the coronavirus outbreaks, with the latest Indian strain compounding the worries. Further, uncertainty over overseas tourism re-opening up and New Zealand’s early stage of the vaccination campaign could prompt the central bank to maintain its monetary stimulus.

The NZ government announced Tuesday that it would pause travel with the Australian state of Victoria for 72 hours initially after 5 cases were found in the past two days in the state.

Kiwi’s fate hinges on any hawkish hints, market mood

Unless the kiwi central bank surprises with some hawkish hints in the forward guidance and or policy statement, the kiwi is likely to remain at the mercy of the US dollar price action and the market mood at the time of the rate announcement.

The kiwi dollar is seen extending its recent advance towards 0.7300 if the central bank’s projections on unconstrained OCR changes, in response to the upbeat economic developments. This could imply OCR hikes from 2023, sooner than the expectations of an early-2024 increase. However, if the RBNZ warrants caution on the employment growth and sounds dovish, NZD/USD could fall back towards 0.7150.

However, with the US dollar under pressure due to easing inflationary concerns and dovish Fed expectations, any downside in the spot could remain limited.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.