Powell testifies next week – Markets await signs the Fed is hawkish but holding out for hard data

Outlook

We switched signals in our trading advisories on the basis of enough indicators pointing to a dollar rally. We thought this meant war panic was going to take hold. After all, the press reported Trump had decided to join Israel in at least one bombing of an Iranian nuclear site—despite the public, Congress and some Trump supporters against it, as well as Trump having promised on the campaign trail “no more wars.”

Check out the indicators on the charts in the Chart Package. We have 6 “buy dollar” signals with a better than 50% likelihood, and three maybes. If this keeps up, we will be forced to reverse signals. We don’t like it. The sentiment is “always buy dollars when the US goes to war,” meaning for the most part the FX market believed Trump will bomb the nuke mountain.

But that was yesterday and so far today we are not getting the follow-through. Perhaps traders think he will chicken out. Another option is Iran coming to the table for talks, despite their refusal today. Israel knows talks have not been working for decades, but Trump is the decider.

The idea of a one-time thing and announced loudly as such, like what Bush did in Kuwait, has some appeal. It allows the US to support Israel without actually going to war, as long as Iran believes it’s a one-time thing and refrains from retaliating.

Chickening out and the one-time thing each would have the dollar retreat and PDQ. Or the FX strategists could decide that chickening out and the one-time thing do not justify changing horses in midstream and let‘s all go back to selling. Another option is the Saudis telling Trump not to do it, or Putin trading Kiev for Tehran.

In a word, high-risk. And that makes it curiouser and curiouser that markets are acting as though nothing is happening. This is consistent with the long-standing habit of markets to ignore politics, with outright war the exception. Market refusal to acknowledge current conditions is to downgrade the prospect of the US at war to “just news.” US at war is dollar-positive, as least at the start, so the failure of the dollar to post gains so far could mean the loss of safe haven status is genuine and lasting.

Next week we get Powell’s testimony to Congress with everyone waiting to hear some kind of affirmation that the Fed is feeling hawkish but waiting for hard data. The press is full of analysis and charts showing everybody and his brother cutting rates while the US is on hold.

The Trump threat to politicize the Fed is still very much with us and has the muscle to damage the dollar and erase whatever safe haven status war may bring. The combination of an unsustainable debt burden plus a castrated Fed would be fatal… but again, we have to watch those Treasury auctions (and the S&P). So far evidence of foreign withdrawal is not impressive.

Forecast: We won’t know the Iran war risk is over until it’s over. We don’t like the idea of the dollar gaining ground on the safe-haven story because we are just becoming accustomed to the US losing safe haven status. Is there such a thing as temporary safe haven status.? It would seem a contradiction in terms.

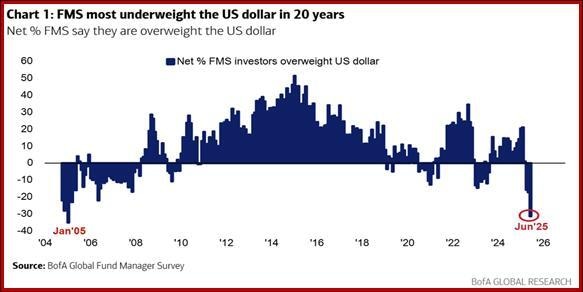

The prospect of a dollar rebound can be due not to the war story, but also or instead of the idea that it has been vastly oversold. See the chart from BoA—the worst first half since 2005. This is not to say it has been overdone, but only to comment that a pullback would be normal. That can be true even if the underlying causes are still present and the decline comes back.

Longer run, Reuters summarizes “The 20-year high in dollar underweighting by asset managers in the BofA survey, by contrast, is of a different order altogether. That indicates both wariness of U.S. assets at large, due to concerns about the current U.S. administration's approach to global trade, geopolitics and institutional integrity, and a more structural dollar retreat.

“It's notable that even with this year's 10% dollar decline and the existing underweight among global funds, almost two-thirds of survey respondents still saw the dollar as overvalued.

“What's more, relatively short interest rates are often the driving force in cyclical currency moves - with the dollar sinking even as widening transatlantic rate gaps suggest otherwise.”

This is a flashing red light warning that if you go long dollars on the war story, you are bucking a strong trend. There are times when fundamentals are needed to override technical signals.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat