Patterns: EUR/AUD, EUR/CAD, NZD/CHF, AUD/CHF

EUR/AUD 4H Chart: Sell signals

The single European currency has declined by 2.87% against the Australian Dollar since last week's trading sessions. The currency pair was pressured lower by the 50– period simple moving average.

All things being equal, the exchange rate will most likely continue to trade in the descending channel pattern. Bearish traders could target a support cluster at the 1.6515 area.

However, given that the currency exchange rate is currently trading near the upper line of the descending channel pattern, a breakout might occur within this week's trading sessions.

EUR/CAD 4H: Two scenarios likely

The Eurozone single currency has edged lower by 2.02% against the Canadian Dollar since last week's trading sessions. The exchange rate was pressured lower by the 200– period simple moving average.

The currency pair is currently testing a resistance cluster formed by the 50– and 100– period SMAs at 1.5274.

If the EUR/CAD pair breaks the resistance cluster, a surge towards the 1.5500 area could be expected within this week's trading sessions.

However, if the 50– and 100– period SMAs holds, bearish traders would continue to pressure the currency exchange rate lower during the following trading sessions.

NZD/CHF 1H Chart: Two scenarios likely

The NZD/CHF currency pair has been trading within an ascending channel since the end of March. The pair has already surpassed the 0.5850 level.

From a theoretical point of view, it is likely that the exchange rate could continue to trade within the given channel in the medium term. In this case the rate could face the resistance formed by the Fibonacci 38.20% retracement at 0.6153 at the beginning of June.

However, note that the currency pair would have to surpass the Fibonacci 23.30% retracement at 0.5919. If the given level holds, it is likely that a reversal south could occur, and the pair could re-test the psychological level at 0.5300.

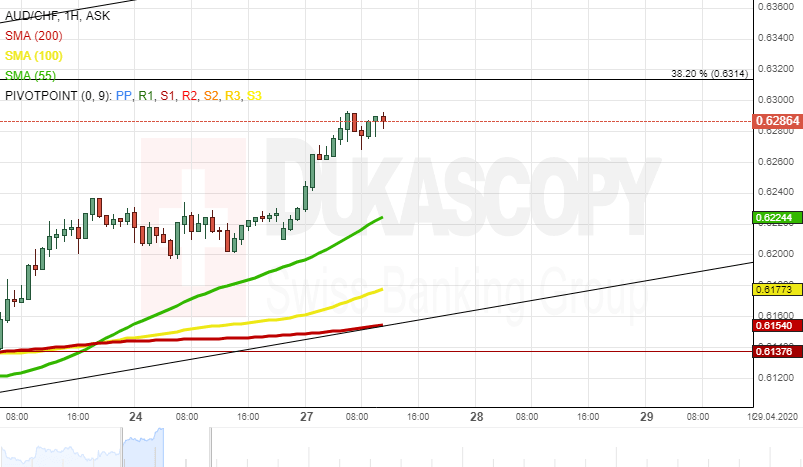

AUD/CHF 1H Chart: Ascending channel in sight

The AUD/CHF exchange rate has been trading within an ascending channel since the end of March. The rate has already exceeded the 0.6200 mark.

From a theoretical perspective, it is likely that the currency pair could continue to trade upwards within the given channel in the medium term. In this case the pair could reach the Fibonacci 50.00% retracement at 0.6599 at the beginning of June.

However, note that the exchange rate would have to surpass the resistance formed by the monthly R1 and the Fibonacci 38.20% retracement in the 0.6314/0.6385 range. If the given resistance holds, it is likely that a reversal south could occur, and the rate could re-test the psychological level at 5.400.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.