Palladium Technical Analysis - Are Palladium Futures Traders Continued Committed for More Upsides?

Palladium retraces $44.51 or 1.81% touching $2,413.84 per ounce, Gold gains $9.30 or 0.60% advancing $1,572 per ounce, Silver surges 27.8 cents or 1.56% reaching $18.052 per ounce.

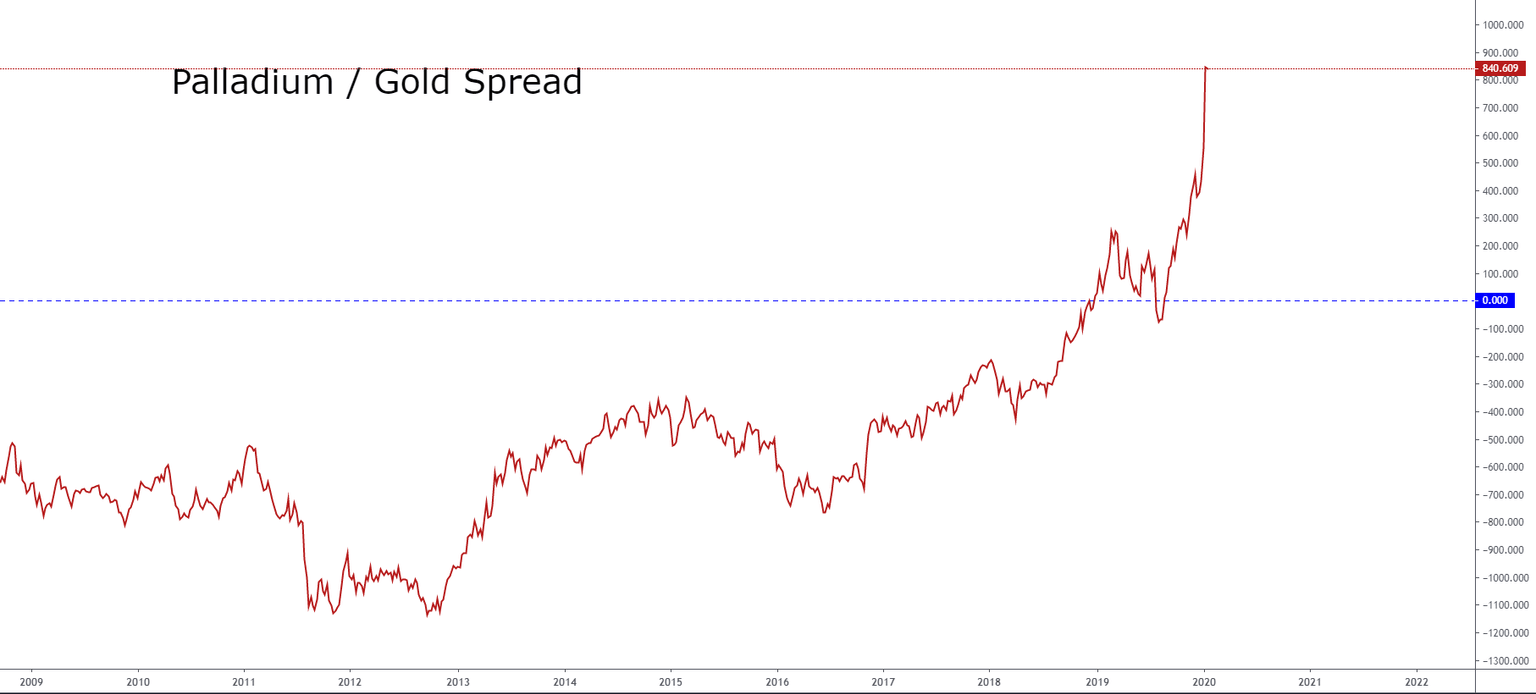

Since late 2018, Palladium, which is used mainly in the automotive sector, became most valued than Gold. Moreover, its differential against it has been increasing over time, and in the current month, Palladium price exceeded the $800 per ounce of difference against Gold.

In the last CFTC report, speculative traders informed that they reduced their net positions by 2.05%, declining to 11,340 from the 11,577 positions reported in the previous week.

On the other hand, in the same report, the topmost market participants informed of an increase of 11.37% in the short positioning and only a modest 2.15% on the long-side. In consequence, with this increase, institutional traders hold 75.92% of their positions in the long side.

This reading makes us presume that institutional sentiment still remains on the bullish side. However, the 11.36 percent increase in short positions makes us perceive that taking profit activity could start soon.

Technical Overview

The log-scale weekly chart of Palladium exposes an advance in its price, which looks like a fifth extended wave, that reached its highest level at $2,531.10 per ounce this week.

According to the Elliott wave theory, an extended wave could reach its top if the price action soars over the upper line of the ascending channel that results from a line linking the end of waves two and four and projecting that line at the top of the third wave (see chart 04).

In the Palladium chart, the price of this precious metal could create a corrective sequence, which would become a wave 4 of Minor degree labeled in green. This movement should give way to a wave 5 of Minor degree. That wave, whose end is shown labeled as 5 in green, should complete the fifth wave of Intermediate degree marked as (5) in blue.

On the one hand, Palladium futures traders are increasing their short positioning. Also, Palladium moves in its fourth wave of a Minor degree of the fifth wave of Intermediate degree. In conclusion, our short-term perspective remains bullish for Palladium; however, long-term, our bias changes from bullish to neutral.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and