Oil smashing stocks

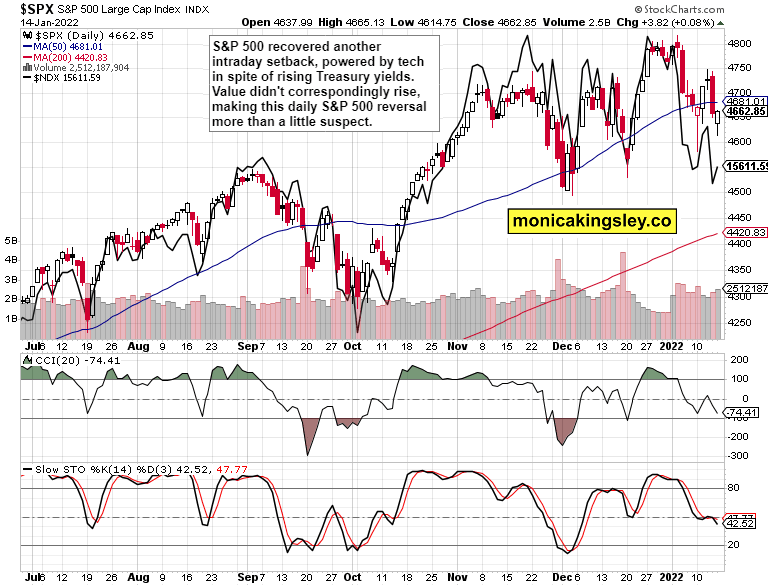

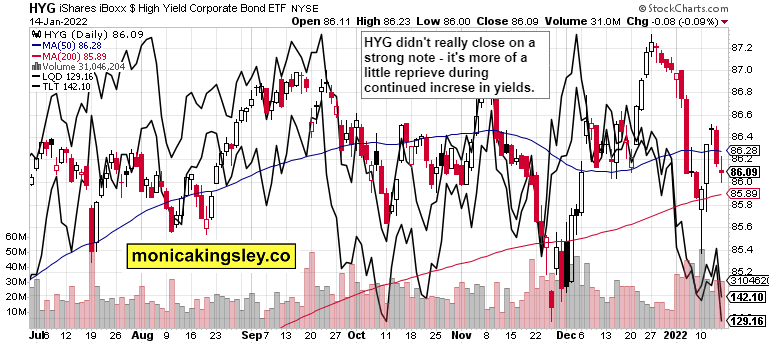

S&P 500 didn‘t like latest weak data releases, but finished well off intraday lows. This reversal though leaves quite something to be desired – and it‘s sectoral composition doesn‘t pass the smell test entirely either. Yields continued to rise while HYG barely closed where it opened – that‘s not really risk-on. Cyclicals, and riskier parts of tech weren‘t visibly outperforming – the S&P 500 rally felt like a defensive bounce off some oversold levels.

That‘s why it won‘t likely hold for long – I don‘t think we have seen the end of selling – more downside awaits. It‘s still correction time, even if 2022 is likely to end up around 5,150 – we‘re still in a bull market, and Big Tech would do well. For now though, rising yields are putting pressure – and they would continue to rise. As liquidity would no longer be added by the Fed by Mar, the question remains how much would funds coming out of the repo facilities and the overnight account at the Fed (think $2t basically) offset the intended tightening.

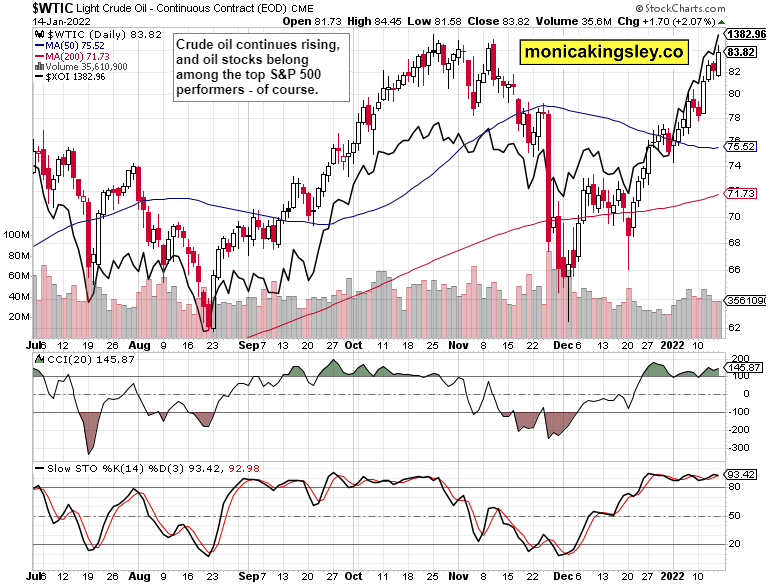

Commodities aren‘t at all shaken, and Wednesday‘s positive copper move doesn‘t look to be an outlier – unlike Friday‘s decline that didn‘t correspond with other base metals. Even though it might be soothing to the pension funds, inflation rates aren‘t likely to come down to the usual massaged 2% during the next 2-3 years, no matter whether the Fed hikes by 0.25% 6 or 8 times. The persistently and unpleasantly 4-5% high CPI is likely to break the mainstream narrative, and stay with us for much longer than generally anticipated, which is only part of the reason why I am looking for gold to leave $1,870s very convincingly in the dust this year.

Both yellow and black gold would rise in tandem, and the rising open crude oil profits (heavy long positions opened at $78) are part of the reason behind permanently elevated inflation ahead. The commodities upswing is also no longer tempered by the rising dollar.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

The tech reversal could carry the daily weight of S&P 500 upswing – the daily weight only. I‘m not looking for this modest show of strength to hold.

Credit markets

HYG didn‘t close strongly either – rising yields are taking their toll, and will continue doing so.

Gold, silver and miners

Gold and silver downswing needn‘t be feared – while the metals are still sideways, the pressure to go up is building, and the dollar woes would be but the first catalyst (challenged faith in the Fed taming inflation would be next).

Crude oil

Crude oil still finds it easiest to keep rising, and black gold could pause a little on the approach to $90 – the technical and fundamental upswing conditions are in place, and oil stocks will continue to be among the best S&P 500 performers.

Copper

Copper catch up was postponed a little – that‘s all. The decline wasn‘t a true reversal, and the red metal would take on $4.60 before too long again.

Bitcoin and Ethereum

Bitcoin and Ethereum still can‘t convince on the upside, and with no dovish surprise on the horizon, the path of least resistance probably remains down for now – today‘s session definitely confirms that.

Summary

S&P 500 upswing isn‘t to be trusted, and its defensive nature out of tune with bonds, is part of the reason why. The stock market correction has further to go, and while tech overall would do well in 2022, it has to decline first – that would set the stage for a good 2H advance. The early phase of the Fed tightening cycle belongs to the bears, and it would continue to be commodities and precious metals to weather the storms best. Long live the inflation trades.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.