Oil price holds steady after judge blocks Biden lease ban

The price of crude oil rose in the overnight session even after a federal judge issued a preliminary injunction stopping the Biden administration from pausing new oil and gas leases. The judge said that the administration did not have the legal right to stop leases on federal lands without authority from Congress. The injunction is a temporary setback for Joe Biden’s administration that seems to be hostile to fossil fuels. In a statement, the Interior Department said that it would comply with the ruling but that it will review its practices. The price of Brent and West Texas Intermediate is hovering near the highest levels in a few years.

The Japanese yen declined against the US dollar after relatively mixed data from the country. In a statement, the Japanese statistics agency said that the country’s exports increased by 49.6% in May, lower than the median estimate of 51.3%. Similarly, imports increased by 27.9%, which was better than the median estimate of 26.6%. As a result, Japan recorded a 187 billion yen trade deficit, after it recorded a 253 billion yen surplus in the previous month. Further data from Japan showed that machinery orders declined from 3.7% to 0.6%. Still, there is a possibility that the Japanese economy will stage a comeback as the economy recovers.

The economic calendar will be relatively busy today. In the United Kingdom, the Office of National Statistics (ONS) will publish the latest consumer price index data. Analysts expect the data to show that the country’s inflation rose to 1.8% in May as commodity prices rose. In China, the National Bureau of Statistics (NBS) will publish the latest fixed asset investments, retail sales, and employment data. These will have an impact on major currencies, including the Chinese yuan and the Australian dollar. In Canada, the statistics agency will release the latest inflation data. In the United States, the focus will be on the Federal Reserve that will publish its decision during the American session.

USD/JPY

The USDJPY pair is trading at 110.10, which is higher than last week’s low of 109.20. On the four-hour chart, the pair is above the lower line of the ascending channel. It has also moved above the 25-day and 15-day exponential moving averages (EMA) while the signal and histogram of the MACD are above the neutral level. The pair will likely keep rising, with the next key target being at 110.30.

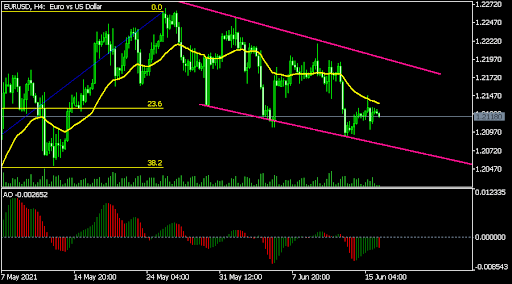

EUR/USD

The EURUSD pair was little changed during the Asian session. On the four-hour chart, the pair has formed a bearish flag pattern slightly below the 23.6% Fibonacci retracement level. The pair has also moved below the 25-day moving average while the awesome oscillator has fallen below the neutral level. The pair will likely break out lower since a flag pattern is usually a sign of continuation.

AUD/USD

The AUDUSD pair rose to an intraday high of 0.7695, which was slightly above this week’s low of 0.7673. On the four-hour chart, the pair has moved above the important support at 0.7690. It has also declined below the 25-day and 15-day moving averages. It is also below the dots of the Parabolic SAR indicator. Therefore, the pair will likely resume the bearish trend after the Chinese data.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.