New Zealand dollar wavers as RBNZ says more support necessary

The New Zealand dollar is unchanged today as traders react to the country’s interest rate decision. The bank left the Official Cash Rate (OCR) unchanged at 025%. It also agreed to continue with its Large Asset Purchase (LSAP) program with a limit of $100 billion. The bank agreed to do more to help steer the country as it goes through its worst economic crisis in decades. The rate decision came at a time when the country just prevailed in its battle against the pandemic. It also came a few weeks ahead of New Zealand’s election.

US and Asian stocks rose for the first time in four days as investors reacted to positive corporate earnings from Nike and KB Home. In its statement, Nike said that its online sales surged by 82%, pushing the stock up by 6%. KB Home, a leading home builder also released impressive results, sending a signal that the home market was strong. Also, investors reacted to Tesla’s announcements in its battery day. The firm said that it expects its deliveries will increase by between 30% and 40% in 2020. At the same time, the market reacted to news that Mitt Romney will vote for Trump’s Supreme Court nominee.

The economic calendar will have some key events today. Markit and its international partners will release the flash manufacturing and services PMIs. These numbers are essential because they provide a picture about the state of the economy. Analysts expect the data will show that the manufacturing PMI in the UK fell to 54.2 while that from the Eurozone rose to 51.9. In the US, they expect the data to show that the PMI rose to 53.1. Separately, the Energy Information Administration (EIA) will release its oil inventories data.

NZD/USD

The NZD/USD pair is trading at 0.6618, which is slightly higher than the intraday low of 0.6595. On the four-hour chart, the price is above the important support at 0.6600. Also, the price is below the 50-day and 25-day exponential moving averages while the signal and main lines of the MACD have moved below the neutral line. The pair is likely to continue the downward trend, with the next main point being the support at 0.6550.

EUR/USD

The EUR/USD pair declined to an intraday low of 1.1684, which is the lowest it has been since July 27. On the four-hour chart, the pair managed to move below the previous ascending channel. It has also moved below the previous resistance level at 1.1736. The price is below the 50-day and 25-day exponential moving averages while the DeMarker indicator has continued to decline. Therefore, now that the pair has moved below its key support, there is a possibility that it will continue falling.

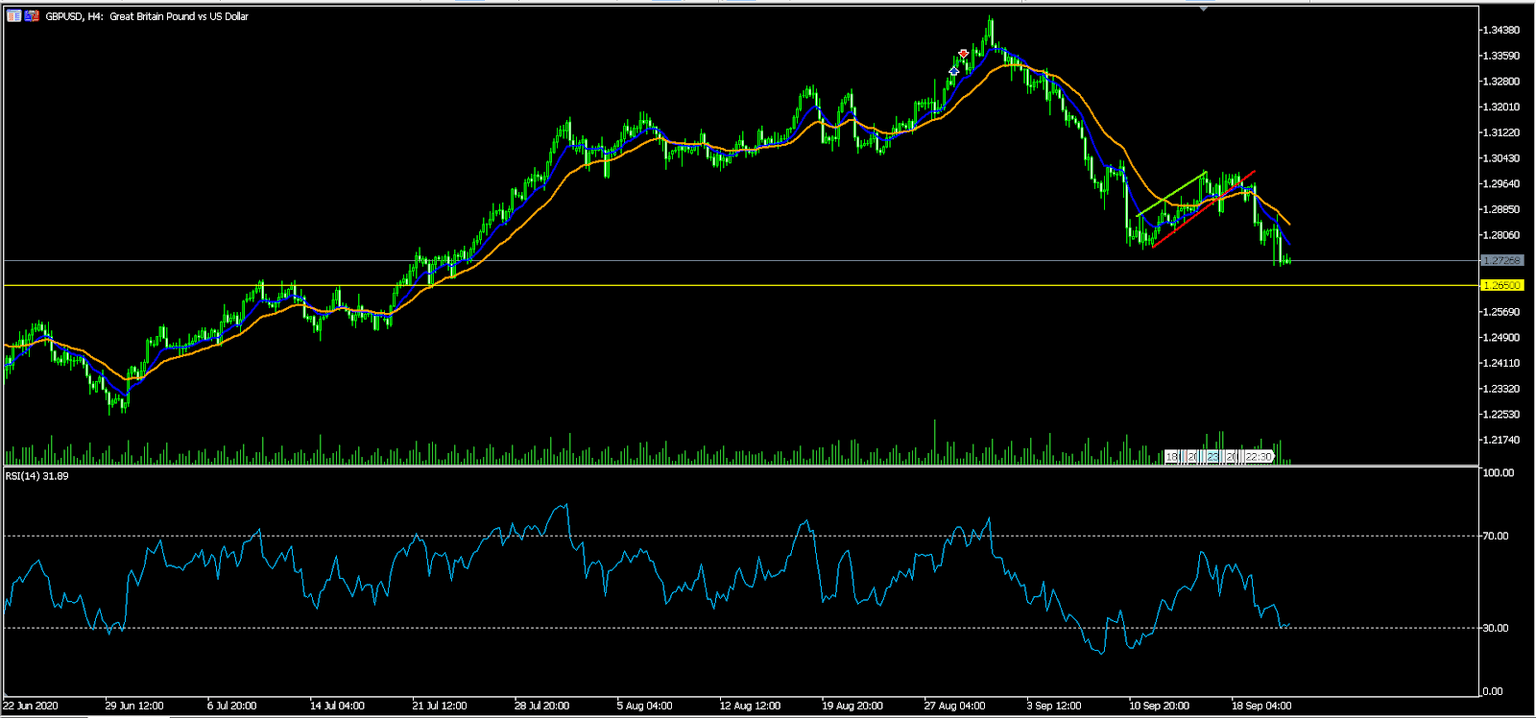

GBP/USD

The GBP/USD pair declined to an intraday low of 1.2725, which is the lowest it has been since July. On the four-hour chart, this price is below the bearish pennant pattern it formed last week. It is also below the dynamic supports of 10-day and 25-day exponential moving averages while the RSI has been on a downward trend. Therefore, the pair is likely to continue falling as bears aim for the next support at 1.2650.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.