New Zealand dollar rises after strong retail sales data

US futures turned positive in the overnight session ahead of key corporate earnings. Later today, companies like Bank of America, Goldman Sachs, and Charles Schwab will deliver their fourth-quarter earnings. In general, analysts expect the numbers to be relatively strong. They also expect forward guidance by most countries to be good because of the stimulus that has been offered and the $1.9 trillion that has been proposed. Other companies set to release their earnings this week are IBM, State Street, Comerica, UnitedHealth, and Procter & Gamble.

The New Zealand dollar strengthened in early trading after relatively strong economic data from the country. According to the statistics bureau, electronic card sales increased by 3.4% in December from the previous month's increase of 1.4%. These numbers are important since most people in New Zealand shop using their credit and debit cards. Business confidence in the country increased from - 40% to - 6% while the capacity utilisation increased to 95.1% in the fourth quarter.

The euro rose slightly in the evening session ahead of important inflation and car registration data. The German statistics agency will release the December consumer price index data. It comes a day ahead of the final CPI data from the Eurozone. Also, the ECB will deliver the latest current account data a day before it starts the first monetary meeting of the year. Meanwhile, in Canada, the BOC will start its meeting today and deliver its interest rate decision tomorrow. Some analysts expect it to implement a micro rate cut.

EUR/USD

The EUR/USD pair bounced back in overnight trading after dropping for the past few consecutive days. It is trading at 1.2096, which is higher than yesterday's low of 1.2074. On the daily chart, the price is slightly below the 25-day moving average. It is also between the middle line and the lower line of the Bollinger Bands. Also, the Relative Strength Index (RSI) has continued to decline. Still, the pair will likely resume the downward trend ahead of the ECB decision.

ETH/USD

The ETH/USD pair bounced back in the overnight session after a few days of consolidation. It has jumped by more than 85% in the past month alone. It is also a few points below this month's high. On the daily chart, the pair is above the 50-day and 25-day moving averages. Similarly, the RSI has continued to rally. Therefore, the pair may continue rising, with the next target being at $1,400.

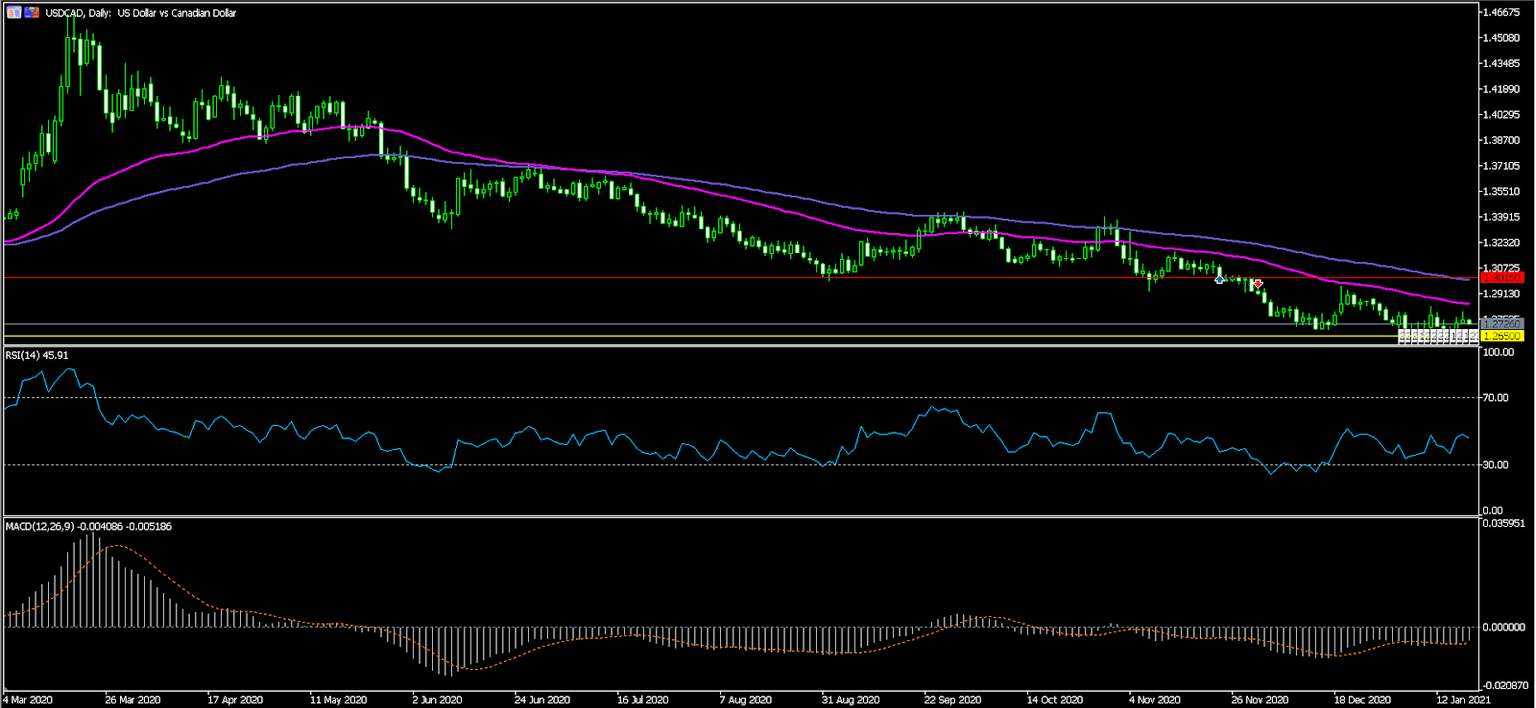

USD/CAD

The USD/CAD pair dropped sharply in the overnight session ahead of the Bank of Canada interest rate meeting. It is trading at 1.2727, which is close to the lowest level in more than 2 years. It is below the moving averages while the Relative Strength Index and the MACD are below the oversold level. Therefore, the pair will likely experience some volatility ahead of the rate decision.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.