Murrey math lines: USD/CHF, gold

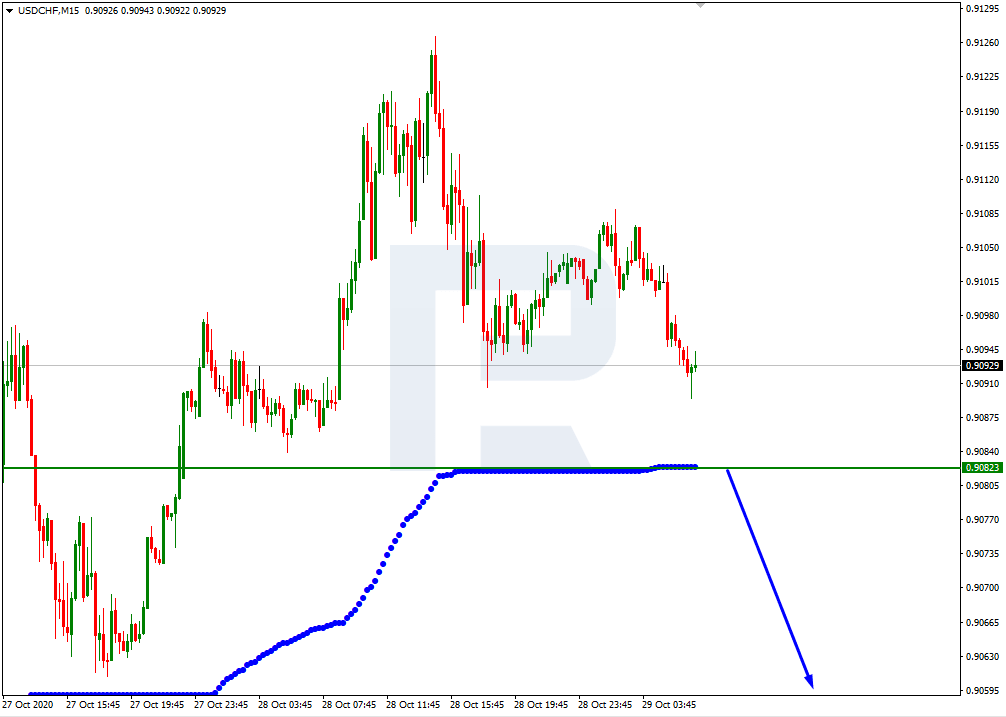

USD/CHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, USDCHF is moving below the 200-day Moving Average and rebounding from 3/8, thus indicating a descending tendency. In this case, today the price is expected to break 2/8 and then continue falling to reach the support at 0/8. Still, this scenario may no longer be valid if the price breaks 3/8 to the upside. After that, the instrument may reverse and continue growing towards 5/8.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue the descending tendency.

XAU/USD, “Gold vs US Dollar”

As we can see in the H4 chart, XAUUSD is moving below the 200-day Moving Average, thus indicating a descending tendency. However, yesterday the asset rebounded from the support at 0/8. In this case, the price is expected to correct upwards to 2/8. Still, this scenario may no longer be valid if the price breaks the support at 0/8 to the downside. After that, the instrument may continue falling towards the next support at -1/8.

In the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue trading upwards.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.