Mid East fears fuel Gold rush to $5,090 as bulls eyeing $5,350

- Weak Dollar Index boost Gold prices as holding cost becomes attractive.

- Mid East escalation fears cause surging safe haven demand for Gold.

- Bond Yields flattening, making Gold relatively attractive.

- After sharp fall in prices, oversold conditions attract value buyers.

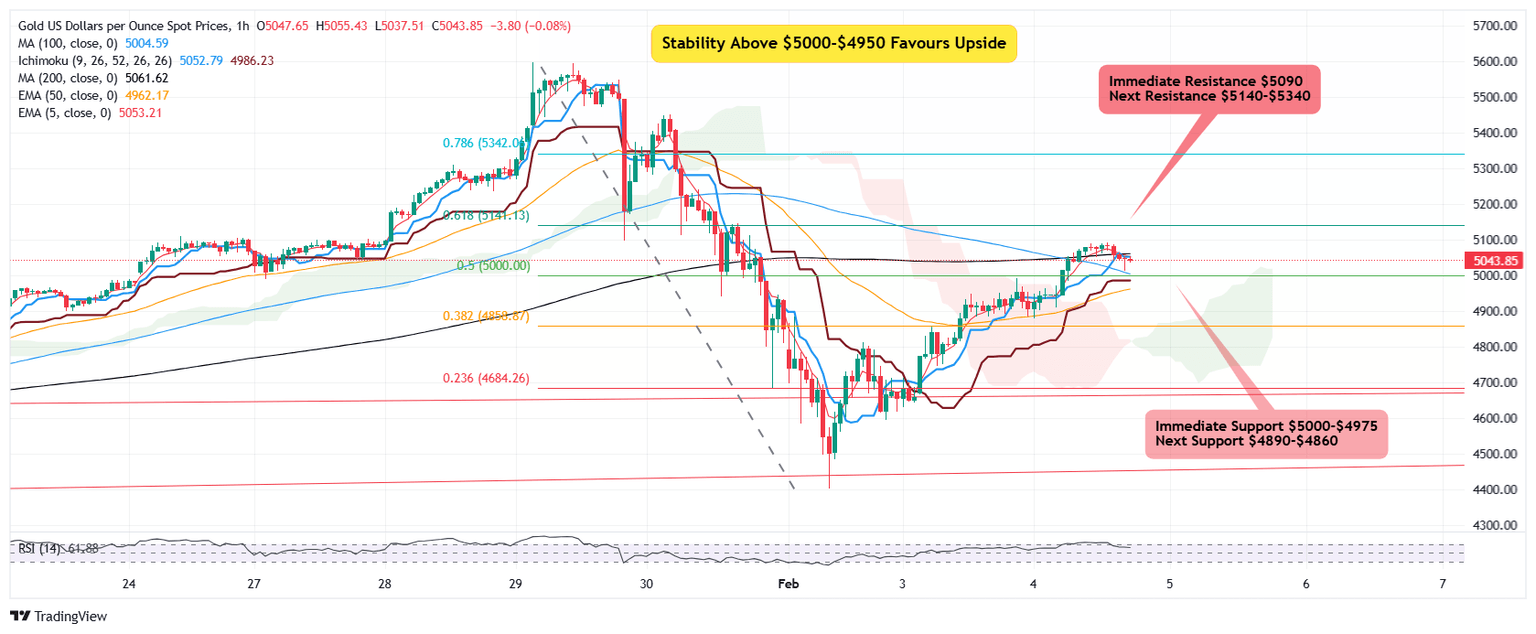

Market Summary: After record high of $5600 Gold prices witnessed historical correction that dragged prices to $4400, a jaw dropping $1200 fall.

This strong price correction shed most of the overbought conditions across higher time frames and attracted strong buying intervention at bargain prices causing a robust demand surge that saw prices rebounding to $5090 during Asian session.

Moreover, fears of middle east escalations triggered a safe haven buying rush in Gold which got tailwind from weak dollar making holding cost rather attractive in comparison to flattening treasury bond yields.

While macro factors stand in Gold's favour, technical indicators support continuation of bullish rebound as well.

Smart money flow shifting from falling crypto portfolio as well as faltering stocks give Gold another traction.

Bullish Scenario:

Price stability above 50% Fibonacci retracement from $5600 high and $4400 low indicates presence of buyers and strong breakout above $5090 will lead to quick advance towards next 61.8% Fibonacci zone $5140

If Gold attracts enough buying momentum above $5140, the next advance aims 78.6% Fibonacci zone $5340 which is considered a premium zone.

Bearish Scenario:

Consolidation below day high $5090 may turn into momentum distribution and strong beak below psychological zone $5000 will put Gold under pressure for further correctional retracement towards $4960-$4910 below which extended decline may expose $4890-$4860

Overall Outlook remains bullish subject to prices holding above $5000

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.