Michigan Consumer Sentiment Index May Preview: Can Americans keep their spending habits?

- American consumer outlook forecast to drop in May.

- Consumers are under stress from soaring inflation.

- Markets are wary that falling sentiment will be a prelude to a pullback in consumer spending.

Markets are spooked. The Dow is down 12.4% since the New Year. The NASDAQ Composite has shed more than a quarter of its value and the broad-based S&P 500 is 17.4% lower.

Treasury rates are at their highest in three years with one of the steepest ascents on record. The dollar has vaulted in every major currency pair and the Dollar Index is at a two-decade peak.

Two inflation fears are driving markets.

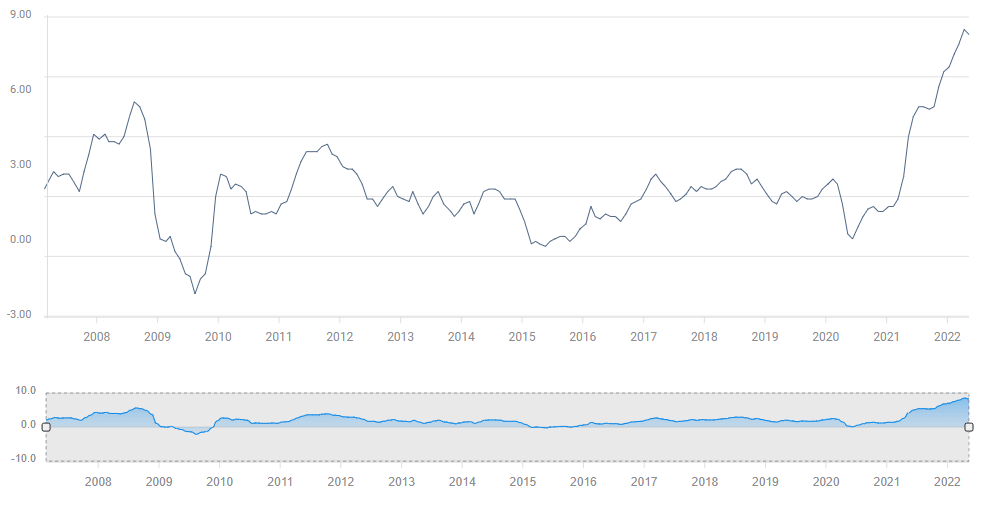

First is the Federal Reserve’s rate campaign. Annual CPI was 8.5% in March, 8.3% in April, more than triple its rate of a year ago. In order to control prices markets expect the Fed to add another 200 basis points to the fed funds rate by December, continuing with three more 0.5% hikes in June, July and September. Treasury futures give majority odds to the fed funds at 3.0% or higher after the December 14 Fed meeting.

CPI

The US economy contracted at a 1.4% annualized rate in the first quarter. Even if the decline was based on surging imports which in the government’s books count against domestic growth, US GDP has fallen sharply from the fourth quarter 6.9% pace. The Atlanta Fed’s latest GDP estimate for the second three months of this year is 1.8%.

Whatever the current expansion, the housing sector has already begun to decline as mortgage rates have soared. Other credit sensitive areas like auto sales and major appliance purchases could follow as the Fed tightens the rate screws. Weak US growth could easily tip into recession under such rate pressure.

The second worry is the consumer. Will the year-long climb in prices, with no sign of abatement, drop the US households into a spending recession. With 70% of US economic activity dependent on the consumer, spending is essential for the recovery to continue.

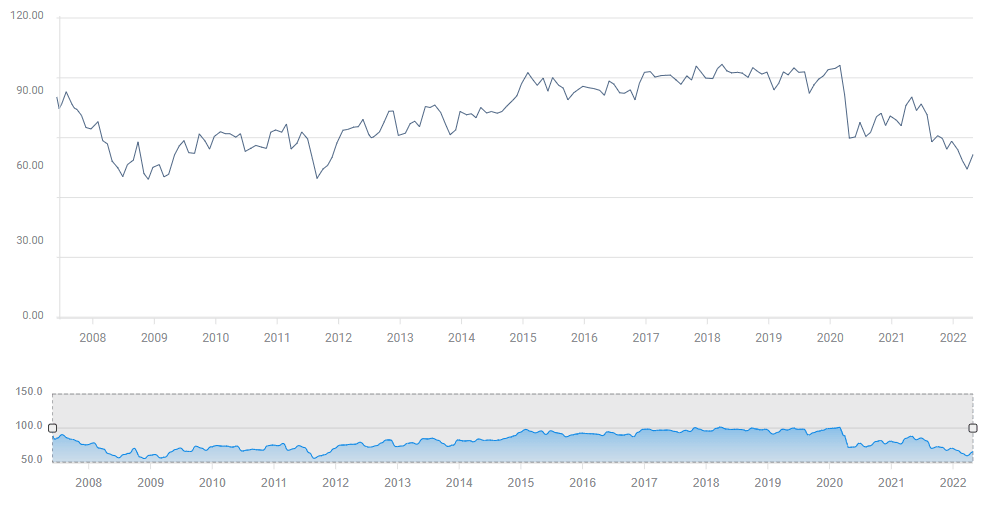

Michigan Consumer Sentiment, Retail Sales and Personal Consumption Expenditures

Americans are clearly unhappy. They are not expected to cheer up in May.

The Michigan Consumer Sentiment Index is forecast to drop to 64.0 from 65.2 in April.

Since the Michigan Index plunged to 70.3 last August, sentiment has remained very pessimistic, dropping to a low of 59.4 in February. Surprisingly though, nominal consumption has been strong.

Michigan Consumer Sentiment

Retail Sales have averaged 0.95% for the six months through March. Personal Consumption Expenditures (PCE), from the Bureau of Economic Analysis (BEA), have measured 0.92% for the same period.

Those excellent results are somewhat deceptive as both figures include price increases in their calculations. Real PCE, also issued by the BEA, but corrected for inflation, shows a very different story. The six-month average is 0.17%, over 80% less than the unadjusted number.

While households continue to spend, consumers would not have to reduce purchases very much for real consumption to become negative. Just a few months of falling spending and a recession becomes almost inevitable.

The chief support for consumer spending is undoubtedly the robust labor market. Nonfarm Payrolls have averaged almost 557,500 for the last six months. There were 11.5 million unfilled jobs in the US in March. Wages rose 5.5% for the year in April, and though outpaced by inflation employers are clearly responding to labor shortages and rising prices.

Conclusion: Consumer sentiment and spending

American families have not stopped spending despite the inflationary drain on household budgets. Weak sentiment has not yet signaled that the people are exhausted by the continual ratcheting higher of the costs of basic necessities.

Can this continue?

Markets are wary that if sentiment sinks much lower it will mean consumers have given up on competing with inflation and decided to wait it out. When and if that happens discretionary spending will crater and likely take US economic growth along with it.

Consumer sentiment numbers are not normally trading events but in the current febrile markets, almost any unexpected result will generate a reaction. If the Michigan Index is worse than expected it will kindle fears of consumer led recession prompting further equity declines and the US dollar safety trade. If it is bettter than forecast it will be ignored.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.