Mastercard earnings report

MasterCard Incorporated's annual earnings report is due on January 28, 2021. Considering the first three quarters reports, this guide will forecast the company's annual earnings report.

The Earnings per share declined in the first three quarters, with an EPS of 1.8 in the first quarter, 1.3 in the second quarter, and 1.6 in the third quarter. The credit card service provider managed net revenue of $3.8 billion in the third quarter, a decrease of 14% since the first quarter. The decrease was because of Covid-19 as the crossborder volume declined by 36% on a local currency basis. One the flipside, decreases were partially offset by some growth factors in all three quarters such as the Dollar growth of 1%, equating to $1.6 trillion, switched transactions growth of 5%, 2% increase due to acquisitions, and data services solutions.

Based on the pattern of the previous quarters, the expected EPS for the fourth quarter is 1.5, with a high of 1.7 and a low of 1.4. For the annual forecast, the expected EPS is 6.3 with a high of 6.4 and a low of 6.0. The quarterly revenue is expected to be $4.02 billion, higher than the third quarter but down by 9% from the previous year.

According to the company's data, during the third quarter of 2020, MasterCard repurchased approximately 6.5 million shares at a cost of $2.1 billion and paid $402 million in dividends. This is greater than the $401 million paid in the second quarter but less than the first-quarter payments of $403 million. The returns for the fourth quarter are expected to be more of the same, between $401 and $402 million.

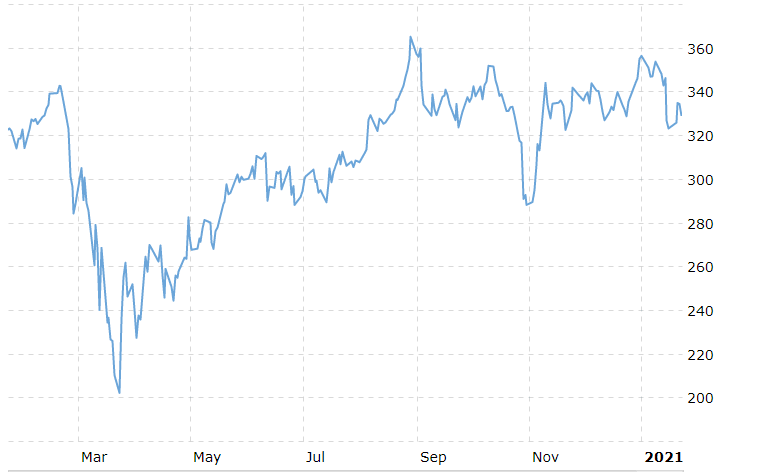

MasterCard stock price since Jan 2020 source: Macro Trends

Since the last report of MasterCard in September 2020, the stock price is down by 0.98%. The price has been fluctuating between $280 and $350, with a low of $288 on October 28. Currently, MasterCard (NYSE: MA) closed the most recent trading day at $329.10 yesterday, after it dropped initially to 200-DMA at $317 area. In the past month, MasterCard gained 1.73% when the business sector lost 0.83%. For the future, Wall Street will be eyeing the report due on January 28. Recent data suggest a positive outcome for the company. The Zacks Analysts suggest a wait-and-watch approach for the share and give a hold signal leaning towards the bullish zone. It is also worth mentioning that Mastercard currently has a PEG ratio of 2.46. This popular metric system is similar to the P/E ratio. The difference between the two systems is that the PEG ratio also takes into account the company's expected earnings.

Technical Analysis

Considering the fact that Visa and MasterCard are pretty much dominating the market, as they keep growing rapidly and efficiently. From a technical perspective, Mastercard stock price could find Support between 320 and 330. At the meantime, the RSI is below 50 on the daily chart indicating the stock is entering oversold territory. Moreover, there is a positive regression trend with October seeing the only dip. However, recent selling occurred at higher than average daily volumes.