Markit's US PMI November Preview: A case of the nerves

- Manufacturing PMI forecast to slip to 53 from 53.4.

- Services PMI expected to drop to 55.5 from 56.9.

- Initial Jobless Claims have put market on notice.

- Poor November PMI results could damage the dollar.

Markets are worried.

Was last Thursday's surprise jump in American Initial Jobless Claims the start of another inexorable labor market catastrophe? Will the economy be again crippled by government ordered paralysis?

That is the slightly melodramatic context for IHS Markit Economics of London, November Purchasing Managers' Indexes (PMI) on Monday.

Normally this newcomer to the PMI field is a precursor for the better known and far older Institute for Supply Management figures released one week later.

This time markets will be looking for any confirmation that the surprise 31,000 increase is, as it was in March, the forerunner of economic trouble.

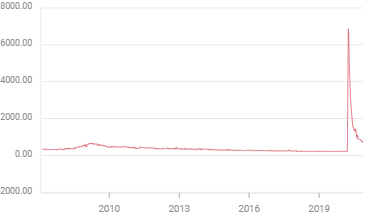

The preliminary Markit Manufacturing PMI is forecast to slip to 53 in November. October's 53.4 was the highest reading since January 2019. The pandemic low as 36.1 in April.

Markit Manufacturing PMI

The Services PMI is expected to fall to 55. The 56.9 score in October was the best since April 2015. The pandemic low was 26.7 in April.

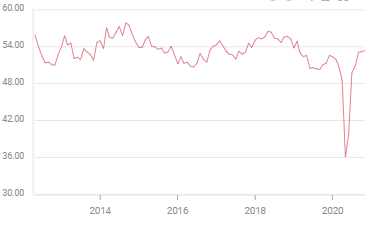

Initial Jobless Claims

The labor market and economic collapse in the second quarter was signaled by the jump in weekly jobless claims from 211,000 on March 6 to 3.307 million on the 20th and the record 6.867 million the following week. The claims figures were frighteningly accurate in predicting the debacle to come.

Initial Jobless Claims

Jobless claims had been predicted to drop to 707,000 in the week of November 13 from 711,000 when they were reported on the 19th. Instead they rose to 742,000. The increase of 31,000 is a far cry from the 3.307 million explosion from March 13 to March 20, from 282,000 to 3.307 million.

Markets nonetheless are concerned. Government imposed closures are rising around the country. Although most new restrictions are in the already decimated restaurant industry and it is unknown how many jobs will be affected, sensitivities are understandably high.

Conclusion

While Markit PMI indexes do not have a separate employment index as ISM does, any unexpected slippage in the general numbers for November will receive the worst interpretation.

Markets are anxious. Equities, the dollar and yields will fall if the purchasing managers are nervous.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.