Markets on edge as the Fed approaches a tipping point

The next FOMC decision hits Wednesday at 2 p.m. ET. For traders, that moment could redraw the macro map: Will Powell hint at a true easing cycle, or hold the line? What if this is his last act as Fed Chair before the 2026 reshuffle? Every word will count.

What a Fed rate cut actually means

A Fed rate cut lowers the cost of borrowing. It signals concern about future growth and typically boosts stocks, weakens the dollar, and drops yields, but only if it comes with the right guidance.

Hawkish vs dovish cuts

Pay attention to the tone surrounding the rate cut in this FOMC:

- A dovish cut opens the door for more easing—markets love that.

- A hawkish cut is one-and-done with warnings attached.

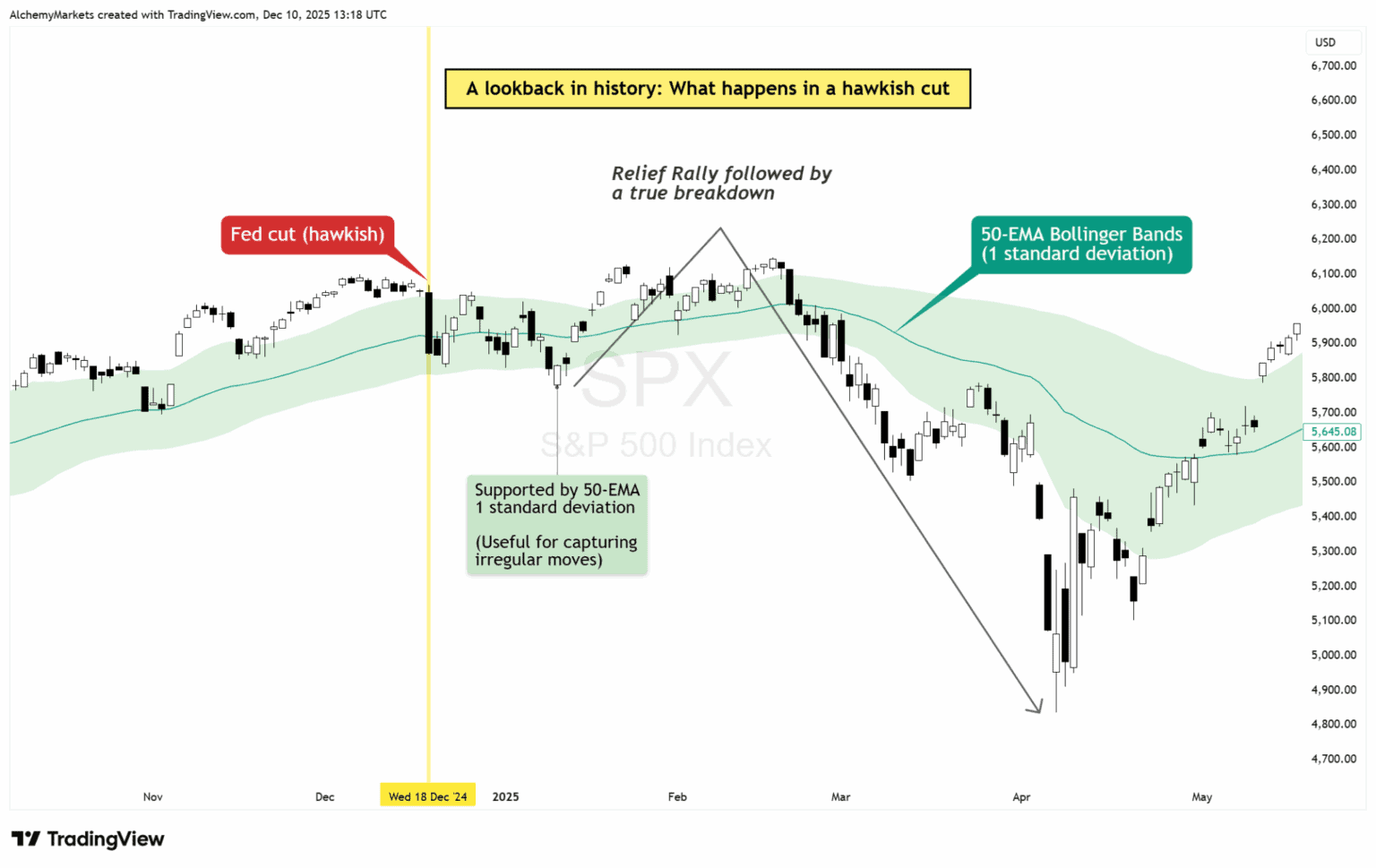

Traders learned this the hard way in December 2024 when a cut lifted the dollar and spiked yields… the S&P 500 sold off as Powell emphasised caution. This demonstrates that tone can hit equities even when rates go down, as investors lose confidence in the markets and derisks.

The US Dollar: Where does it go from here?

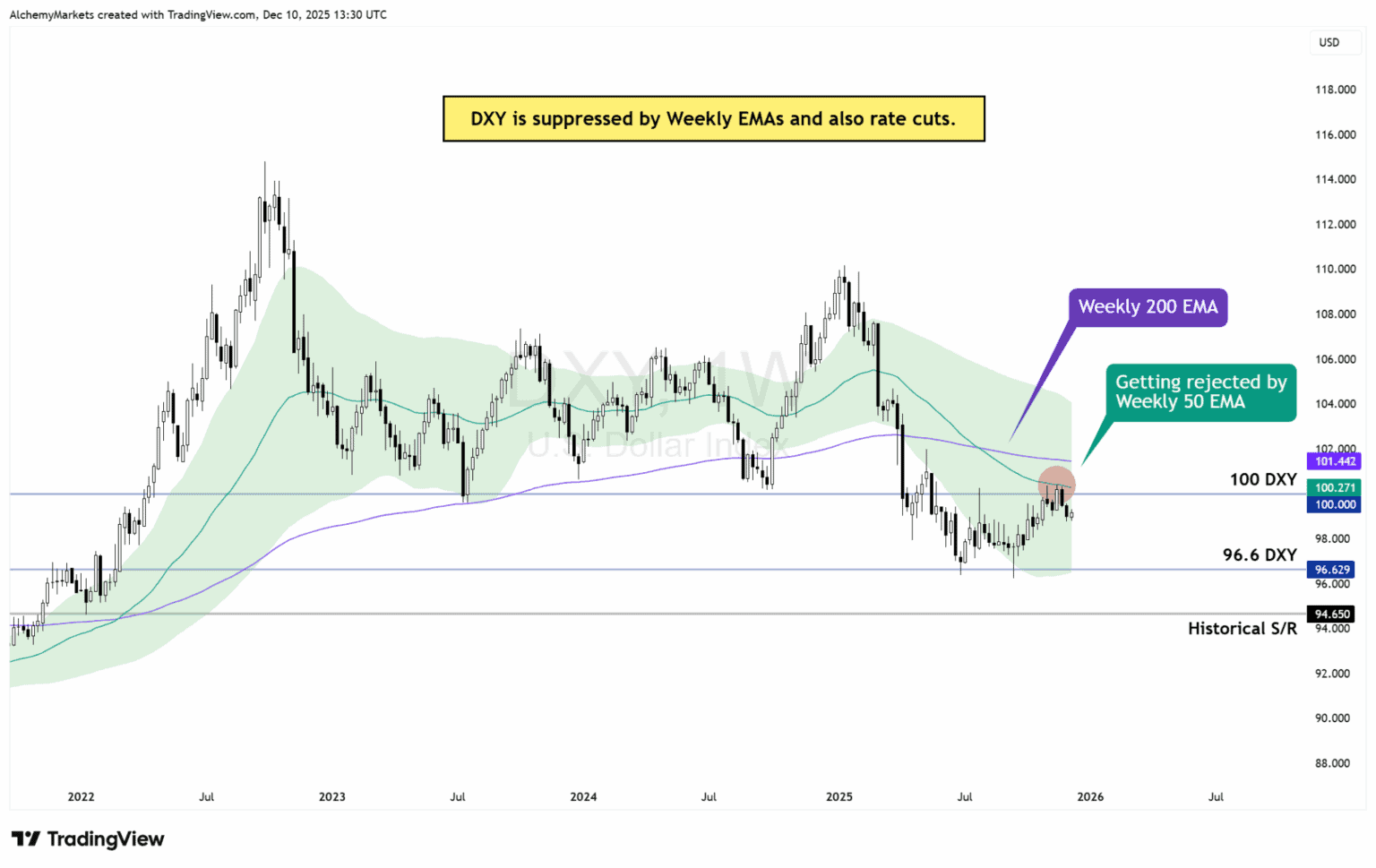

The DXY plunged nearly 10% in early 2025 as the market front-ran Fed cuts. But once Powell signaled a slower path, the dollar bounced and stalled under 100.

Now, the story is best seen in the chart:

- DXY is being rejected at the 50-week EMA, unable to reclaim trend control.

- The 200-week EMA overhead adds longer-term pressure.

- If the Fed turns more dovish, this setup could trigger a technical breakdown toward 96.6 or even 94.6.

- But if Powell signals a hawkish cut —even pauses (highly unlikely)—we could see a squeeze above 100, unwinding crowded dollar shorts.

Current projections keep US interest rates above 3% through 2026. Powell has stressed caution; he doesn’t want to relive the inflation rebound of the ’70s.

Bond yields and the curve

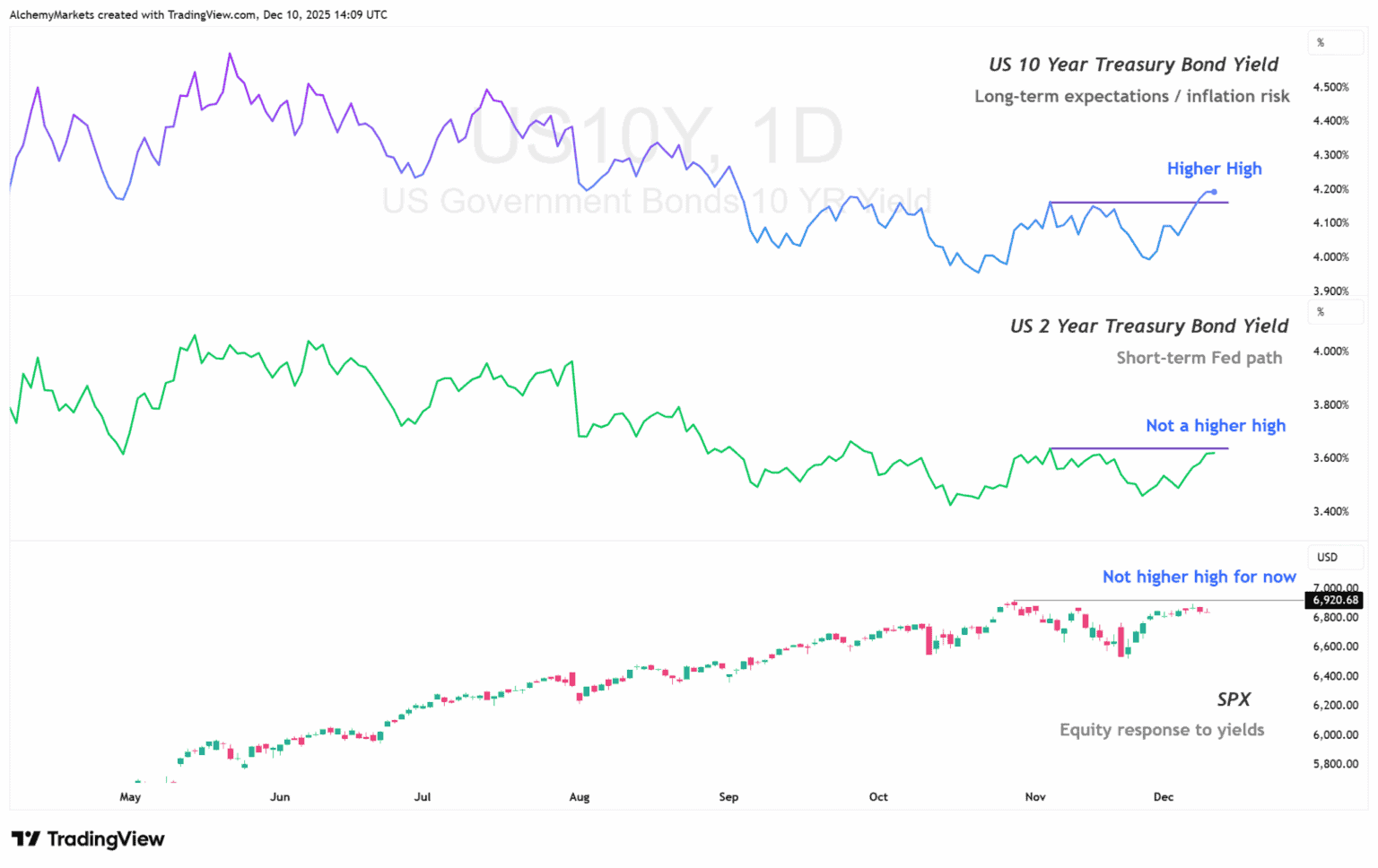

Normally, Fed cuts pull down short-term yields like the 2Y.

But the 10Y tells a deeper story—it reflects what the market thinks about inflation, future growth, and how much debt the government is dumping into the system.

That’s what made late 2025 confusing: the Fed cut rates, yet both 2Y and 10Y yields began rising, pushing right into resistance zones (see chart).

Here’s what traders are now watching:

- If Powell doubles down on cautious messaging → Yields may stay elevated, even with cuts.

- If the market believes deeper cuts are inevitable → Yields could roll over again.

For SPX:

- Falling yields = tailwind for risk assets, especially high-duration tech and growth.

- Rising yields = valuation pressure, as future earnings get discounted harder.

SPX has been chopping sideways while both 2Y and 10Y creep higher—a market in wait-and-see mode, unsure whether to price in disinflation or fiscal anxiety.

Final thoughts

This FOMC could be a turning point. Not just for rates—but for Powell’s legacy. Traders should ask: is this the start of a true easing cycle or a tactical adjustment? Either way, markets won’t wait for confirmation.

If Powell strikes a balance and the dots show a steady path lower, risk assets could catch fire. But if he hesitates or signals pause, expect a defensive reshuffle.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.