Gold rebounds as government shutdown clouds Fed policy outlook

Gold (XAUUSD) is attempting to recover after a sharp pullback last week, supported by a weaker Dollar and rising Fed uncertainty. The U.S. government shutdown has disrupted key economic data releases, adding pressure on the Dollar and clouding the policy outlook. This delay has shifted market expectations and created a more favorable backdrop for gold. At the same time, easing global tensions have reduced geopolitical stress, but domestic risks remain elevated. This combination of Dollar weakness, policy uncertainty, and domestic risks continues to support gold’s recovery in the near term.

Gold strengthens on shutdown disruptions and Dollar softness

Gold is attempting to recover after last week’s sharp pullback, with price now holding above the $4,800 zone. The move comes as the U.S. government enters its fourth day of a partial shutdown. A funding deadlock over immigration has delayed several key economic releases. The Bureau of Labor Statistics confirmed it will not publish the January jobs report as scheduled. This disruption has added fresh uncertainty to the Fed’s policy outlook.

Moreover, the delayed release of key U.S. economic data is pressuring the Dollar and creating a more supportive environment for gold. The Dollar weakened as markets responded to the absence of key macro signals. The scheduled release of the Job Openings and Labor Turnover Survey (JOLTS) was also postponed, deepening the uncertainty. With limited visibility, markets are reassessing the outlook for interest rate cuts. This lack of clarity is weighing on Dollar momentum and indirectly supporting gold, which typically benefits when the Dollar weakens.

Meanwhile, global tensions have eased slightly, offering a calmer geopolitical backdrop. U.S.-Iran tensions have cooled after both sides signaled openness to talks. The U.S. and India also finalized a trade agreement, reducing global friction. Although recent de-escalations may limit safe-haven demand, economic concerns within the U.S. remain unresolved. This balance of eased global tensions and persistent U.S. risks keeps gold underpinned in the near term.

Gold holds above rising trendline after sharp technical rebound

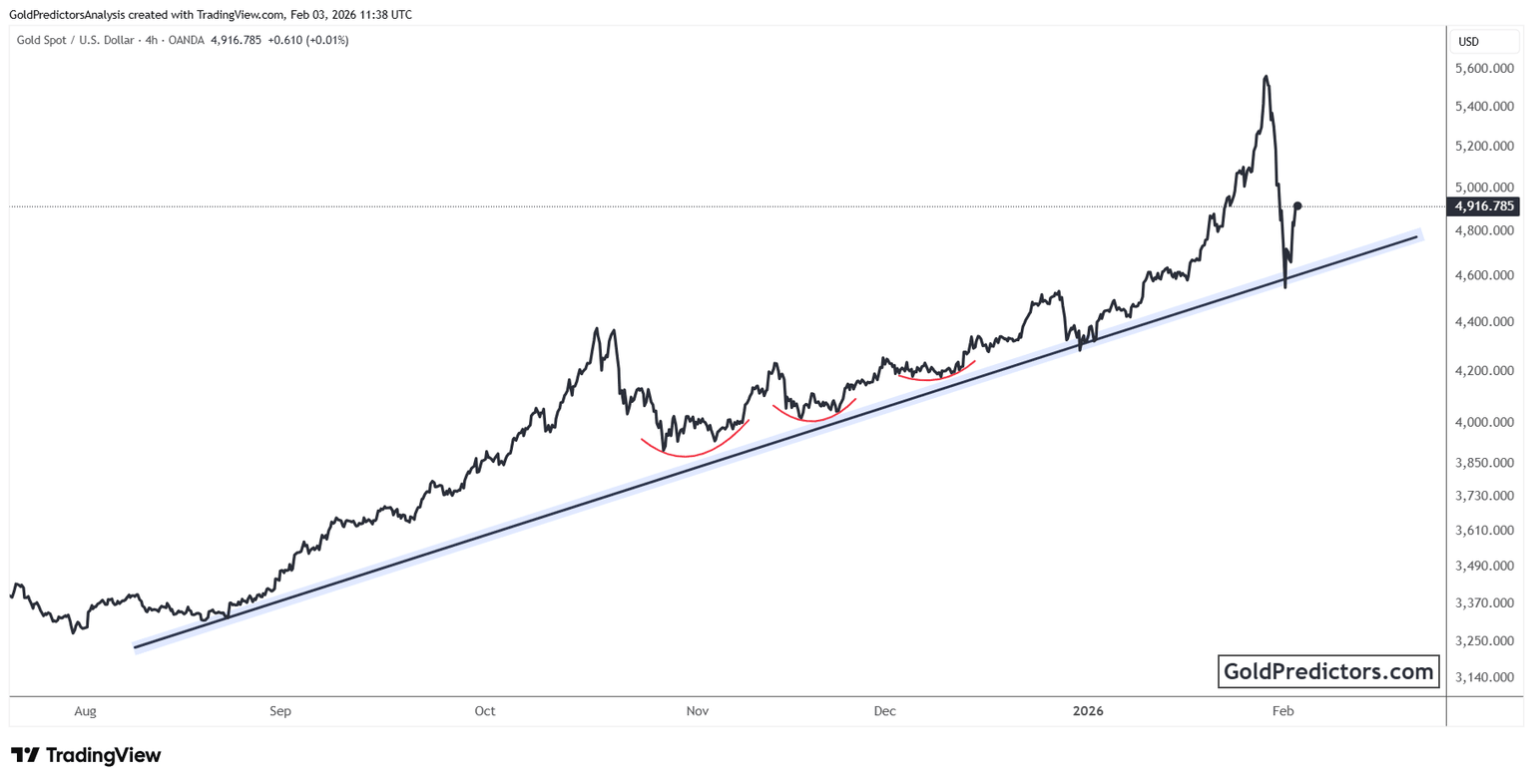

The gold chart below shows a sharp rebound following a successful test of its multi-month trendline support. This rising trendline, in place since early August, has consistently provided a strong base throughout the broader advance. Each pullback formed rounded basing structures near this line, setting the stage for successive upward moves.

The recent spike toward $5,600 marked an overextended move that quickly reversed, triggering a steep correction back toward the rising trendline. Although price briefly slipped beneath the line, it found strong buying interest and reclaimed support with a powerful upside response. This behavior reflects ongoing demand despite heightened volatility.

Currently, gold is holding steady near $4,900, reclaiming its position above the ascending trendline. This level continues to act as a strong technical base. As long as the price remains above this support, the broader bullish structure stays intact. Repeated rebounds from this area indicate that ongoing consolidation could lay the groundwork for a renewed upward move.

Gold outlook: Bullish structure intact amid persistent domestic uncertainty

Gold remains supported by a weakening Dollar, delayed U.S. data, and elevated domestic risks. While easing geopolitical tensions may limit safe-haven flows, the broader environment still favors gold. Technically, the structure remains constructive as price holds above its rising trendline. This continued stability suggests that the recent rebound could develop into a stronger recovery if support levels persist.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.