March NFP Shock Resilience

Timeline

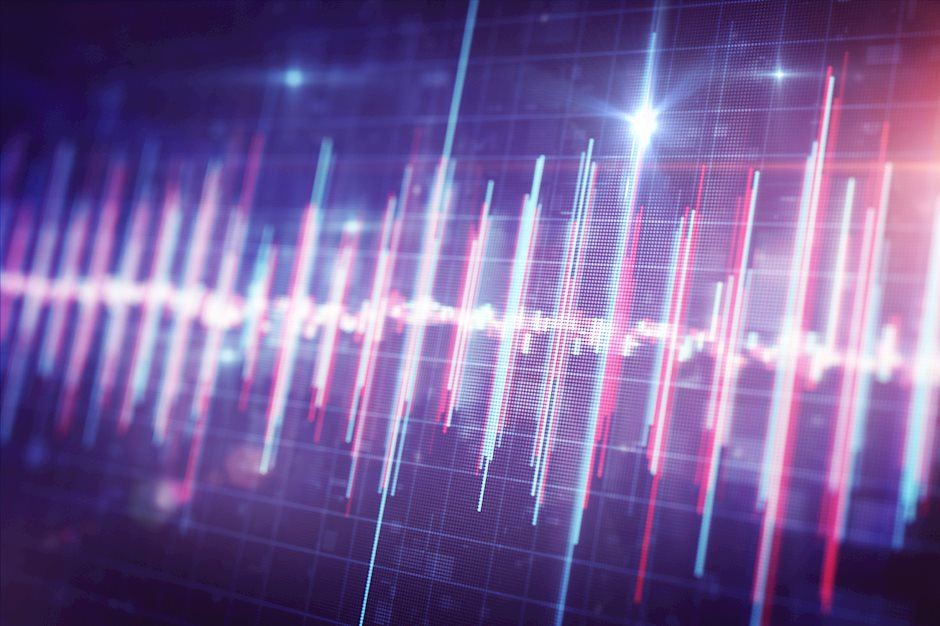

13:29:00-13:29:50: Business as usual

13:29:50 - 13:29:58: Brokers start to get defensive, spreads double

13:29:58 - 13:30:11: The Rage! Even minimum average spreads go as high as 1, or even more. Some brokers simply "step aside" and quote a 10+ pips spread.

12:30:11 - 12:31:00: The dust is settling, spreads recover relatively fast to normal levels when compared to earlier NFP events

Why is this information useful?

One thing you will need to know when preparing to trade the Employment Situation report is the difficulties there are to trade the NFP release through broker platforms. We constantly hear about the increase in bid/ask spreads and prices not being accessible for seconds after the release. This is simply due to the lack of interest liquidity providers have to supply broker platforms with prices during the heated seconds around the release. Liquidity providers give priority to their own volume clients and could not care less about retail traders over these critical seconds.

Most Forex brokers now use Non-Dealing-Desk and ECN business models. They are not market makers. This means you receive the retail market price for your trades. During high volatility situations the market is either very thin or has a glut of orders that needs to be processed. In either case, the BID/ASK spread can widen, sometimes dramatically. Its not your broker's fault... that is the market price at that moment.

The information contained in this report allows you to place your stops adequately so you can minimise the risk of being stopped out at the release It also allows you to calculate your profit potential more realistically taking into account the higher trading costs derived from higher spreads.

TradeProofer.com is a Forex traders' community monitoring Forex broker spreads realtime. Its systems monitor dozens of Forex brokers' spreads moved around economic releases, such as the NFP announcement under the U.S. Employment Report.

Author

TradeProofer Team

TradeProofer