Japanese Yen weakens as USD/JPY climbs amid BoJ rate hike uncertainty

The USD/JPY pair reached a high of 151.07 on Tuesday, marking its highest level in a week. This movement is largely attributed to ongoing uncertainty regarding the timing of the next interest rate hike by the Bank of Japan (BoJ). The market remains split on whether the BoJ will implement a rate increase in December or delay it until January.

Recent statements from BoJ Governor Kazuo Ueda highlighted that a rate hike is imminent, based on stable economic indicators aligning with expectations. Contrarily, BoJ policymaker Toyoaki Nakamura expressed concerns over the sustainability of wage growth and signs of economic weakening in Japan, adding layers of uncertainty that are influencing market dynamics.

Recent GDP data for Japan showed a growth of 0.3% quarter-on-quarter in Q3, surpassing the expected 0.2% increase. This stronger-than-anticipated economic performance supports a more aggressive stance on future monetary policy adjustments by the BoJ.

Looking ahead, the full scope of the BoJ's monetary policy for 2025 remains unclear, but increased pressure is expected as the Federal Reserve's fiscal adjustments set a significant pace for change.

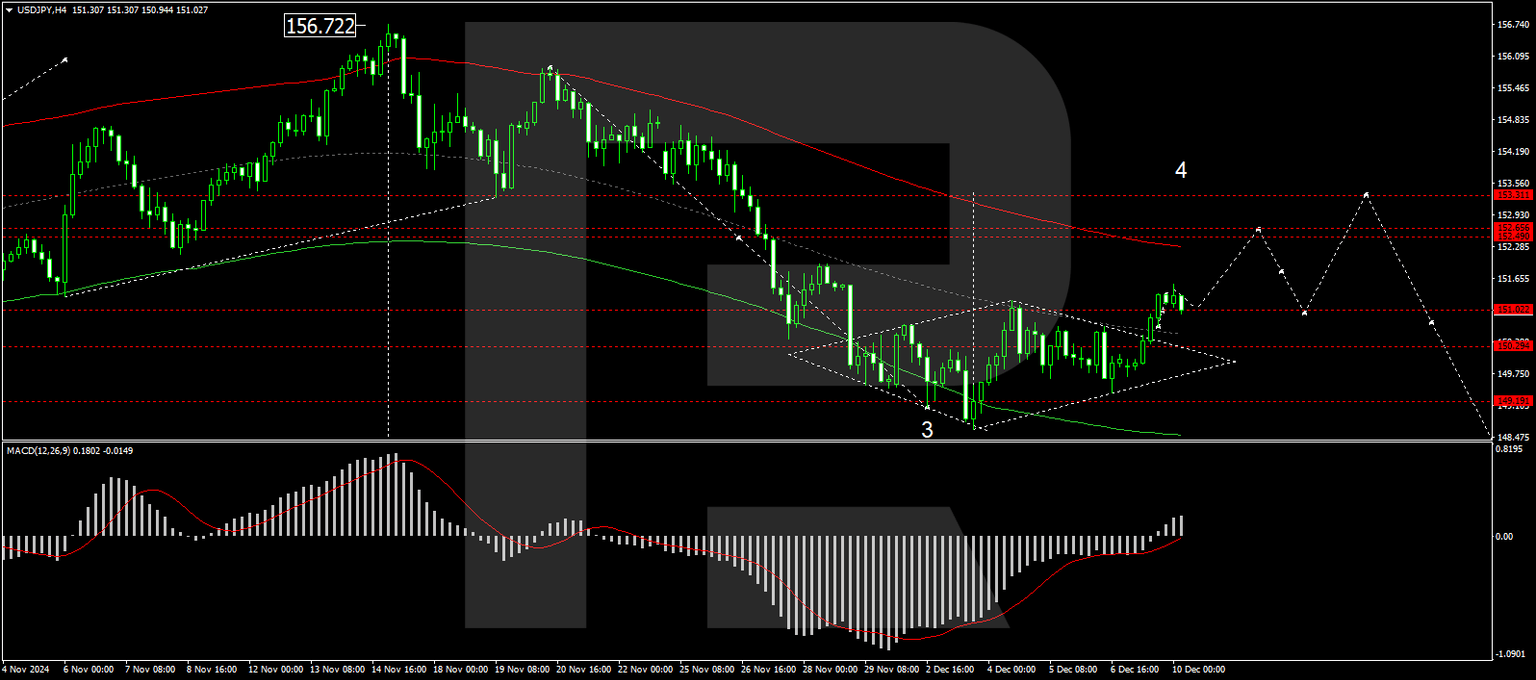

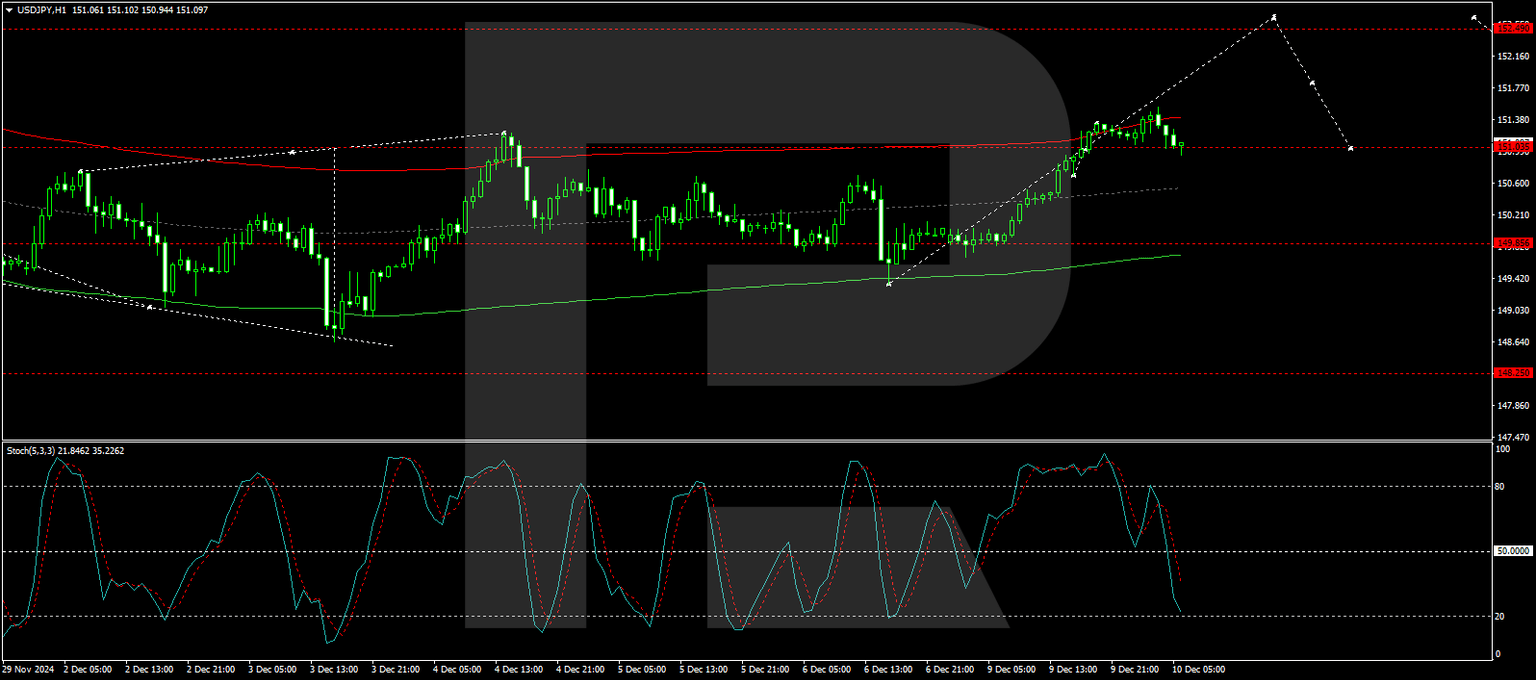

Technical analysis of USD/JPY

H4 chart: USD/JPY found support at 149.35 and has since been on an upward trajectory. The pair recently breached the 151.00 level, indicating potential for further gains towards 152.50. Currently, a narrow consolidation range has formed around 151.00. Should there be a downward exit from this range, a corrective move to 149.90 might follow. Conversely, an upward break could see the continuation of the upward wave to 152.50, potentially extending to 153.30. The MACD indicator supports this bullish outlook, with its signal line below zero but ascending sharply.

H1 chart: the market has established a consolidation range around 151.00. A downward exit from this range could lead to a correction towards 149.90. If the pair breaks upwards, it is expected to continue the upward wave towards 152.50. Upon reaching this target, a possible correction back to 149.90 may occur. The Stochastic oscillator aligns with this analysis, showing the signal line below 50 and heading towards 20, indicating potential downward movement before resuming upward momentum.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.