Is USD/JPY creating a double top formation? [Video]

![Is USD/JPY creating a double top formation? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/crumpled-us-and-japanese-currency-13375743_XtraLarge.jpg)

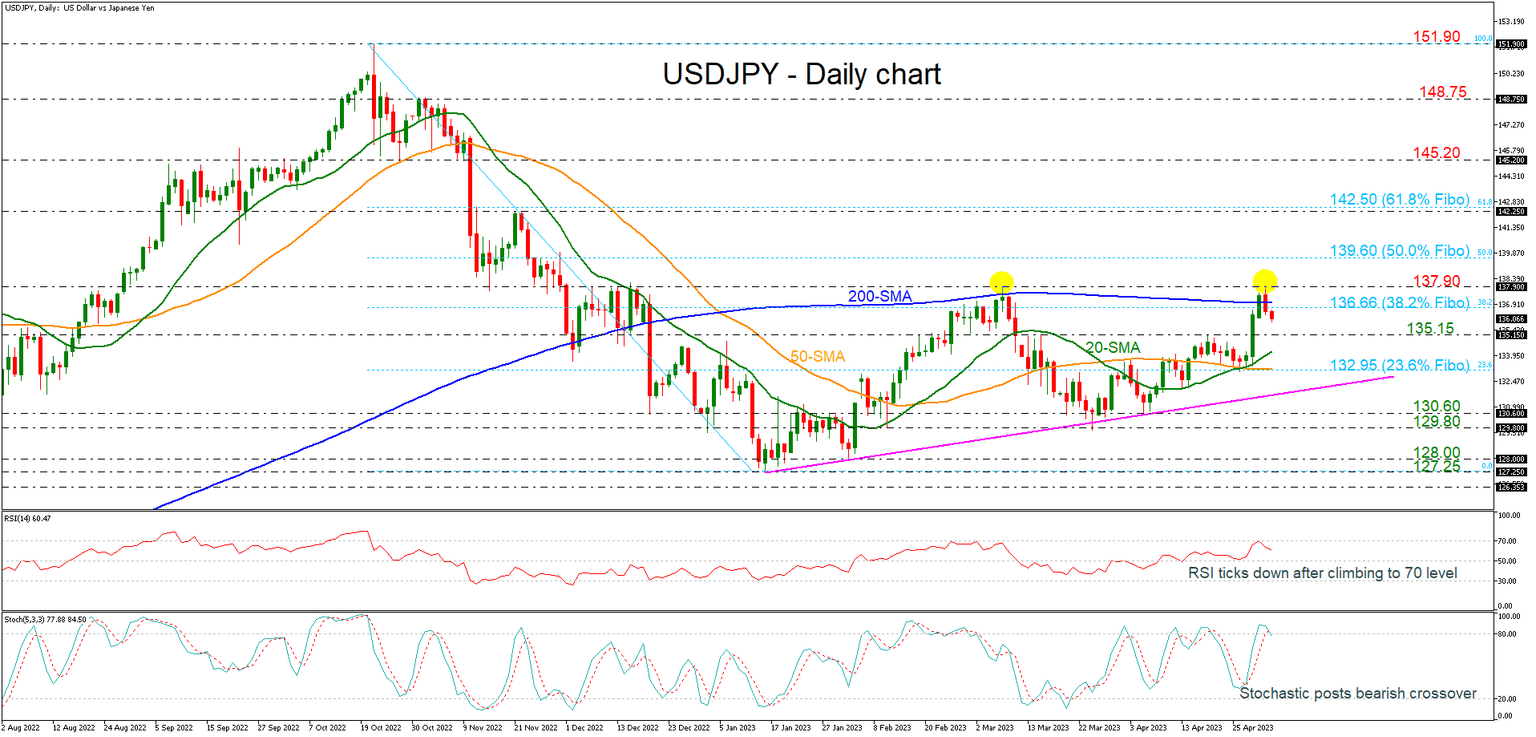

USDJPY plunged below the 200-day simple moving average (SMA) once again after the climb towards the 137.90 resistance level, which is acting both as a significant resistance level and a possible double top pattern is in progress. The pullback below the 38.2% Fibonacci retracement level of the down leg from 151.90 to 127.25 at 136.66 is indicating the start of a consolidation area in the medium-term timeframe.

Technically, the RSI has found strong resistance near the 70 level and dropped lower again, while the stochastic oscillator posted a bearish crossover within its %K and %D lines in the overbought region, suggesting that more losses could come.

More declining movement could meet the 135.15 support ahead of the 20- and the 50-day SMAs at 134.20 and 132.95 respectively, which overlaps with the 23.6% Fibonacci of 132.95. Slightly lower, the uptrend line at 132.14 may halt bearish actions; however, steeper losses could change the outlook to neutral, hitting 130.60.

Otherwise, any successful attempts above the 137.90 barrier could open the way for a rally until the 50.0% Fibonacci of 139.60 and the 142.25 hurdle. Marginally higher, the 61.8% Fibonacci of 142.50 could be the next target.

All in all, USDJPY may give the green light for the start of a double top formation after the touch of the 137.90 level. Only a jump above the aforementioned mark could switch the outlook back to a bullish one.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.