Is the dollar trading against the euro independently of interest rates?

The US dollar has been gaining ground against the euro for just over a year. From a 1.2372 close on April 18th last year to the 1.1180 finish on May 23rd the united currency has lost 9.6% versus the greenback. For roughly half of that period April to November 2018 US interest rates were rising, for the second half they were falling.

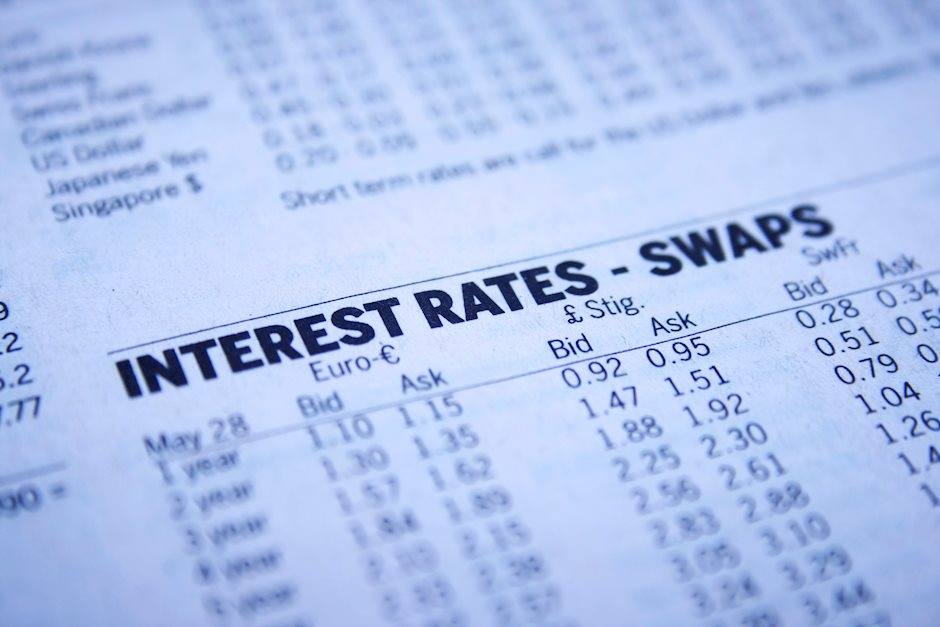

The interest rate on the 2-year Treasury, the government security with the closest tie to currency movements rose from 2.40% on April 18th 2018 to 2.95% on November 8th, from then it fell to 2.18% by May 24th.

Reuters

For the first period of rising US rates (4/18/18-11/8/18) the euro lost 8.2%. In the second period (11/9/18-5/24/19) the euro lost the balance 1.6%, given the percentage difference in the original rate.

If we look at the German 2-year yield for a European comparison it has moved from -0.57% on April 18th last year to -0.61% on November 8th and then to -0.63% on May 24th.

Reuters

Comparatively the US range of 55 basis points on the upside and 77 on the downside dwarf the German change of 6 points. Clearly the euro level is not being driven by interest rate differentials.

In effect the fall in US rates has blunted the dollar advantage but it has not taken over the relationship between the currencies. The macro-economic effects of the European economic slowdown and the potential damage from yet unsettled British departure continue to weigh heavily on the euro despite the shrinking rate advantage for the dollar.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.